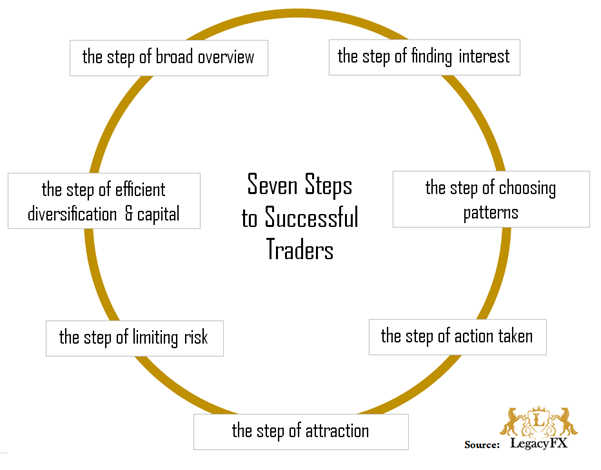

Successful countries, societies, businesses, people, including successful traders, all, owe their success to the fact that they are following seven concrete steps. As long as they follow these steps consistently, they can be successful. LegacyFX introduces these steps in order for traders to be successful when get involved in trading.

In the first step, successful people including successful traders, need to have the ability to observe if a set of data create conditions for a remarkable event. An event is remarkable if it causes great interest.

A set of data that indicates a continuous and significant disturbance in social behaviour or major economic data, or a change in price values, are some examples that can create a remarkable event that causes interest. Thus, a pandemic that affects social behaviours or, the continuous decline or increase in GDP or a big fluctuation of the prices of a financial instrument, all create conditions of remarkable events, which cause lots of interest.

Where there is interest, there is a challenge and opportunity from which a significant benefit can be created. A set of data that affect the prices of a financial instrument create remarkable conditions for this instrument, which could cause the interest of traders for this instrument, while arise opportunities that can give significant benefits. We will call this step the step of finding interest.

In the second step, each data set creates patterns for the economy, society, business, or financial instrument. Successful people, countries, entrepreneurs, and traders need to map and discover these patterns.

There is no, a unique mapping neither a unique pattern. So, as they will find and analyze multiple patterns, finally they must choose which are the pattern or the patterns that need to follow.

The type of pattern they will follow is very important because at the end of the day, the pattern, or patterns they will choose, will determine the strategy they will follow. A set of data that includes price movements and the volume of a financial instrument over multiple time frames creates many different mappings and patterns. The same is true of all financial and business data or a set of behavioural indicators.

In this step, countries, or companies, or traders, must choose the patterns that will follow. Based on these patterns will create strategies by determining signals for action. We call this step the step of choosing patterns.

In the third step, once the patterns have been selected, policymakers or traders await confirmation of the designated signals, such as hunters waiting for their prey. For example, policymakers determine the patterns to follow according to a set of data on the level of GDP, unemployment, and inflation, for example over the last three quarters and they take action when signals to reach specific levels on the above indicators are confirmed. The same for traders, when signals confirmed, is like the prey appears, and thus, like hunters they shoot, and acting, as they are getting involved in a trade. For example, when signals of patterns where price formation and/or combinations of technical indicators are confirmed, the trader receives an entry signal, taking immediate action, for trading. We call this step, the step of action taken.

In the fourth step, successful people, countries, people, entrepreneurs, traders set their goals and loss limits. The ratio between the result that gives potential goals and losses must always be bigger than 1. Goals and losses are determined by the pattern or patterns used to pursue a policy or for traders to engage in a trade. As trade is executed, the stop-loss order determines the maximum tolerance if the direction of the financial instrument will move against the expectations. The target price is defined by the expected positive movement, for this financial instrument. The ratio between the target price and stop-loss indicate how attractive a trade can be. The higher the 1 the more attractive the trade is. We call this step the step of attraction.

In the fifth step, successful people, countries, entrepreneurs, traders when participating in challenges and opportunities, calculate their optimal position in them in relation to the potential losses that may occur. As a basic principle that they follow is that all the challenges and opportunities that are exposed, in the worst-case scenario will never be able to irreparably damage their total wealth. For traders, their total exposure is calculated for all their positions, in terms of the total risk they take and their total wealth. As a general rule, all positions in the worst-case scenario should not cause losses of more than 8%-10% of their total wealth. While the potential gains can be unlimited. We call this step the step of limiting risk.

In the sixth step, successful people, countries, entrepreneurs, traders find the optimum leverage in order to use more efficient their capital to support their challenges and opportunities arise. Since the limit of risks indicates the optimal size of an opportunity, high leverage gives a competitive advantage, for success with risk limitation.

In trading, high leverage secures more power to traders, since risk limitations stay unchanged, while with high leverage which means low capital requirements, make diversification, and expected profits more effective. We call this step the step of efficient diversification and capital.

