Have you ever felt trapped into a losing loop? The chances are that you have, especially if you’ve been trading for some time. Consecutive losses are as frequent as sharp, forceful downtrends. Exactly like the markets rise and decline in a manner that often seems unexpected, so does trading performance. We get our personal highs and lows and sideways trends. Experienced traders know that this is how it works and don’t get too bogged down with multiple losses in a row. But not everyone is good at handling this; for some, once trading performance goes into a downward spiral, it’s not that easy to get a reversal. The reason is partly neuropsychological: under stress, our production of cortisol increases, slowly rendering us weak, timid, anxious and risk-averse. Excessive cortisol production makes us more likely to base our decision-making on fear, anxiety and exaggerated perception of danger.

Then, there is also mind conditioning. Although we cannot change the way our body works, neuroscience constantly emphasises our brain’s neuroplasticity. That means that even if nature is not always on our side, we can recondition our mind to respond differently to events that are perhaps unpleasant and strengthen new neural pathways that will gradually work to our advantage.

There are many ways to recondition our mind. It’s crucial to realise mind deconditioning and reconditioning is what we need, instead of just following the familiar adage “control your emotions when trading”. In fact, emotional control may be surprisingly detrimental.

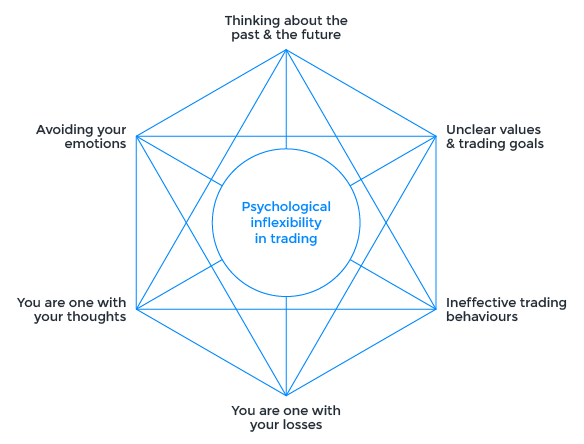

Take a look at the “Hexaflex” below, an Acceptance and Commitment Therapy (ACT) concept that describes six facets of psychological (in)flexibility. These facets interconnect in sabotaging our trading efforts, or any other aspect of life. If we reverse them, we can build mental resilience and achieve better results. As you may see in the diagram, the six facets are;

⦁ Thinking about the past & the future

⦁ Avoiding your emotions (experiential avoidance)

⦁ Unclear values

⦁ Ineffective trading behaviours

⦁ You are one with your thoughts (cognitive fusion)

⦁ You are one with your loses (self as content)

1st facet: Thinking about the past & future.

You can’t stop thinking about what happened yesterday or last week.

You can’t stop worrying about the possibility of repeating the same mistakes in the future.

Antidote: Be here, now. Last week or next week doesn’t matter. Be here, now. Focus on executing your trading plan and analysing the market in the now. Thoughts may creep in: my decision wasn’t right yesterday, I won’t take this trade because maybe I’ll be wrong again. Your mind will do that all the time, this is how it works.It likes wandering in the past and predicting the future. Don’t buy into its chatter. Be aware of it and distance yourself from it. Bring yourself back to the present moment. What’s important for you as a trader in the now?

2nd facet: Experiential avoidance.

The need to avoid the unpleasant emotion is what drives you.

When you experience consecutive losses, it’s unavoidable to feel disappointment, worry, regret and anxiety. If you are like most people, chances are that you will fight these feelings and try to get rid of them as soon as possible. Running away from the reality of your experience-this is experiential avoidance. What’s wrong with that? You may wonder. Are we supposed to enjoy being miserable? Logic tells us that in order to trade effectively, we must control or eliminate emotions. This is what trading psychology is about, right?

It may sound counterintuitive, but successful trading psychology is completely unrelated to eliminating or controlling emotions. The reason is that the struggle against emotions causes us to act in ways that hurt our trading further. This brings us to the third facet of the hexagon, the “ineffective behaviours”.

3rd facet: Ineffective trading behaviours

You avoid trading, you make impulsive decisions, you overtrade.

