Key points

Shift from hardware to software: AI enthusiasm is moving from semiconductors like NVIDIA and AMD to software leaders such as Salesforce and Palantir, signaling a maturing market narrative.

Why software? Software companies are driving AI adoption with tools for data utilization, enterprise integration, and scalable revenue models, making them indispensable in the AI ecosystem.

Potential emerging winners: Cloud giants like Microsoft and Oracle, AI-powered cybersecurity firms like Crowdstrike, and generative AI pioneers like Adobe are poised to benefit from this shift.

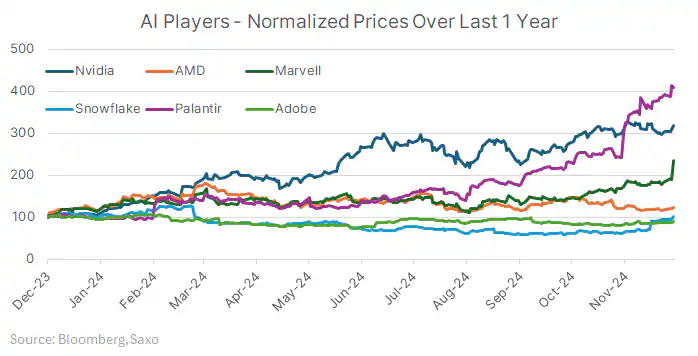

The market's obsession with AI is evolving. After fueling a massive rally in semiconductor stocks like NVIDIA and AMD, the enthusiasm is now shifting toward software companies, with names like Marvell, Snowflake and Palantir leading the charge. This pivot underscores the growing realization that AI's true potential lies in its application across industries, not just in the hardware powering it.

The semiconductor surge

Semiconductors were the initial winners of the AI boom, driven by the race to develop the processing power needed for advanced AI models. NVIDIA's leadership in GPUs and AMD's innovations positioned them as the flagship names of the rally. While these "shovels" remain essential tools in the ongoing AI gold rush, the spotlight is shifting. As the focus moves to delivering real-world AI applications, investor enthusiasm is increasingly turning toward software companies that bring AI to life.

Why software is the next frontier

Data utilization: Snowflake specializes in data storage and analytics, providing the critical infrastructure to harness and deploy AI effectively. Its strong position in the data space enables companies to leverage AI for business intelligence and analytics at scale.

AI monetization success: Salesforce’s AgentForce, launched in October, is an early success in AI monetization, enhancing sales processes with AI-driven automation and personalization capabilities.

AI integration: Palantir has established itself as a leader in operational AI and decision-making tools, helping enterprises integrate AI seamlessly into their workflows. With its stock up 300% YTD, Palantir's AI platform is gaining traction in government, defense, and enterprise sectors, positioning it as a standout in the AI ecosystem.

Broader applications: Unlike semis, whose primary growth is tied to hardware sales, software companies benefit from recurring revenues and diverse use cases across sectors.

As adoption deepens, the focus will likely move toward companies offering scalable AI solutions for enterprises. Investors looking to ride this wave should consider a barbell strategy—balancing exposure between the hardware providers (semiconductors) and the enablers (software companies).

Who could be the next winners in the AI revolution?

The next wave of AI winners will likely span industries that incorporate AI into their operations and products. Cloud computing, cybersecurity, healthcare, and generative AI remain key areas of focus.

1. Cloud providers

Cloud infrastructure is critical for storing, processing, and deploying AI solutions. These giants stand to benefit as AI adoption grows.

-

Microsoft (MSFT): Integrating OpenAI’s models into Azure, driving enterprise AI adoption.

-

Amazon (AMZN): AWS’s suite of AI and machine learning tools like SageMaker continues to lead.

-

Oracle (ORCL): Positioned well with its AI-powered cloud solutions and strong focus on enterprise clients.

-

Alphabet (GOOGL): Google Cloud leverages its deep AI expertise and market-leading research.

2. AI-powered cybersecurity

The surge in AI adoption raises the stakes for protecting systems and data, making AI-driven cybersecurity solutions a critical growth area.

-

CrowdStrike (CRWD): Pioneering predictive threat detection with AI.

-

Palo Alto Networks (PANW): Expanding its use of AI to enhance network security and threat prevention.

3. Generative AI applications

Generative AI is transforming industries, from content creation to drug discovery, offering immense growth potential for enabling platforms.

-

Adobe (ADBE): Its Firefly tools cater to the growing demand for generative content creation.

-

ServiceNow (NOW): Using generative AI to automate workflows and enhance productivity.

4. AI-oriented SaaS and data companies

As AI adoption scales, SaaS and data companies providing the foundation for AI solutions are becoming indispensable.

-

Snowflake (SNOW): Enabling data-driven AI applications with its robust platform.

-

Palantir (PLTR): Operational AI and decision-making tools make it a standout in enterprise markets.

5. AI-powered healthcare

The healthcare sector is poised for disruption as AI transforms diagnostics, drug discovery, and personalized medicine.

-

Intuitive Surgical (ISRG): AI-powered robotics enhance surgical precision.

-

Moderna (MRNA): Using AI to accelerate vaccine development and mRNA innovations.

6. Hardware beyond semiconductors

AI requires a broader ecosystem of specialized hardware beyond semiconductors, creating new opportunities.

-

Arista Networks (ANET): Providing networking solutions tailored for AI-scale workloads.

-

Pure Storage (PSTG): Gaining traction for its AI-optimized storage solutions.

7. AI-powered consumer products

As AI integrates into consumer technologies, companies leveraging AI in smart devices, AR/VR, and autonomous vehicles stand to gain.

-

Apple (AAPL): Innovating AI-driven features in its ecosystem and exploring AR/VR.

-

Tesla (TSLA): Advancing AI in autonomous driving and energy solutions.

ETF opportunities

-

For semis exposure: Consider ETFs like SOXX (iShares Semiconductor ETF) or SMH (VanEck Semiconductor ETF).

-

For AI software: Look at funds like AIQ (Global X Artificial Intelligence & Technology ETF) or BOTZ (Global X Robotics & Artificial Intelligence ETF).

-

For cloud growth: Consider CLOU (Global X Cloud Computing ETF).

-

For AI-driven cybersecurity: HACK (ETFMG Prime Cyber Security ETF).

-

For automation and robotics exposure: ROBO (Global X Robotics & AI ETF).

By focusing on these next-wave beneficiaries, investors can position themselves to capitalize on AI’s transformative potential across the economy.

Read the original analysis: The evolving AI narrative: From semis to software

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.