ADP Employment Report set to show modest hiring extended into January

- The US ADP Employment Change report is expected to show that job creation remains subdued.

- The ADP report is more important than usual as Nonfarm Payrolls data is delayed due to the partial US Government shutdown.

- Kevin Warsh’s appointment as the next Fed Chair and strong US economic data are boosting a US Dollar recovery.

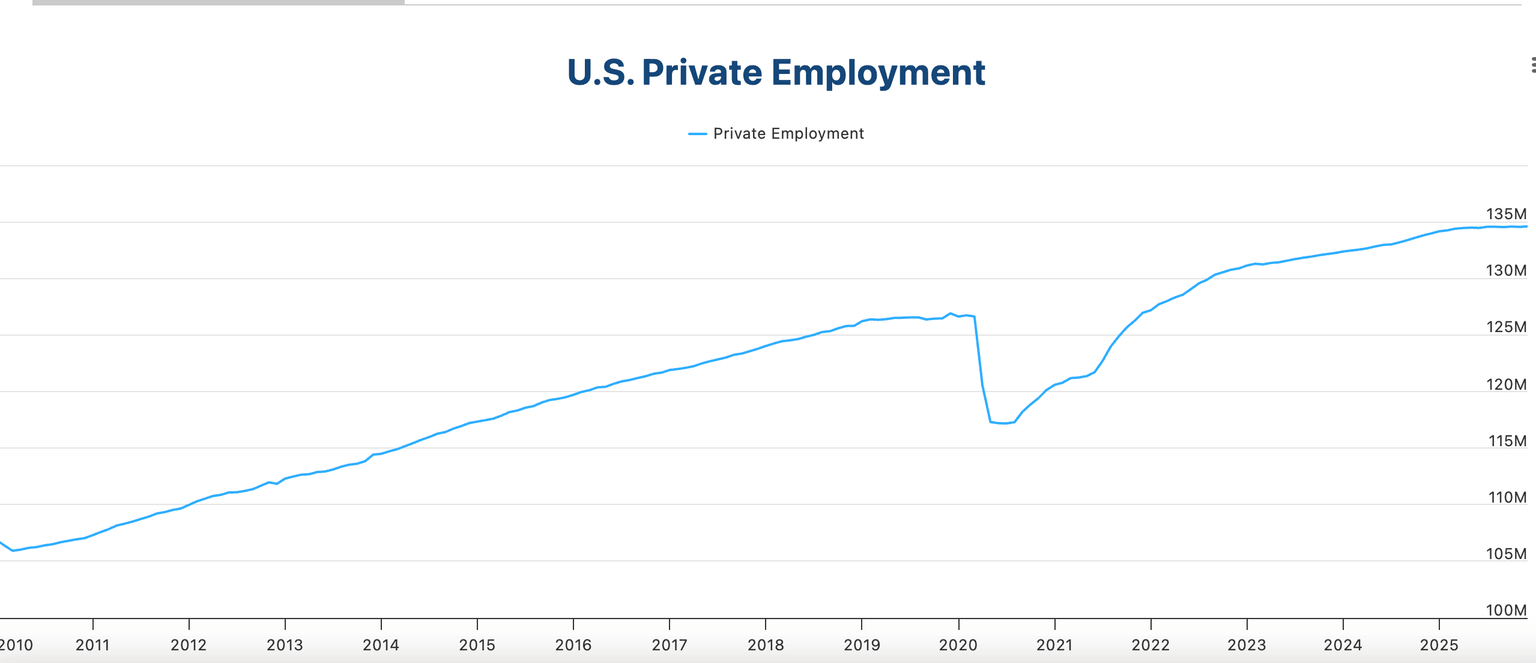

The Automatic Data Processing (ADP) Research Institute will release its monthly report on private-sector job creation for January on Wednesday. The so-called ADP Employment Change report is expected to show that the United States (US) economy added 48K new jobs, following the 41K new payrolls witnessed in December.

