Have you ever said the following?

-

The market knows if I'm long or short.

-

The market knows where my stop is.

-

The market knows when I enter and reverses.

-

The market knows my maximum pain point.

Yes, to all of them. Right?

But instead of feeling sapped of confidence and maybe saying:

*@#$%! What sort of loser am I?"

Guess who else says it?

Answer: Everyone

Really? Yes!

Well then. Phew! That's right. Phew!

Because you now realise:

-

You're not tainted.

-

You're not broken.

-

There's nothing wrong with you.

And if it's not you... There's light at the end of the tunnel. Make sense?

And it's the most empowering realisation you'll ever encounter in trading. Tell you why in a minute:

A twisted irony

You know pokie machines feature sophisticated programming preying on human behaviour. And while for some, it's an addictive path to ruin; you also know you'll never fall for such devious ploys. Agree?

Now imagine you've never placed a trade.

And someone says the market will lure you into:

-

Entering at precisely the wrong moment.

-

Placing your stop at the exact bottom/top of the market.

-

Reaching for your maximum pain point so you exit.

You'd say:

"No way! "That'll never happen to me."

But wait...

You now know differently.

So as twisted as it might seem:

It takes firsthand experience to appreciate the counter-intuitive and predatory nature of markets.

And the same goes for the traders who've gone on to achieve mind-boggling success.

Take Michael Marcus, who turned $1400 into $80 million over his trading career. Only after experiencing several traumatic account blowouts did he accept this reality - turning to external mentorship (Ed Seykota) to gain the insider knowledge instrumental in building his phenomenal career.

And I use the word 'insider' because it's not widely understood. You won't find it via a Google search, for example. Agree?

But the good news is it's available via the proper channels. Whether that's:

1. Applying for an internship at a professional trading firm, or

2. Seeking a professional trading curriculum built on professional trading firm expertise.

For example:

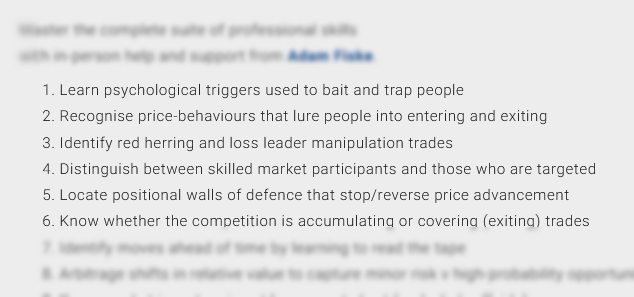

Can you see the first 6 expertise fields in a professional trading curriculum (available to independent traders) below cover how the market lures traders into actingwithout knowing it's happening?

Why's it important?

If you've been trading markets for any reasonable period, you've worked out there are two distinct groups of people in the market.

Group one:

• Market makers, proprietary trading firms, hedge funds.

Goup two:

• the majority including => had some success but it didn't last - still need to reach consistency - not making money.

And instinctively, you've concluded that the money flows from group 2 to group 1 with palpable regularity. Agree?

So wouldn't you love to know how that mouse trap works? Of course! Because knowing how it works is equivalent to owning the goose that lays the golden egg. Make sense?

Hence why it's important.

And guess what? When you narrow down external training/guidance/mentoring to including must-have 'insider' expertise; you'll find options limited making your decision an easy one.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.