The word ‘spoof’ has resurfaced with vengeance in 2018. The CFTC is announcing it will fine UBS, HSBC and Deutschebank for ‘spoofing’ and manipulating the US Futures market. Spoofing is a criminal offense under a provision implemented as part of the 2010 Dodd-Frank financial reform. After this last week maybe the CFTC should look into the antics of President Trump and Treasury Secretary Mnuchin, but they won’t.

When Donald Trump left Davos this week, he was smiling. Between him and Steve Mnuchin the US administration managed to ‘spoof’ the markets.

Spoofing is the art of creating the illusion or better still the temporary reality of a higher or lower price in order to fade it. It is not to be confused with the drinking game where players try to guess the number of coins concealed in others’ hands. Regardless of what Trump and Mnuchin were really up to, the ‘spoof’ in the USD market was very revealing.

This description gives a reasonable impression but it doesn’t hit the nail as institutional forex traders used to in the 1980s and 1990s. The likes of the red Ferrari driving Ebco traders would bid a currency 10-15pips above the current spot through the broker boxes (preferably get someone to overbid it) then hit as many bids in the direct interbank market as they could and the price would fall at least 15 pips. Except in the case of Steve Mnuchin his lower USD comments caused EURUSD to rally 130 pips (1pct) and the day later Donald Trump’s retort that he could see the USD getting stronger and stronger prompted a reversal of 130 pips. The perfect spoof – even if it took a day rather than a minute. I was reminded of a morning as a bank trader when I was called in at 6am as a major client, an Arabic Oil Authority, informed us it was starting a major USD buying programme (over $1bn). We all walked in and bought Dollars. The market ramped 400 pips. And stopped… and then a British Oil company with significant trading limits called and started selling aggressively. The market collapsed 700 pips…all in the space of 3 hours before returning to the 6am level. The Arab client had told all its London Banks it was buying and then used its Oil intermediary to sell on its behalf into a London market that was massively long. Manipulative and nasty but no lasting effect. Its account was suspended by a number of banks who lost serious money but reinstated shortly after. Profit before principle.

So what was the US administration really doing this week and why? Certainly, the effect was similar to that of manipulation but, unlike spoofing, it probably was not by design. I have seen countless accusations of government or central bank manipulation on social media since I joined Twitter in 2011. It may feel like they are trying to move the market in a certain way. But it is rarely either their intent or within their ability to sustain a currency move if the fundamentals or indeed technicals/sentiment do not allow; that is unless they create the fundamentals through, say, a change in monetary policy.

Anyone who traded the USDJPY downtrend in the early 90s will recall waiting for BoJ buying intervention and a 150 pip rally to sell as the central bank was swimming against a powerful tide and doomed to failure.

It is not so much what a Government’s agenda is but how it goes about trying to achieve that will determine its success in the longer term. Donald Trump has a breath-taking agenda; simply to Make America Great Again for Americans through an aggressive domestic, economic and foreign policy. The altruistic dimension to this platform is that other nations will benefit from this leadership even if some only become begrudging friends. Global stock markets have rallied 36.5% in the 319 trading days after his election or 28.3% in the 266 days since his inauguration. How much more than if Donald Trump hadn’t been elected is uncertain. But it is why many business leaders were lining up to share a tenderloin dinner with him in Davos this week (putting aside any curiosity value). They have benefited from the expectation of even greater economic growth (4% now 6% Trump promise compared to Friday’s 2.6% release for 2017 Q4) through a combination of lower taxes ($1.5trn) deregulation and $1trn infrastructure spending – the details for which were allegedly leaked this week.

A lower Dollar has, at least until now, played a significant role in this agenda as it makes US exports cheaper and imports more expensive. How much longer it needs to play this role comes down to the question that dominated 2017. Can the reality of economic growth can catch up with the expectation or hope. One of the main intended beneficiaries of the Trump plan is the blue collar worker through the revitalization of US manufacturing. Although the manufacturing sector continues to grow at a faster rate than the economy (2.8%) the number of blue collar workers who elected him has steadily fallen in the last two decades (34% decline from 1998 to 2010). The reason is increased overseas outsourcing due to the relative strength of the Dollar, or the weakness of manufacturing competitors’ currencies. Unless, or until, fiscal expansion and consequent economic growth is able to replace these missing jobs then a lower Dollar serves as a useful stop-gap. Donald Trump previously claimed that China artificially undervalues its currency, the yuan, and therefore gains an unfair competitive advantage by 15 percent to 40 percent. Although this may be debatable, it is no coincidence that, when the President withdrew his accusation that China was a currency manipulator a few days after his meeting with Chinese President Xi Jin, he started talking the USD down. But is it coincidence that when Steve Mnuchin’s lower Dollar comment helped the Dollar Index to an almost 15% decline on the year, the next day the President effectively says enough. In principle no, in profit or detail yes. The Yuan has only fallen 6.7%.

