After a certain age, holders of retirement accounts such as Individual Retirement Accounts (IRAs) are required to start making mandatory withdrawals, known as Required Minimum Distributions (RMDs).

These withdrawals, imposed by the U.S. tax authorities, must be carefully anticipated to avoid heavy penalties and preserve the coherence of your retirement strategy.

Understanding how RMDs work

RMDs are minimum withdrawals imposed by the Internal Revenue Service (IRS) on funds held in certain retirement accounts, notably Traditional IRAs.

They are designed to ensure that savings accumulated tax-free over the years are actually subject to tax at retirement.

Since the SECURE 2.0 law came into force, the age at which these withdrawals are required has been raised. People born between 1951 and 1959 must start their RMDs at age 73, while those born in 1960 or later must wait until age 75.

Roth IRAs, on the other hand, are not subject to RMDs as long as the account holder is alive, making them a strategic long-term tool for certain people in retirement planning.

Calculation method

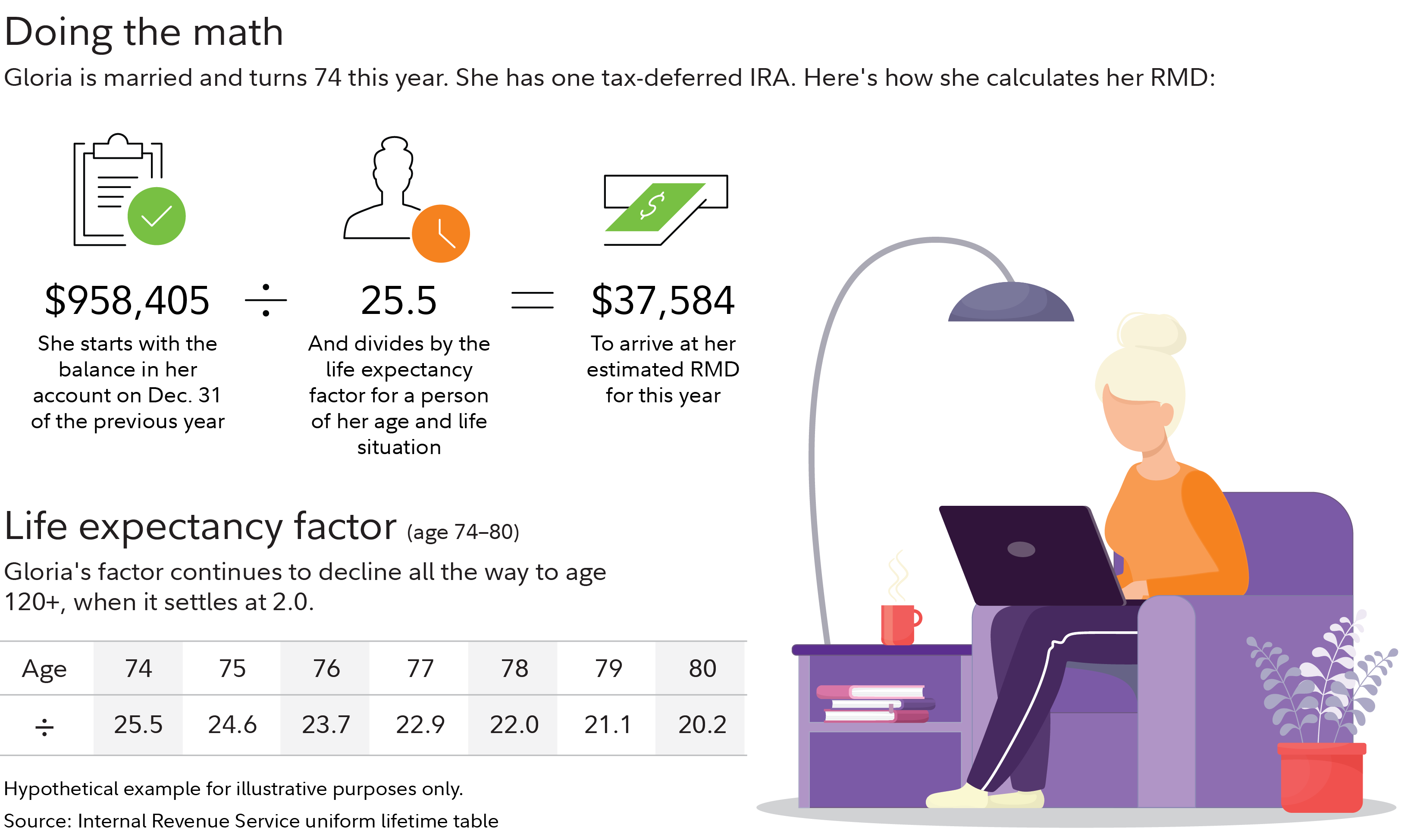

The annual RMD is calculated by dividing the account balance at December 31 of the previous year by a factor determined by the IRS, based on the account holder's life expectancy. This calculation is updated each year.

