When do you have edge?

- When you take uncrowded trades (opposite to the crowd).

- That exploit price inefficiencies.

Okay, but aren't markets efficient? Yes and No. The majority determines fair price. But sometimes price trades at a discount or premium to its fair price due to events such as:

- A change in the fundamentals (e.g. interest rate increase)

- An absence of traders due to a regional holiday (e.g. Chinese New Year)

- Illiquidity due to traders waiting for the release of critical data (e.g. CPI)

When something is expensive or cheap relative to its fair value, it doesn't remain so long. Because traders quickly act on inefficiencies to make a profit. But here's the deal: the biggest inefficiencies occur in the shortest periods. Or another way to say this is your largest edge trades happen in the smallest time windows.

Look at the "Market Wizards" (Famously reported in books of the same name). The best traders are wrong half the time. So how are these traders so successful? It's in their nuance of time and monetary risk relative to relative to trades that are working. The following will break it down for you:

How much 'heat'?

Heat refers to your position trading at a worse price than your entry.

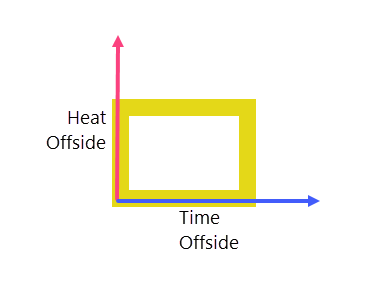

The diagram has two axis time and heat. The "taller" the box, the greater heat a trade takes. The "wider" the box, the longer the trade takes heat.

Do you like taking heat on trades? No, of course not. Well then: if unfair prices only last for a moment, trading unfair prices means you won't take heat for more than a moment. And if you enter at an unfair price, you know the market will act immediately, and the price won't continue getting less and less fair.

To illustrate using recent trades, the yellow boxes show you how much heat the trade took for how long the trade took heat.

Example 1

Example 2

Ask yourself: What would it do for you if you took as little heat for as little time when you trade?

- Would your losses no longer exceed your gains?

- Would you trade consistently?

- Would you feel confident?

- Would you feel a greater sense of well-being knowing you've moved on from trading that's painful?

When trading as a business (for cash flow), can you see how short-term price inefficiencies offer you a tremendous edge? The payoff versus the risk is outstanding because the risk is miniature.

Here's the good news: Half the time you're wrong. It could be your timing or a miscalculation. But the market is quick to act on genuine inefficiencies. So if that's not what's occurring, then you know you've made an error. And there's no need to experience more than a paper cut loss.

Okay, sounds great; what's the catch? There is no catch. Competency is transferrable. The right quality and quantity of guidance have you replicating this. And it takes far less time than spending years and years under your own steam.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.