Overview

The financial market is a deep and complex jungle. Traders are rarely fully understand the forces that drive the markets (the buyers, the sellers and how the market is positioned).

As the FX market (unlike other markets) is mostly traded OTC (Over-the-Counter), it makes the analysis of the market position a difficult task. Most trades are not cleared through an exchange (or a central clearing facility), meaning that we (traders and analysts) cannot analyze and understand how the market is positioned. Given that we have no actual way to understand who the sellers/buyers are (which is a critical piece of information, which I will elaborate later on), or how the order-book looks like (where the limit orders, stop-losses orders and the sizes of the orders), we face a difficult mission navigating through the scary jungle that is called FX market.

In addition to understanding the “market positioning” in the different currencies, one needs to look at the relative strength of a certain currency when looking to establish a successful strategy (rather than looking at a single-dimensional scope, which the currency strength against the USD).

In this Quantitative research piece we will review methods to gather a lot of valuable information from sources that are widely available and that will help you in preparing your trading strategies, and take advantage of different analysis techniques to build long term strategies.

Currency Strength – Looking from an indexed POV

We often look at currencies as pairs (i.e. EUR/USD, USD/JPY) because it’s easier to understand the concept better. A currency itself, so we were taught, has no value unless it’s compared to another currency. The perception that currencies come in pair is flawed, and prevents us from looking at the “big picture”. Most currencies are quoted linked to the USD, however this immediately cancels our ability to assess the USD strength relative to other currencies.

To remedy this issue one should look at the FX world from an indexed POV. The notion of index is that once we compare currencies as indices (the same idea of equity indices) we can determine relative strength/weakness of a currency, we can rank the currencies according to their indices’ strength and analyze different time-frames.

Let’s assume that for some reason USD becomes the worst performing currency among all G10 currencies. If we look at the EUR/USD and AUD/USD we might see that they both strengthen against the USD, however it will be harder for us to determine which currency is stronger between the two unless we look at EUR/AUD. This process we will have to do for every currency pair so we can understand the relative strength of the currencies (bear in mind that just in the G10 complex we have 45 currency pairs.)

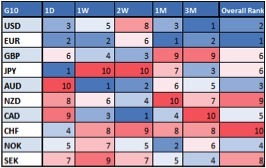

The notion of index provides a good remedy, as it takes into account all exchange rates within group (which accounts for 45 currency pairs in total). Here is an example of a Scoreboard for the G10 currencies using few different reference periods:

In this table we can see that different currencies have been ranked differently based on different reference periods, however, the EUR has been overall ranked the highest, so we will be inclined to be Long EUR. On the other hand, we can see that CHF has been the weakest among the G10 currencies. Let’s look at the EURCHF chart:

1- EURCHF Daily Chart (source: Bloomberg)

As we can see, EURCHF has strengthen about 3% since the beginning of December. We might have not spotted this dynamic in case we were not following EURCHF on a frequent basis, however, using the currency indices we can identify strength (or weakness) of a currency.

This analysis will help us detect attractive currency pairs to trade and take long dated view on their overall direction (trend).

Bear in mind that as we use daily closing prices, this analysis will not work well for short dated trades.

Market Positioning – Reading through the data

As we might understand by now, the FX market is very difficult to analyze in term of positioning. The major issue for that is the fact the vast majority of the FX market is traded OTC (over-the-counter), so the market participants are not obligated to disclose their trade, and trades are not cleared via a facility that reports these positions. Luckily, currency managers are still using FX exchange-traded instruments as part of their investments and trading strategies, and therefore we can analyze the published data by the US CFTC (Commodity Futures Trading Committee). A weekly report about the open interest in the market for a large list of assets (including commodities, equities, interest rates and FX) is published at the close of trading day on Friday, with a data that is relevant to the week ended on Tuesday (i.e., the data is published with a 3-day lag).

What can we understand from these reports?

As the reports are filtered by few types of investors: Commercials (Mostly banks and insurance companies), Non-Commercial (Asset Managers, Investment Managers), Non-Reportable (Hedge Funds, proprietary firms and small speculative traders), we can look at the spread between the Commercial type account and the Non-Commercial type accounts to see the “Net Speculative Position”, which, surprisingly enough, is highly correlated with the short-term price action of most currencies.

