As prices continue to rise, inflation remains one of the biggest risks for American retirees. Rapid price growth can insidiously erode the purchasing power of your retirement savings, even if you've spent decades saving with discipline.

For those who rely on an Individual Retirement Account (IRA), it's crucial to adopt the right strategies to counter this effect and secure their financial future.

Understanding the impact of inflation on an IRA

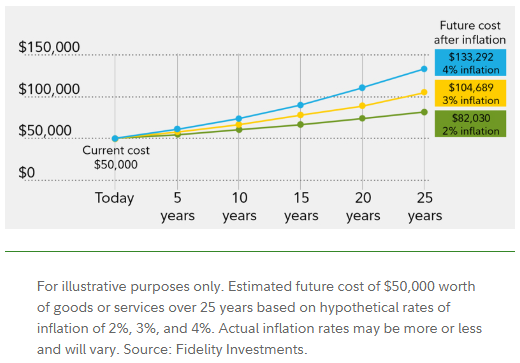

Inflation is a generalized rise in prices. Over the long term, even moderate inflation reduces the real value of your IRA.

For example, with inflation at 3% per year, a basket of goods costing $100 today will cost $134 in 10 years.

This phenomenon particularly affects retirees, who are often dependent on a fixed income from their Social Security and retirement accounts.

Yet only Social Security payments are indexed to inflation via annual cost-of-living adjustments (COLAs). Your other sources of income, including IRA withdrawals, are not automatically protected.

IRAs and inflation: Risks and solutions

An Individual Retirement Account (IRA) allows you to grow your savings tax-free. But without the right strategy, inflation can erode the benefits of these accounts, especially if your portfolio is poorly allocated or too conservative.

1. Diversify your IRA to resist inflation

Don't put all your eggs in one basket. A diversified IRA should include :

- Equities: Historically, the stock market has outperformed inflation. Focus on solid companies capable of raising their prices (and dividends) in times of inflation.

- Inflation-protected bonds: Treasury Inflation-Protected Securities (TIPS) adjust according to the Consumer Price Index (CPI).

- Real assets: Real estate, commodities (Gold, Oil, agriculture) or REITs (real estate investment trusts) help offset price rises.

2. Include indexed products in your allocation

Adding TIPS, commodity index funds or dividend-increasing equity funds to your IRA can provide effective protection. In times of high inflation, these products tend to better preserve their value.

But beware, TIPS are fiscally complex. Inflation-linked capital adjustments are taxable every year, even if you don't receive the money. That's why it's a good idea to put them in an IRA to avoid annual taxation.

3. Adopt a dynamic withdrawal strategy

In the decumulation phase, the risk of inflation is aggravated by regular withdrawals. It is therefore advisable to avoid a rigid approach.

The rule of withdrawing 4% of your retirement savings in the first year and adjusting subsequent withdrawals in line with inflation can be a good starting point. The withdrawal rate should be adjusted each year according to inflation, the performance of your portfolio and your life expectancy.

4. Defer your Social Security benefits

Deferring your Social Security benefits is a powerful anti-inflation strategy.

Each year of deferral (up to age 70) permanently increases your payments, and because they are indexed to the cost of living, you also benefit from a larger COLA over the long term.

5. Anticipate healthcare costs

Inflation in the healthcare sector is often higher than average. Set aside a reserve or consider opening an HSA (Health Savings Account) if you qualify.

This account, combined with your IRA, can enable you to cover a significant proportion of medical expenses.

Tariffs, geopolitical instability and inflationary pressures

US inflation, measured by the Consumer Price Index (CPI), stood at 2.4% in May compared with the same month a year earlier. While this is way below the 9% rate seen in mid-2022, it still shows a significant rise in prices.

And inflationary pressures are not about to disappear. Indeed, expectations of future inflation remain high, partly due to geopolitical instability and the potential return of protectionist trade policies.

For example, tariffs imposed by the Trump administration had already contributed to rising costs in supply chains.

If a return to such policies is confirmed, this could fuel further inflationary pressures. In this context, IRA holders must remain vigilant and adjust their portfolios accordingly.

Traditional IRA or Roth IRA: What's the right choice in the face of inflation?

The Roth IRA is often preferred in times of high inflation, as withdrawals are tax-free. If inflation pushes up your marginal tax bracket, you could save a lot by paying taxes now rather than later.

The Traditional IRA, on the other hand, is more advantageous if you plan to be in a lower tax bracket at retirement. But beware: high inflation could upset these forecasts.

Conversions from Traditional IRA to Roth IRA (Roth Conversion IRA) can be an interesting strategy, especially in years of low income or stock market correction.

Anticipate, diversify, adjust

Inflation is a silent threat, but with careful planning, your Individual Retirement Account (IRA) can remain a reliable pillar of your retirement planning.

By diversifying your investments, incorporating index-linked assets, rethinking your withdrawals and making intelligent use of Social Security, you can protect your purchasing power.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

Nifty 50: The crash to 25,400s - Nature’s gift or a trap?

While the broader market panicked as Nifty tumbled from 25,800 to the 25,400 zones, disciplined Elliott Wave traders were waiting for a specific 'Alternate Scenario.'