What the US administration needed was a lower Dollar to restore competitiveness, not a falling Dollar that could undermine confidence in US assets or the economy as a whole. This begs three important questions.

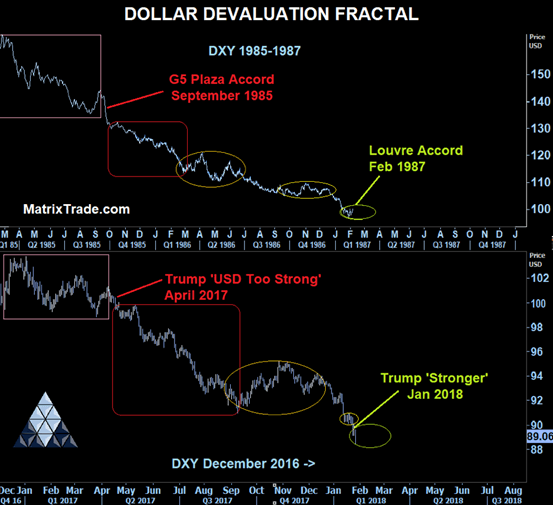

Firstly, was Donald Trump’s ‘stronger and stronger’ comment effectively saying he is happy the Dollar is now low enough and he will now rely on his other economic policies to achieve the ambitious manufacturing and economic growth plans. (Ironically similar to the Louvre Accord of February 1987 that followed the September 1985 G5 Plaza Accord to devalue the Dollar).

Secondly, whether he was simply trying to stop a further fall or indeed an acute Dollar crisis particularly when he was on the world’s stage at Davos.

Thirdly, irrespective of whether the US administration has a deliberate USD policy or if their comments this week were premeditated or just reactive, are they capable of stopping a further fall in the Dollar or a sequence of market movements that has a strong historical precedent.

Precedent

There are many precedents for managed competitive devaluations that will be the subject of next week’s newsletter and in particular their effect on stocks, bonds and the real economy. But there are two that help us now – primarily due to the market’s reaction to this week’s news.

Short Term

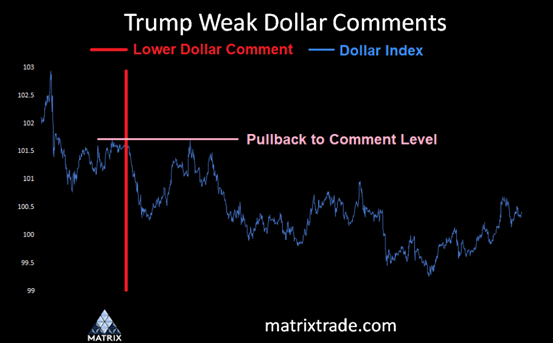

Most recently how the market reacted to Donald Trump’s lower Dollar wish in January and April 2017.

After the initial drop, the market retraced fully to the level of the comment before resuming the decline. This is consistent with a possible consensus or at least fear that, because previous comments led to an aggressive trend, ‘stronger and stronger’ will become self-fulfilling and that we have seen a major USD bottom for the foreseeable future. However, unless the President makes up US economic policy instantly on the hoof, Mnuchin’s comments the day before suggests there is, as yet, no concerted effort to drive the USD higher at least until economic performance can justify it, at which point it becomes more of a counter to the, so far, elusive inflation.

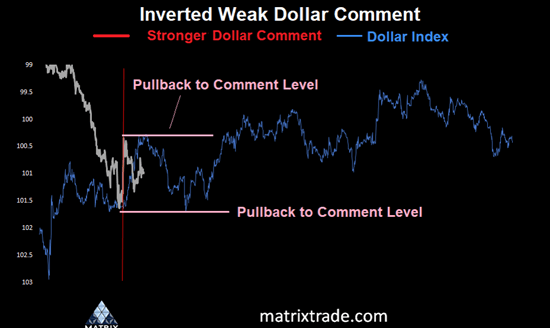

An inverted USD comment fractal also possibly suggests that the context is different and that it may only be applicable in the very short term; that it is both comment driven moves are unwound:

Medium Term

Currencies and particularly currency devaluations can play a pivotal role in the medium term trends of other asset classes. The issue, most particularly for us at this juncture in the stock market uptrend, is whether any development in US foreign exchange policy has any bearing on the course of the 1929/1987 style stock blowout. The answer is a stunning YES!