In the seventh and final step, countries, people, entrepreneurs, traders, as they act by setting targets and limits of losses and as they engage in policymaking or trading, in real terms, and facing real outcomes, they are forced to manipulate their emotions. This means that they are in the most difficult step towards success.

There are many ways to manage emotions when you are experiencing real results. One of the most effective ways is when one can have a broad overview of all the critical issues mentioned in the steps above. Thus, it is vital to have an overview of all the data that is of high interest in conjunction with the patterns that have been chosen and the specific signals that confirm the patterns that policymakers or traders choose. The overview should also include the ratio of potential goals and losses to assess the attractiveness of an opportunity. Also, success requires a broad overview of leverage as an indicator of capital efficiency.

There can be no management of emotions if there can be no comprehensive overview of all the important issues mentioned above. Emotion management, then, is closely linked to a broad overview of all-important issues. We call this step as the step of a broad overview.

If you think about it, every each of us experience the same steps in our daily lives for many of our activities. From time to time remarkable events happen everywhere. In many countries in many industries, eventually in all forms of activities. People are interested in these events and are looking for ways to take advantage of them by looking if there are patterns, so that they can engage in the opportunities that a remarkable event may offer. As establish patterns, they are waiting for signals to get involved in an opportunity and set the values to engage in an opportunity, they set their expectations and risk limitation to find the optimal exposure and deal with the real outcomes by managing emotions.

The good news is that in trading, all the above-mentioned steps can be quantified:

If you think about it, every each of us experiences the same steps in our daily lives for many of our activities. From time to time remarkable events happen everywhere. In many countries in many industries, eventually in all forms of activities. People are interested in these events and are looking for ways to take advantage of them by looking if there are patterns so that they can engage in the opportunities that a remarkable event may offer. As establish patterns, they are waiting for signals to get involved in an opportunity and set the values to engage in an opportunity, they set their expectations and risk limitation to find the optimal exposure and deal with the real outcomes by managing emotions.

The good news is that in trading, all the above-mentioned steps can be quantified:

- set of data that create conditions for a remarkable event

- patterns to create strategies

- confirmation of the designated signals to take action

- goals and losses that indicate the attraction of a position

- risk limitation in relation to the optimal position

- optimum leverage as the capital and diversification to be more effective

- the manipulation of emotions by establishing a broad overview

All the above issues and the combination of them is a good recipe that LegacyFX offers for traders to be successful.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The Article/Information available on this website is for informational purposes only, you should not construe any such information or other material as investment advice or any other research recommendation. Nothing contained on this Article/ Information in this website constitutes a solicitation, recommendation, endorsement, or offer by LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. LegacyFX and A.N. ALLNEW INVESTMENTS LIMITED in Cyprus or any affiliate Company, XE PRIME VENTURES LTD in Cayman Islands, AN All New Investments BY LLC in Belarus and AN All New Investments (VA) Ltd in Vanuatu are not liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the website, but investors themselves assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Article/ Information on the website before making any decisions based on such information or other Article.

Editors’ Picks

USD/JPY drops back below 157.00 on Japan's verbal intervention

USD/JPY has come under moderate selling pressure below 157.00 in the Asian session on Monday. The Japanese Yen lost ground to near 157.70 following Japan’s ruling Liberal Democratic Party's outright majority win in Sunday’s lower house election, opening the door to more fiscal stimulus by Prime Minister Sanae Takaichi. However, JPY buyers jumped back and dragged the pair southward on FX verbal intervention by Japan’s Finance Minister Katayama.

Gold eyes acceptance above $5,000, kicking off a big week

Gold is consolidating the latest uptick at around the $5,000 mark, with buyers gathering pace for a sustained uptrend as a critical week kicks off. All eyes remain on the delayed Nonfarm Payrolls and Consumer Price Index data from the United States due on Wednesday and Friday, respectively.

AUD/USD: Buyers eyes 0.7050 amid upbeat mood

AUD/USD builds on Friday's goodish rebound from sub-0.6900 levels and kicks off the new week on a positive note, with bulls awaiting a sustained move and acceptance above mid-0.7000s before placing fresh bets. The widening RBA-Fed divergence, along with the upbeat market mood, acts as a tailwind for the risk-sensitive Aussie amid some follow-through US Dollar selling for the second straight day.

Top Crypto Gainers: Aster, Decred, and Kaspa rise as selling pressure wanes

Altcoins such as Aster, Decred, and Kaspa are leading the broader cryptocurrency market recovery over the last 24 hours, as Bitcoin holds above $70,000 on Monday, up from the $60,000 dip on Thursday.

Weekly column: Saturn-Neptune and the end of the Dollar’s 15-year bull cycle

Tariffs are not only inflationary for a nation but also risk undermining the trust and credibility that go hand in hand with the responsibility of being the leading nation in the free world and controlling the world’s reserve currency.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.