For example, if the IRA balance is $500,000 and the IRS factor is 25, the minimum amount to withdraw will be $20,000.

This amount is considered taxable income, and its omission can result in a penalty of up to 25% of the amount not withdrawn, reduced to 10% if the error is corrected promptly.

Interaction with Social Security benefits

RMDs are added to other sources of retirement income, notably Social Security benefits.

This combination can push the retiree over a higher tax threshold, resulting in increased taxation, including on a portion of social security benefits that would otherwise be partially or totally exempt.

It is therefore essential to integrate RMDs into a global approach to retirement planning, taking into account all available income and its tax impact.

Withdrawal schedule

The first RMD must be made no later than April 1 of the year following that in which the holder reaches the required age. For subsequent years, withdrawals must be made by December 31.

It is important to note, however, that postponing the first withdrawal until April 1 implies two withdrawals in the same tax year, which may result in a significant increase in taxable income.

Planning strategies

There are several strategies for limiting the tax impact of RMDs and integrating them optimally into a retirement strategy:

- Converting to a Roth IRA: Gradually transferring a portion of funds from a Traditional IRA to a Roth IRA eliminates future RMDs on converted amounts, while taking advantage of favorable tax treatment on withdrawals.

- Use RMDs to finance current expenses: Withdrawals can be used to cover day-to-day living expenses in retirement, limiting the need for other taxable sources of income.

- Qualified Charitable Distribution: All or part of the RMD can be transferred directly to a recognized charity. This donation, capped at $100,000 per year, is not included in taxable income.

- Spread withdrawals over the year: Withdrawing the required amounts in monthly or quarterly payments can optimize cash management and spread out tax charges.

Special case of multiple accounts

When a taxpayer holds several IRA accounts, he or she is allowed to calculate the total amount required for all accounts and make the withdrawal from just one of them.

However, this flexibility does not apply to 401(k) plans, for which each account is treated separately and requires its own RMD.

Long-term issues

RMDs should not be seen as a mere administrative formality, but as a central element of end-of-career financial planning.

Integrating them into a coherent retirement planning scheme optimizes overall taxation, preserves the value of remaining assets and coordinates withdrawals with Social Security benefits.

Anticipating these withdrawals well before the legal retirement age can limit their negative impact. The choices made by savers in their 50s and 60s have a decisive effect on the structure of their future income and their ability to cope with unforeseen events.

Anticipating RMDs

Required Minimum Distributions are an unavoidable regulatory constraint for holders of certain retirement accounts, but also an opportunity to efficiently structure their withdrawals and taxation.

By approaching them with rigor and anticipation, retirees can minimize their negative effects and preserve their long-term financial security objectives.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: US Dollar recovers ahead of ECB, more Trump in the docket Premium

The EUR/USD pair soared in the last week of January, hitting a multi-year high of 1.2082 before finally retreating and trimming most of its weekly gains to settle around the 1.1900 level.

Gold: Correction should be temporary Premium

Gold (XAU/USD) kept winning this week, and on Thursday it briefly reached new all-time highs just beyond the $5,600 mark per troy ounce. Since then, the yellow metal has entered a correction phase, as some traders took profits at the right time and the US Dollar (USD) rose sharply.

GBP/USD: Pound Sterling eyes more upside, with Golden Cross in play Premium

The Pound Sterling (GBP) accelerated its bullish momentum against the US Dollar (USD), with GBP/USD recording its highest level in four years near 1.3870 before experiencing a late pullback.

Bitcoin: BTC correction deepens as Fed stance, US-Iran risks, mining disruptions weigh

Bitcoin (BTC) price extends correction, trading below $82,000 after sliding more than 5% so far this week. The bearish price action in BTC was fueled by fading institutional demand, as evidenced by spot Exchange-Traded Funds (ETFs), which recorded $978 million in inflows through Thursday.

US Dollar: Fed caution meets political noise Premium

It was a rough and volatile week for the US Dollar (USD). Indeed, the US Dollar Index (DXY) built on the previous week’s decline and retreated to the 95.50 region, an area last visited in February 2022.

Best Brokers for EUR/USD Trading

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.