It so happens that the 1987 and 2018 USD downtrends are very comparable. Although the scale of the decline, and the significance of official announcements is much smaller in 2017 than 1986, the structure and timing are remarkably similar.

The G5 Plaza Accord of September 1985 coincides at a similar early point in the downtrends to Donald Trump’s April 2017 wish to see a lower Dollar. The analogy goes further. It too was a pro-growth device (signed by Germany, France, the United States, Japan and the United Kingdom) to weaken the USD and reduce a US current account deficit that had reached 3% of GDP (2.6% in April 2017). Just as importantly it would help Europe and Japan reduce significant current account surpluses (as they have now) that threatened still struggling economic growth. Again it would seem a step too far to compare continued Bundesbank intervention through 1986 (timed by a 50 day $-Mark moving average – no joke) with such incidents as Draghi’s June Sintra speech but the effect was similar. However, as the Dollar downtrend continued into 1987 it reached a point where it was threatening US and global growth through an increasing US fiscal deficit and a rise in commodity prices that was penalizing developing countries. The result, at a similar point to now in the USD downtrend, was the Louvre Accord late February 1987 that sought to stabilize the Dollar into a range effectively ending the G5 Dollar devaluation policy and clearly analogous to Donald Trump’s prediction this week that USD would get stronger.

The analogy is remarkable. It helps emphasize why the highly unusual combination of a falling Dollar, rampant stock market, rising commodity prices and bond yields has only been 3 times in American history 1928-1929, 1986-1987 and 2017-2018.

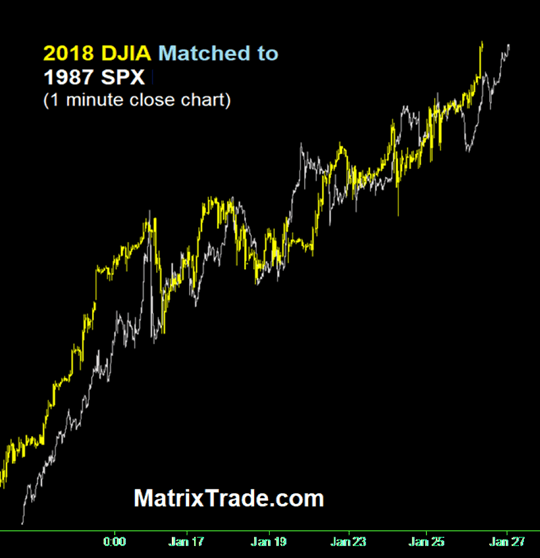

So what was the stock market doing at this inflection point in the 1987 USD downtrend?

Whether the market follows the Louvre Accord template of February 1987 remains to be seen but if the USD and stock markets continue with this template — President Trump may not be smiling next year at Davos following a far from immaculate year.

MatrixTrade.com makes no warranties or guarantees in respect of its content. All information is provided as general commentary and does not constitute investment advice or recommendation.

Editors’ Picks

EUR/USD clings to strong gains above 1.1850 on USD weakness

EUR/USD preserves its bullish momentum to start the week and trades above 1.1850. The US Dollar struggles to find demand ahead of Wednesday's critical January employment report and helps the pair continue to push higher.

USD/JPY slumps below 157.00 on intervention risks

The Japanese Yen outperforms the US Dollar to start the week on the back of speculations that authorities will step in to stem JPY weakness in the domestic currency following Prime Minister Sanae Takaichi's landslide win in Sunday's election.

Gold holds steady above $5,000

Gold builds on the gains it posted to end the previous week and holds steady above $5,000 on Monday. Data released over the weekend showed that the People's Bank of China extended its Gold buying spree for a 15th month in January. Moreover, dovish US Fed expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

Cardano steadies as whale selling caps recovery

Cardano (ADA) steadies at $0.27 at the time of writing on Monday after slipping more than 5% in the previous week. On-chain data indicate a bearish trend, with certain whales offloading ADA. However, the technical outlook suggests bearish momentum is weakening, raising the possibility of a short-term relief rebound if buying interest picks up.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.