- AMC shares fall 3% on Wednesday, targetting $11.

- The meme stock is technically still bullish, remains above key support.

- The movie theatre chain's shares are above key moving averages.

Update April 29: AMC Entertainment Holdings Inc (NYSE: AMC) is changing hands at just under $11 on Thursday's premarket trading, a modest recovery after Wednesday's tumble of 5.32% to $10.85. While America's fast reopening is bringing cinephiles back to theaters, the company's recent raising of funds diluted current investors' holdings and triggered a sell-off. Can AMC recover? The fresh interest in Nokia, after the Finnish firm's impressive earnings, may prompt some to wait before jumping on the stock.

AMC is a global cinema chain and, as a result, has struggled during the global pandemic as most of these cinemas have been closed for the better part of a year. The company narrowly avoided bankruptcy through the interest of retail traders. By strongly backing it, these retail traders allowed AMC to raise capital and debt, meaning it could survive the pandemic. AMC and GameStop were two of the meme stock favorites at the height of the retail trading boom. Volumes on retail trading sites are lessening as the US opens back up, reducing the captive trading audience.

First AMC breaks the short-term triangle formation, and now it smashes the longer-term downtrend in a strong surge on Monday.

AMC still has serious problems, which make a long-term investment in the stock questionable. The company just has way too much debt and is facing headwinds from streaming players releasing online and in cinemas simultaneously. Disney has recently made such announcements. Yes, there is definitely pent-up demand, which will come out over the summer as economies reopen, but AMC needs to repay this massive debt pile, and it needs more than a short-term kick to do so.