Example: Regret

When you feel regret about your previous decisions, you want to avoid feeling regret again. You may hold losing positions too long or close winning positions too fast. You may keep adding funds to your losing positions, hoping that the market will reverse. Or you may avoid trading altogether.

The need to avoid the discomfort that regret creates and the desire to substitute regret with a positive feeling (relief, joy) makes you trade ineffectively.

Antidote: Accept what was, what is and what will be. What does it mean to accept? Rather than a passive submission to the unpleasant, accepting a difficult emotion means befriending it, looking at it from a beginner’s eye, allowing it to explain itself and listening to its message. Once you stop fighting the emotion and just let it be, you will be able to focus on what matters, which is your trading plan and values.

4th facet: Unclear values

In order to focus on fulfilling your values, you must have identified them. There’s nowhere to go without knowing what truly matters to us. Values are the foundations of our goals and about how we choose to behave at a given moment.

Antidote: Clearly define your trading values.

To do so, you may want to reflect on the following:

⦁ Assuming that you have managed to become a successful trader, what attributes and behaviours would have assisted you to get there?

⦁ How your ideal trader self would deal with losses?

⦁ How would you know you succeeded?

⦁ If you were to be an accomplished trader, what your advice would be to novices?

5th facet: Cognitive Fusion -You and your thoughts are one

When you are in the state of cognitive fusion, you and your thoughts are one.You don’t comprehend that the incessant chatter of your mind is not reality but instead your perceived reality. You buy into your mind’s judgements and evaluations and let them determine your emotions and actions.

Example: You are having the thought that “ I must add more money and modify my targets”.

“I must make back my losses”, “I can’t afford to keep losing”.

In a state of cognitive fusion, you willingly obey your mind’s suggestions. Your thoughts are your reality, not just passing mental events. It is precisely because you believe them that you act on them and once you do so, you further entrap yourself into a losing spiral.

Antidote: Defusion- You don’t have to obey your mind. Do your thoughts help you? Keep them. Do they cause trouble? Choose to not buy into their catastrophic scenarios. Your mind won’t stop, it will keep bombarding you. But you can choose to decondition its habits and build new ones. So don’t let your mind boss you around. Go back to your values and trading plan and take actions that support them.

6th facet: Self as content-You and your losses are one

After consecutive losses, you might be inclined to give up. However, the majority of successful, well-known traders will tell you that before they started making any consistent profits, they went through bumpy journeys with considerable losses.Your mind will sell you the idea that “I am not good at trading”. Your experience of actual loss will confirm it. But you are not your thoughts, neither you are your experiences.

Antidote: Self as context- You are not your losses. Don’t let your experiences pull you down. You may use them as lessons, but losing doesn’t make us eternal losers. Neither does winning. Observe your experiences from a distance and stick to your trading values and goals. There will always be a reversal.

Are you ready to raise your trading standards? Open a trading account today and access manual, copy and automated trading from a single platform.

Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Editors’ Picks

GBP/USD drops below 1.3600 after weak UK jobs report

GBP/USD is seeing a fresh selling wave, giving up the 1.3600 level in Tuesday's European trading. The United Kingdom employment data showed worsening labor market conditions, bolstering bets for a BoE interest rate cut next month. This narrative is weighing heavily on the Pound Sterling.

EUR/USD stays depressed near 1.1850 ahead of German ZEW

EUR/USD remains in the red near 1.1850 in the European session on Tuesday. A broad US Dollar bullish consolidation combined with a softer risk tone keep the pair undermined ahead of the German ZEW sentiment survey.

Gold pares intraday losses; keeps the red above $4,900 amid receding safe-haven demand

Gold (XAU/USD) attracts some follow-through selling for the second straight day and dives to over a one-week low, around the $4,858 area, heading into the European session on Tuesday.

Pi Network rallies ahead of its first anniversary

Pi Network trades above $0.1800 at the time of writing on Tuesday, recording nearly 5% gains so far. On-chain data indicate that large wallet investors, commonly known as whales, have accumulated approximately 4 million PI tokens over the last 24 hours.

The week ahead: Key inflation readings and why the AI trade could be overdone

It is likely to be a quiet start to the week, with US markets closed on Monday for Presidents Day. European markets are higher across the board and gold is clinging to the $5,000 level after the tamer than expected CPI report in the US reduced haven flows to precious metals.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.