In complex adaptive systems like modern financial markets, a change the price of any one market has a spillover effect into other markets. One of the best understood and most straightforward of these intermarket relationships is the impact of the US dollar on US stocks. In short, a strong dollar tends to boost the performance of domestic stocks at the expense of foreign rival, as well as the performance of importers at the expense of exporters.

Foreign vs. Domestic

Intuitively, fluctuations in the value of the dollar directly impact the returns that US investors see on the foreign stock investments. To take a trite example, if the UK’s FTSE index rallies 20% in a year in local currency terms, a UK investor would see the value of his holdings (in pound sterling) rise by 20%. However, if the value of the dollar also rose by 10% against the pound over the course of the year, a US investor’s return on his FTSE investment would be closer to 10%.

Of course, corporate executives are well aware of this connection. As an example, FactSet found that two-thirds of the companies in the Dow Jones Industrial Average cited foreign exchange as a headwind for their earnings in Q3 2018, following a sharp 9% surge in the value of the dollar index over the last six months.

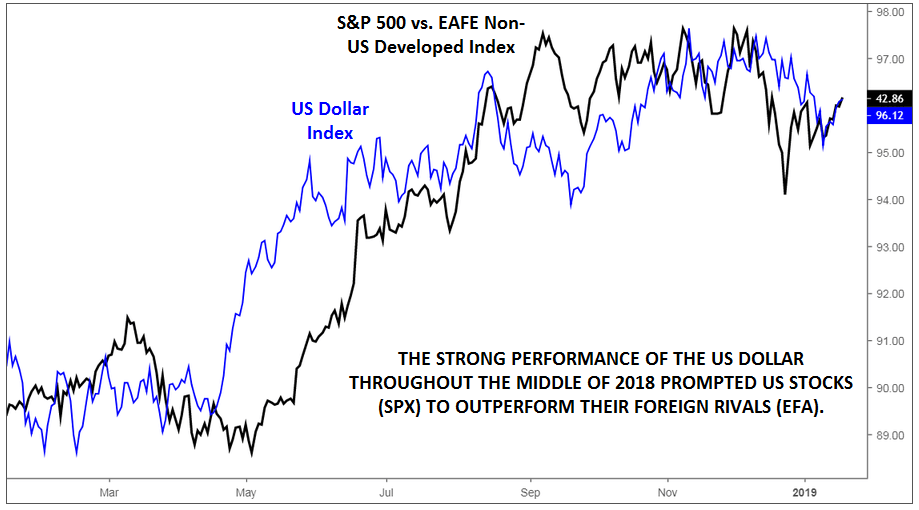

This direct, mechanical relationship can help traders determine how aggressively to allocate to foreign stocks. For instance, if the dollar has just experienced a strong year, sentiment is frothy, and the buck appears overvalued on historically-reliable metrics like purchasing power parity, a US investor may consider increasing his allocation to foreign stocks, reasoning that the greenback is more likely to fall than rise moving forward. The chart below underscores this point, showing the relative performance of the S&P 500 (SPX) against foreign stocks (EFA). As the dollar rose throughout the middle of 2018, US stocks outperformed their foreign rivals:

Source: TradingView, FOREX.com

As you can see, it’s critical that global stock investors monitor FX market fluctuations, even if they’re not trading FX directly themselves.

Importers vs. Exporters

Even for investors who trade exclusively domestic stocks, the foreign exchange market can have a major impact. Given the economy’s global nature, businesses are increasingly coordinating (and competing) with rivals across oceans, not just in the next town over.

Fluctuations in the FX market have a direct business impact on the operations of importers and exporters. If the value of the dollar rises relative to its rivals, the dollar cost of foreign imports falls. For companies that are net importers, this directly decreases expenses, increasing margins and by extension, profits at such firms. The converse occurs with net exporters: a rising dollar makes their goods more expensive for foreign buyers, forcing the company to either cut prices or see sales decline.

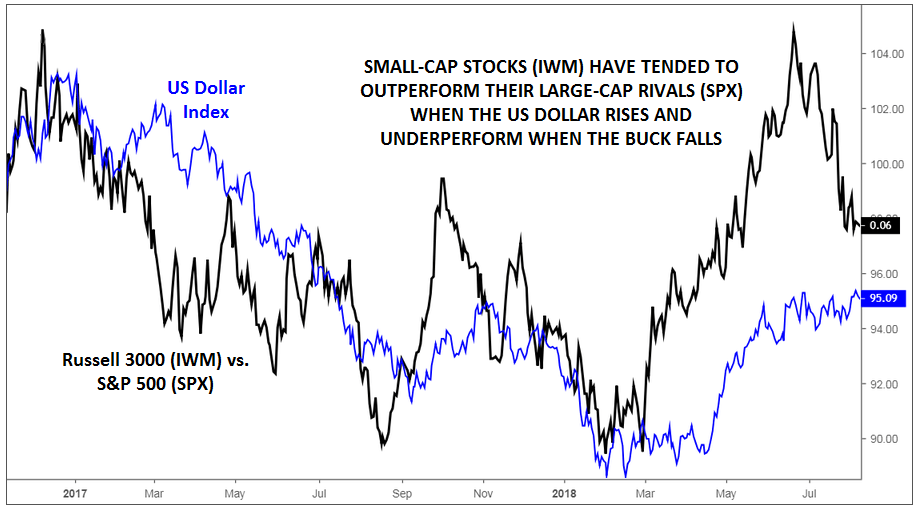

Because small-capitalization stocks derive more of their revenue from the US than their large-capitalization rivals, traders can use the performance of small- and large-capitalization stocks as a proxy for importers and exporters. As the chart below shows, small-cap stocks (IWM) have tended to outperform their large-cap brethren in periods when the US dollar rises and underperform when the greenback falls:

Source: TradingView, FOREX.com

In today’s global economy, trading stocks without at least a cursory knowledge of developments in the FX market is akin to driving with one eye closed. On the other hand, experience trading one market can give readers a big leg up in learning to trade the another.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Editors’ Picks

EUR/USD plummets to 1.1840 on US NFP

EUR/USD’s selling momentum now picks up pace and rapidly hits the 1.1840 region on Wednesday. Indeed, the pair’s decline comes amid rising buying pressure on the US Dollar in the wake of firmer-than-expected results from US NFP in January.

GBP/USD approaches 1.3600 on USD-buying

GBP/USD adds to Tuesday’s pullback and trades closer to the 1.3600 support on Wednesday. That said, Cable’s extra downside traction comes against the backdrop of renewed strength in the Greenback as investors assess the latest US NFP data.

Gold trims gains post-NFP, targets $5,000

Gold rapidly reverses initial gains and retreats to the vicinity of the $5,000 region per troy ounce amid further gains in the Greenback and rising US Treasury yields, all following the latest US NFP readings.

Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.