With the proliferation of retirement planning options in the United States, the choice between the types of Individual Retirement Accounts (IRA), mainly a Traditional IRA or a Roth IRA, remains one of the most common dilemmas. While both offer tax advantages, they do so in very different ways.

This article offers a comparison of these two account types to help everyone make an informed decision, tailored to their personal situation.

The decisive factor: Taxation... but when?

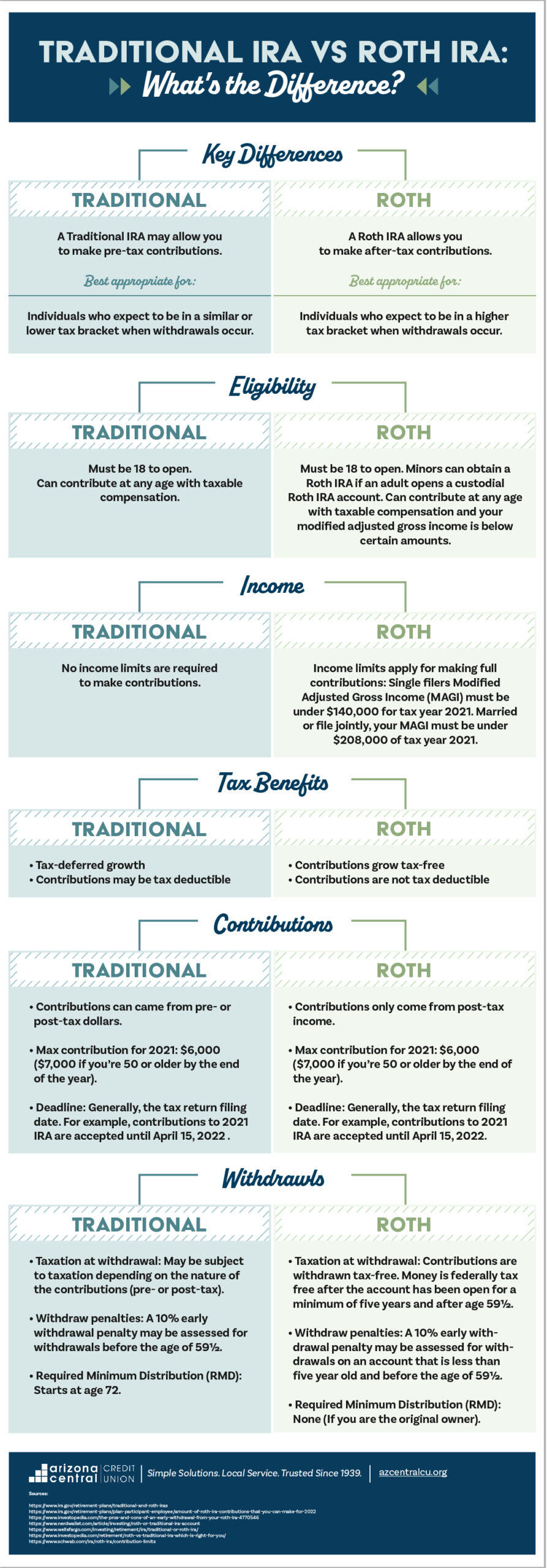

The main distinction between a Traditional IRA and a Roth IRA lies in the timing of the tax advantage.

With a Traditional IRA, contributions are generally tax-deductible in the year they are made, reducing taxable income. On the other hand, withdrawals at retirement are taxed as ordinary income.

The Roth IRA, on the other hand, is funded with income that has already been taxed. It offers no immediate tax reduction, but future withdrawals, including earnings, are tax-free, provided certain age and account aging conditions are met.

This choice may also be influenced by other sources of retirement income, such as Social Security, which is taxed according to your overall income. The type of IRA you choose can therefore have an impact on the amount of your net benefits.

Eligibility conditions and income limits

Access to these accounts is not identical. A Traditional IRA is open to anyone with income, with no income limit. However, tax deductibility may be restricted if you are already covered by a company retirement plan and your income exceeds certain thresholds.

