AMC Entertainment Holdings Stock Price and Forecast: AMC shares drop after earnings release

- AMC reported earnings after the close on Monday.

- AMC beat on EPS and on revenue.

- AMC shares had popped 8% before the earnings were released.

AMC shares tried to front-run what turned out to be an earnings beat on Monday with AMC stock closing the regular session before the release up over 8%. AMC stock popped above $45 and closed above there, having topped out at $45.95. Closing near the top end of the range is often a strong sign, so let us see if the results warrant further gains.

AMC quote, 15-minute

AMC stock news

The strong move before earnings was due to AMC saying it was teaming with Disney to bring back four fan favourites to cinemas from November 12 to 14. "We appreciate Disney working together with us to provide AMC movie-goers the opportunity to see their favorite Disney films with family and friends in their local theatre," said Elizabeth Frank, Executive Vice President, Worldwide Programming & Chief Content Officer at AMC Theatres. This as well as bullish anticipation of the earnings release helped AMC make hefty gains in the regular session.

Earnings then came out just after the market closed. Earnings per share (EPS) came in at -$0.44 ahead of the estimates of -$0.53. Revenue also topped analyst forecasts at $755.6 million versus the expectation of $708.25 million.

CEO Adam Aron said, “Thanks to an increasingly appealing film slate, rising COVID-19 vaccination counts, our commitment to robust health and safety protocols and our own greatly increased marketing activity, AMC’s theatres in the U.S., Europe and the Middle East safely welcomed back 40 million guests during the third quarter of 2021." He added, "Our October theatre admissions revenues were the highest of any month since before the global pandemic forced the closure of our cinemas more than a year and a half ago.”

The reaction of AMC stock was volatile with the stock rising 5% to a high of $47.50 before gradually sliding lower as the afterhours session wore on. Currently, AMC shares are down 5% in the premarket, trading at $42.76. In a sign of trying to tap into the zeitgeist, the company said it was looking into creating its own cryptocurrency. Aron also said AMC was looking into the concept of joint ventures with Hollywood studios for commemorative NFTs, according to Reuters. In a nod to the diamond hands, Aron said, "In the almost 6 full years I have led AMC...I have not sold a single AMC share."

AMC stock forecast

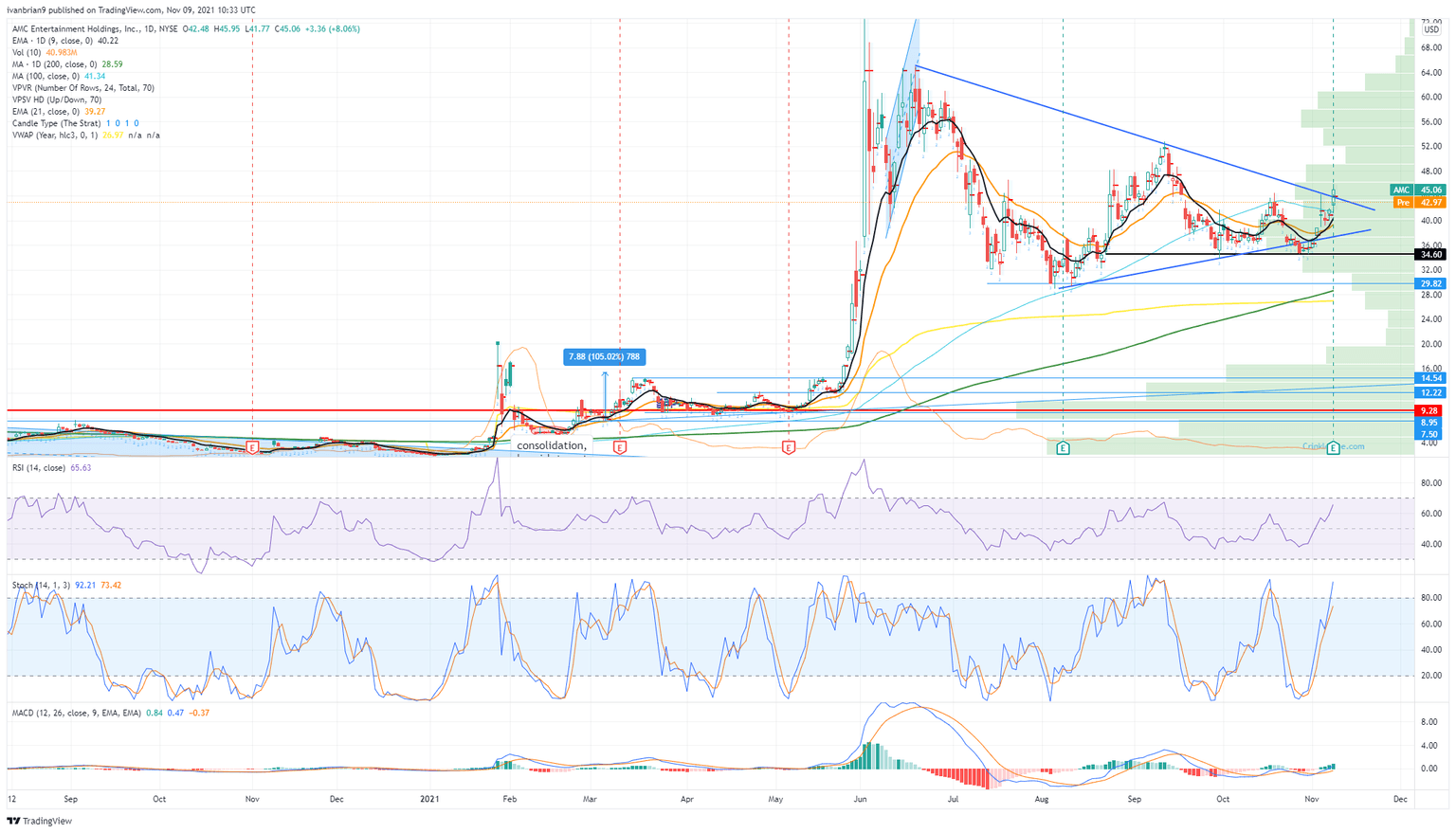

AMC stock has been in a reducing range, as we can see, which has resulted in a triangle formation. It is not the cleanest triangle formation ever but still interesting. The move on Monday in the regular session certainly was promising, but it appears to have been a case of "buy the rumour, sell the fact" now that earnings news is out. Despite a beat on both top and obttom lines, the shares have fallen 5%.

Holding above $40 keeps things bullish with the next resistance target at $52.79, the high from September. Breaking $40 will likely see a move to test support at $34.60 and then $30. $40 then is the short-term pivot point, and $34.60 is the medium pivot. $34.60 was a perfect double bottom, which is of course a bullish formation.

AMC daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637720495296703823.png&w=1536&q=95)