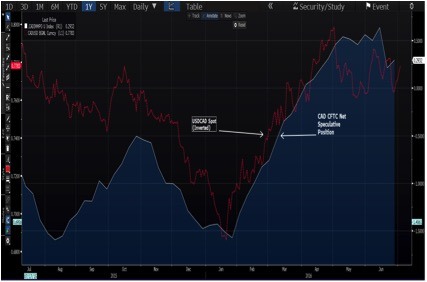

Let’s look at the following example (USDCAD vs CAD CFTC Net Speculative Position):

Figure ii: Source - Bloomberg

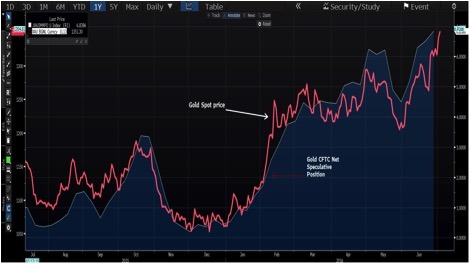

As one can see, the correlation between the position index and the price action is relatively high, and it seems as if the underlying price action follows the positioning index closely. Obviously, the CFTC data (from the exchanges) reveals only fraction of the entire market, however, for the major currencies these will usually give an accurate gauge of the positioning for the different assets (especially for commodities, which are more exchange-traded instruments in their nature). Looking at Gold price action vs. Positioning, shows the high degree of correlation, which mentioned above.

Figure iii : Source - Bloomberg

To Summarize, A true understanding of the FX market, including the different forces that operate in this market, how they affect the price action, and how to take advantage of these effects, requires constant learning, data manipulation, and out-of-the-box way of thinking. The old “technical trading” will only take you further to some extent, but will lack in helping you develop a successful strategy. Only by taking the road less traveled, so to speak, traders will be able to get an edge. Quantitative approach to trading used to be the sole domain of sophisticated investors and hedge funds, but with few simple steps any trader can adapt these principals.

1. Introduction This risk disclosure and warning notice is provided to you (our Client and prospective Client) in compliance to the Provision of Investment Services, the Exercise of Investment Activities, the Operation of Regulated Markets and Other Related Matters Law 144(I)/2007, as subsequently amended from time to time (“the Law”), which is applicable in WGM Services Limited (“the Company”). All Clients and prospective Clients should read carefully the following risk disclosure and warnings contained in this document, before applying to the Company for a trading account and before they begin to trade with the Company. However, it is noted that this document cannot and does not disclose or explain all of the risks and other significant aspects involved in dealing in Binary Options. The notice was designed to explain in general terms the nature of the risks involved when dealing in Binary Options on a fair and non-misleading basis.

2. Risks 2.1. Trading in Binary Options is VERY SPECULATIVE AND HIGHLY RISKY and is not suitable for all members of the general public but only for those investors who: (a) understand and are willing to assume the economic, legal and other risks involved. (b) taking into account their personal financial circumstances, financial resources, life style and obligations are financially able to assume the loss of their entire investment. (c) have the knowledge to understand Binary Options trading and the underlying assets and markets. 2.2. The Company will not provide the Client with any advice relating to Binary Options, the underlying assets and markets or make investment recommendations of any kind. So, if the Client does not understand the risks involved he should seek advice and consultation from an independent financial advisor. If the Client still does not understand the risks involved in trading in Binary Options, he should not trade at all. 2.3. Binary Option are derivative financial instruments deriving their value from the prices of the underlying assets/markets in which they refer to (for example currency, equity indices, stocks, metals, indices futures, forwards etc.). Although the prices at which the Company trades are set by an algorithm developed by the Company, the prices are derived from the underlying assets /market. It is important therefore that the Client understands the risks associated with trading in the relevant underlying asset/ market because fluctuations in the price of the underlying asset/ market will affect the profitability of his trade.

Editors’ Picks

EUR/USD tests nine-day EMA support near 1.1850

EUR/USD inches lower during the Asian hours on Monday, trading around 1.1870 at the time of writing. The 14-day Relative Strength Index momentum indicator at 56 stays above the midline, confirming improving momentum. RSI has cooled from prior overbought readings but stabilizes above 50, suggesting dips could stay limited before buyers reassert control.

GBP/USD flat lines as traders await key UK macro data and FOMC minutes

The GBP/USD pair kicks off a new week on a subdued note and oscillates in a narrow range, just below mid-1.3600s, during the Asian session. Moreover, the mixed fundamental backdrop warrants some caution for aggressive traders as the market focus now shifts to this week's important releases from the UK and the US.

Gold slides below $5,000 amid USD uptick and positive risk tone; downside seems limited

Gold attracts fresh sellers at the start of a new week and reverses a part of Friday's strong move up of over $150 from sub-$4,900 levels. The commodity slides back below the $5,000 psychological mark during the Asian session, though the downside potential seems limited amid a combination of supporting factors.

Bitcoin, Ethereum and Ripple consolidate within key ranges as selling pressure eases

Bitcoin and Ethereum prices have been trading sideways within key ranges following the massive correction. Meanwhile, XRP recovers slightly, breaking above the key resistance zone. The top three cryptocurrencies hint at a potential short-term recovery, with momentum indicators showing fading bearish signs.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.