My last article was called Your 401(k): So Many Mutual Funds, Which to Choose There I described the selection of mutual funds from among the ones offered in your employer’s 401(k) or other pension plan. But mutual funds are sometimes not the only choices in a 401(k). Some plans offer other types of assets, which are not quite so easy to compare.

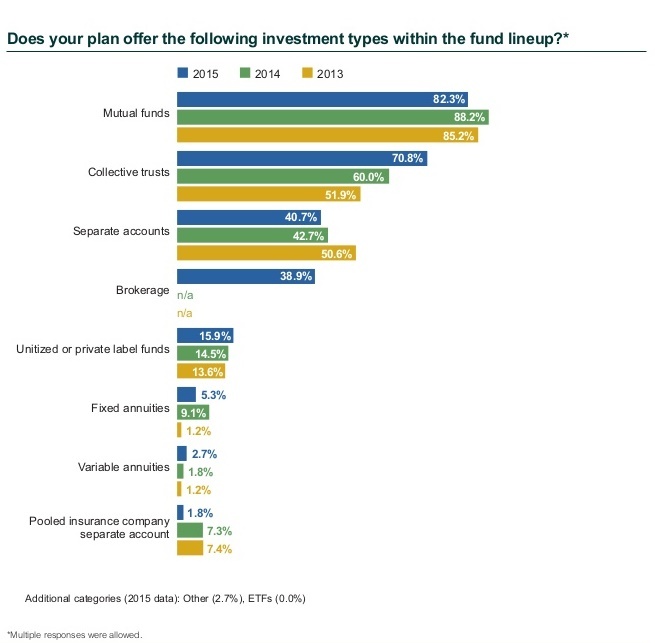

Below is a chart of various types of assets offered in 401(k) plans, with the percentages of plans that offer each one:

It’s clear that mutual funds are the category offered by the most pension plans (88% of plans offered them as of 2014). But the next big category is collective trusts.

What is a Collective Trust?

Collective trusts are for practical purposes similar to mutual funds, in that each represents a pool of capital invested in a basket of stocks or other securities. Collective trusts are also known as Collective investment trusts (CITs), commingled funds, collective investment funds or collective trust funds. I’ll refer to them all as CITs. You can often recognize them in your list of available investments by the word Trust or the abbreviation TR in the name, although not always.

These are not new. In fact, the earliest ones were created in 1927, years before the Investment Company Act of 1940 which defined the “modern” mutual fund.

The good news about them from the employee/investor’s point of view, is that the amount of fees that they extract from the fund is usually less than that of an equivalent standard mutual fund which contains the same assets (although often not as low as an Exchange-Traded Fund). Depending on what else is available to you, a CIT might be the best choice within your particular 401(k).

The reason for the lower fees is that these vehicles are not covered under the same regulations as mutual funds, and they are not offered to retail investors. This means their regulatory and record-keeping costs are lower.

CITs are not available directly to retail investors, but only through institutional structures including 401(k)s.

The not-so-good news about CITs is that it’s hard to get information about them. ETFs and standard mutual funds have tons of publicly available information. Yahoo Finance, Morningstar and other sources can tell you everything there is to know about mutual funds. There is no equivalent information available for CITs. Usually the only way to get any info on them is to login to your account on your plan administrator’s site. There you might find how the trust has performed compared with an index benchmark or category average.

By looking it up on the administrator’s site, at least you can see what the category is that it’s being compared to. You can then indirectly compare it to other offerings in that category (say Large Cap Value funds or Small Cap Funds, etc.), as described in my earlier article on which mutual fund to choose. In this way, you can make some evaluation of its suitability for you. If it happens to be the best performer among your stock fund choices, and it has been in existence long enough to have a track record that you can evaluate, then add it to your short list of candidates.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD treads water around 1.1900

EUR/USD edges a tad lower around the 1.1900 area, coming under mild pressure despite the US Dollar keeps the offered stance on turnaround Tuesday. On the US data front, December Retail Sales fell short of expectations, while the ADP four week average printed at 6.5K.

GBP/USD looks weak near 1.3670

GBP/USD trades on the back foot around the 1.3670 region on Tuesday. Cable’s modest retracement also comes in tandem with the decent decline in the Greenback. Moving forward, the US NFP and CPI data in combination with key UK releases should kee the quid under scrutiny in the next few days.

Gold the battle of wills continues with bulls not ready to give up

Gold comes under marked selling pressure on Tuesday, giving back part of its recent two day advance and threatening to challenge the key $5,000 mark per troy ounce. The yellow metal’s correction follows a better tone in the risk complex, a lower Greenback and shrinking US Treasuty yields.

AI Crypto Update: BankrCoin, Pippin surge as sector market cap steadies above $12B

The Artificial Intelligence (AI) segment is largely on the back foot with major coins such as Bittensor (TAO) and Internet Computer (ICP) extending losses amid a sticky risk-off sentiment.

Dollar drops and stocks rally: The week of reckoning for US economic data

Following a sizeable move lower in US technology Stocks last week, we have witnessed a meaningful recovery unfold. The USD Index is in a concerning position; the monthly price continues to hold the south channel support.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.