AMC stock forecast

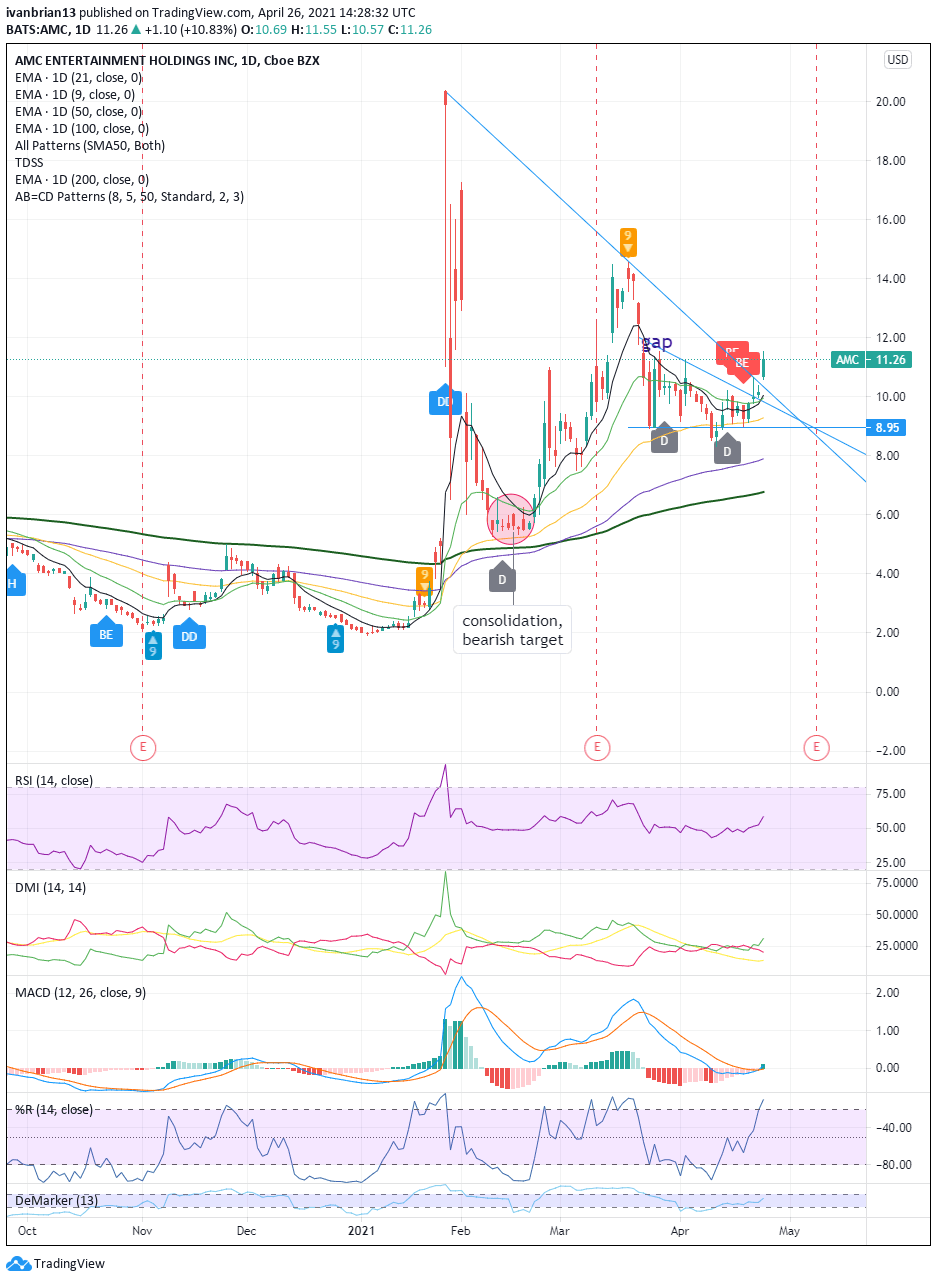

The bigger picture is on the trend line from the spike high of $20.36 in January, along with the high of $14.54 on March 18. AMC shares stopped perfectly on this resistance on Thursday. Friday's session is therefore crucial to giving us some clues as to how to play this one. A further move higher confirms the triangle breakout but will quickly need to break the longer-term downtrend line. That will mean the next target is the gap from the formation of the triangle at $11.76. Above this is $14.54, the high from March 18.

This is what I wrote on Thursday last week and it has transpired beautifully on Monday with a powerful breakout and AMC shares up 11%. Now AMC needs to target and fill the gap resistance at $11.76. Ok, I'm asking a lot, 10% is enough right. Well true AMC does not have to go straight there but that is now the next target for bulls. After that, the high at $14.54 is the next resistance before a target of highs at $20.36.

Pullback support can be used to enter longs on the trendline support at $10.38. Moving below this level is bearish so that is the place to stop out long positions. A break below the 9 and 21-day moving averages is a bearish one and will bring the bears ultimate target below $6 into focus.

The MACD looks to give a crossover buy signal so keep a close eye on that. RSI is neutral and the Directional Movement Index (DMI has already crossed, giving a bullish signal. This is not a strong signal as the yellow average trend line is below 25. This signals the trend is weak so caution is needed. Well caution is always needed in successful trading, mostly careful risk management. No indicator is foolproof.

Previous updates

Update April 29: The shares of AMC Entertainment Holdings Inc. (NYSE: AMC) corrected sharply from five-week highs of $12.21 but managed to end Wednesday in the green around $10.85. The stock price lost nearly 5.5% in Wednesday trading before recovering 0.5% in post-market hours. The movie theatre chain updated its investors about the company’s plans to raise fresh capital, which triggered a slide in its shares. AMC is considering authorizing 500 million more shares but is planning to issue and sell only 43 million shares. Holding above Monday’s low of $10.59 is critical for the bullish traders.

Update 28: AMC shares continue to slide after announcing a fresh capital raise. AMC said it is to shelve plans to issue 500 million new shares but instead is to proceed with a smaller offering of 43 million. AMC remains above 9-day moving average at $10.53.

Update April 27: AMC Entertainment Holdings Inc (NYSE: AMC) opened in the positive territory and climbed to its highest level in nearly five weeks at $12.22 on renewed optimism for looser coronavirus-related restrictions. However, the US Centers for Disease Control and Prevention (CDC) said on Tuesday that it continues to recommend masking for indoor visits to movie theaters. AMC shares retraced a large portion of the daily advance after this development and were last seen trading at $11.50, gaining 0.6% on the day. Nevertheless, this recent decline seems more like a technical correction of Monday's 13% rally rather than the beginning of a downtrend.

Update April 27: AMC Entertainment Holdings Inc (NYSE: AMC) has been extending its gains in Tuesday's trade, changing hands at nearly $12. This is the highest level since late March and an extension of the company's breakout. The movie theater company is benefiting from America's rapid reopening and falling covid cases. The CDC is expected to publish new and looser guidance for those that have been inoculated. The next technical barrier is the mid-March peak of $14.04.

Update: AMC shares pushed sharply higher on Monday as risk was firmly back on across the meme space with GameStop closing up nearly 12%. AMC took out some key technical levels by breaking out of the triangle formation and also filling the gap on the chart at $11.76. Now AMC is firmly in the hands of the bulls, but a pullback is likely as nothing goes up in a straight line. The first support is $10.65, the high from Wednesday, and next is the 9-day moving average at $10.10. This needs to hold to maintain the bullish trend. The upside target is $14.54, the high from March 18.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.