These figures will be observed with particular interest this time, as the US Bureau of Labour Statistics (BLS) announced on Monday that the release of Friday’s key Nonfarm Payrolls (NFP) report will be delayed due to a partial US government shutdown. With the ADP report as the main reference for US employment this month, a significant deviation in the final figures might have a strong impact on the US Dollar (USD).

ADP Jobs Report will test the strength of the US economic recovery

January’s ADP Employment Change report comes in a context of improving optimism about the US economic outlook. A string of positive macroeconomic releases, namely the Q3 Gross Domestic Product (GDP) report and strong manufacturing activity, coupled with sticky inflation levels, have prompted traders to dial down bets of interest rate cuts by the Federal Reserve (Fed), at least until June.

This has boosted a recent US Dollar recovery, also triggered by investors’ relief after US President Trump confirmed that former Fed governor Kevin Warsh will replace Jerome Powell as Fed Chair at the end of his term.

The US economy showed a robust 4.4% anualized growth in the third quarter, according to the final GDP estimation released in January. Apart from that, factory activity expanded at its fastest pace in more than three years, according to January’s ISM Manufacturing PMI report, retail consumption bounced up strongly in November, and consumer sentiment data show a steady improvement over the last three months.

Bearing this in mind and considering that consumer inflation remains steady at levels well above the Fed’s 2% target for price stability, employment figures will be the last piece in the puzzle to assess the US central bank’s near-term monetary policy path.

January’s ADP report is expected to confirm that the labor market remains steady. Market consensus suggests that employment growth remains sluggish, but that employers are not firing either, or at least not to a large extent. This scenario cements the Fed’s stance of a cautious approach to rate cuts.

Atlanta Federal Reserve President Raphael Bostic stated at a panel speech on Monday that the central bank is close to the neutral rate and that monetary policy should remain “mildly restrictive” to get inflation back to the target. Unless the ADP shows a severe setback, this view would apply to the vast majority of the central bank’s monetary policy committee.

When will the ADP Report be released, and how could it affect the USD?

ADP will release the US Employment Change report on Wednesday at 13:15 GMT, and it is expected to show that the private sector added 48K new jobs in January.

The immediate US Dollar trend is positive. The US Dollar Index (DXY), which measures the value of the Greenback against six major currencies, appreciated 2% in the past week. Market’s relief following the appointment of former Fed Governor Kevin Warsh as the next Fed Chairman halted the US Dollar’s bleeding, while bright US economic data, a trade deal with India, and hopes that negotiations with Iran might de-escalate tensions in the Middle East, keep the Greenback supported.

Guillermo Alcala, FX Analyst at FXStreet, highlights resistance levels in the 98.00 area and 98.48 as the main hurdles for USD bulls: “The US Dollar Index is on a bullish correction amid a broader bearish trend, and bulls need to breach resistance at a previous support area around 98.00 to confirm a larger recovery and expose the January 23 high, at 98.48, ahead of the 100.00 round level.

On the downside, Alcalá sees the 97.05 level as key to maintain the immediate bullish recovery alive: “A bearish reaction below the 97.00 level would put the current recovery in question and increase pressure towards the January 28 close, at the 96.35 area.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Economic Indicator

ADP Employment Change 4-week average

The preliminary ADP weekly estimate, released by Automatic Data Processing Inc, provides a four-week moving average of the latest total private-employment change in the US. Generally, a rise in the indicator has positive implications for consumer spending and stimulates economic growth. Therefore, a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Tue Feb 10, 2026 13:15

Frequency: Weekly

Consensus: -

Previous: 7.75K

Source: ADP Research Institute

The ADP weekly report provides the change in private sector employment, offering the most current view of the labor market based on ADP's fine-grained, high-frequency data. Traders often consider employment figures from ADP, America's largest payrolls provider, as the harbringer of the Bureau of Labor Statistics release of Nonfarm Payrolls.

Author

FXStreet Team

FXStreet