The Roth IRA is however reserved for taxpayers below a certain modified adjusted income level (MAGI). In 2025, the ability to contribute begins to decrease as early as $150,000 for a single person (with total elimination at $165,000), and as early as $236,000 for a married couple filing jointly (with total elimination at $246,000).

Withdrawal rules: Flexibility versus obligation

Traditional IRA withdrawals are permitted from age 59 and half, but taxed. Before that age, a 10% penalty applies, except for certain purposes (real estate purchase, medical expenses, disability, etc.). Required Minimum Distributions (RMDs) must begin at age 73 (or 75 for those born in 1960 or later), even if you don't need the funds.

With a Roth IRA, you can withdraw your contributions at any time, tax-free and penalty-free. However, earnings are tax-exempt only after five years and if you are at least 59 and half years old, or in specific cases (disability, death, first real estate purchase). There are no RMDs to pay during your lifetime, offering greater flexibility at the end of your life or when passing on an inheritance.

Contribution limits: Identical ceilings

For the 2025 tax year, the rules are the same for both Traditional and Roth IRAs:

- Maximum contribution: $7,000

- Catch-up contribution from age 50: $8,000

These limits are cumulative for all your IRAs (Traditional + Roth). It is possible to contribute to both types simultaneously, provided the total contribution does not exceed the overall annual limit.

Other criteria to consider

- Impact on aid and tax credits: A Traditional IRA, by reducing your taxable income, may improve your eligibility for certain credits (such as the child tax credit or the student interest rebate).

- Flexibility in times of need: The Roth IRA allows freer access to your pre-retirement contributions, which can be an advantage for younger workers or those without a safety net.

- Inheritance: The Roth IRA is often favored in estate strategies, as heirs also benefit from tax-free withdrawals, albeit subject to a distribution schedule.

- Finally, the combination of income from an IRA and Social Security can vary your effective tax rate at retirement. Good retirement planning can help you manage the cross-taxation of these two sources.

A personal decision, not a universal one

Neither the Traditional IRA nor the Roth IRA is inherently "better". The choice depends on your current income, your tax expectations for retirement, your need for short-term flexibility and your long-term wealth objectives.

And don't forget that withdrawals from a Traditional IRA can increase your taxable income, which could make a larger portion of your Social Security benefits taxable. Once again, your choice of account type will influence your overall tax situation in retirement.

Many people also choose to diversify by opening both types of accounts within the authorized limit.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD tests nine-day EMA support near 1.1850

EUR/USD inches lower during the Asian hours on Monday, trading around 1.1870 at the time of writing. The 14-day Relative Strength Index momentum indicator at 56 stays above the midline, confirming improving momentum. RSI has cooled from prior overbought readings but stabilizes above 50, suggesting dips could stay limited before buyers reassert control.

GBP/USD flat lines as traders await key UK macro data and FOMC minutes

The GBP/USD pair kicks off a new week on a subdued note and oscillates in a narrow range, just below mid-1.3600s, during the Asian session. Moreover, the mixed fundamental backdrop warrants some caution for aggressive traders as the market focus now shifts to this week's important releases from the UK and the US.

Gold slides below $5,000 amid USD uptick and positive risk tone; downside seems limited

Gold attracts fresh sellers at the start of a new week and reverses a part of Friday's strong move up of over $150 from sub-$4,900 levels. The commodity slides back below the $5,000 psychological mark during the Asian session, though the downside potential seems limited amid a combination of supporting factors.

Bitcoin, Ethereum and Ripple consolidate within key ranges as selling pressure eases

Bitcoin and Ethereum prices have been trading sideways within key ranges following the massive correction. Meanwhile, XRP recovers slightly, breaking above the key resistance zone. The top three cryptocurrencies hint at a potential short-term recovery, with momentum indicators showing fading bearish signs.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

Vertiv Holdings explodes higher, but can bulls break through this resistance ceiling?

Vertiv Holdings, LLC (VRT) is a provider of critical digital infrastructure and continuity solutions. The stock just delivered one of those rare trading days that gets everyone's attention. VRT rocketed 24.49% higher yesterday, closing at $248.5, so what's the technical picture telling us here?