Most investors I speak to do not have a true retirement plan. This doesn’t mean that they are not saving for their retirement, it simply means that they have not taken the time to put together a proper plan that will ensure them that they can retire when they want to and, more importantly, live the lifestyle they choose.

When faced with retirement decisions, people either pour money into mutual funds listed in their company’s 401k plan or trust a financial advisor to guide them through the process. There are several problems with either of these choices and these problems could leave you well behind your goals or could postpone your retirement indefinitely.

Benefits of Creating a Real Retirement Plan

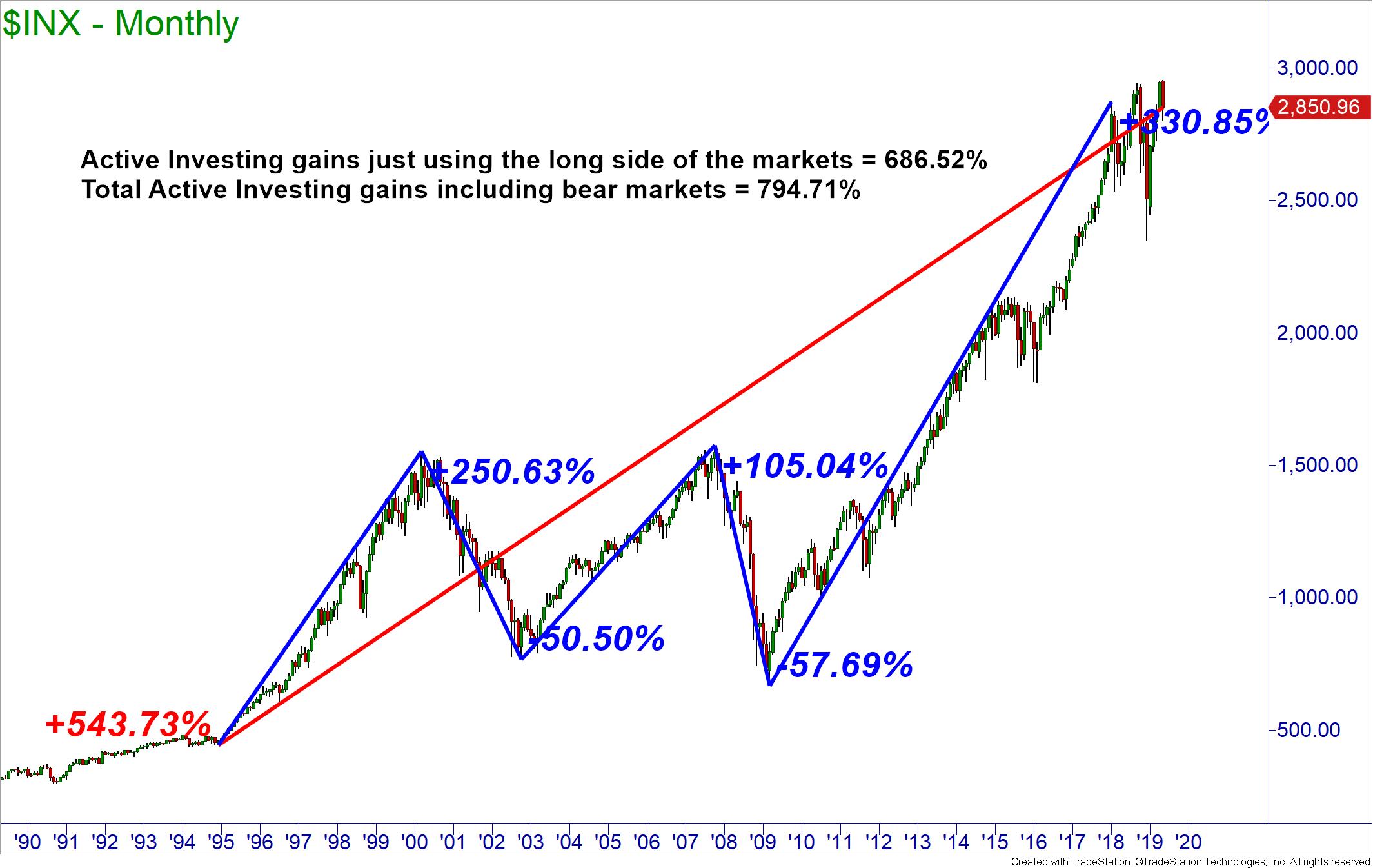

Everyone needs a retirement plan. A plan requires that you have several things factored out. You should know what it is you are investing in, what your cost basis is, where you plan to exit your investment and what the potential profit or loss might be. This type of retirement planning is important because markets do not move straight up or down, so timing your entries and exits could increase your returns while lowering the risk and time required to achieve your goals.

Financial markets experience booms and busts. Financial advisors will often tell you to ride out both environments with a simple buy and hold strategy where you leave your investments alone. Even when the markets are in a long-term rally, there is evidence that this is not the most beneficial. Why? Because even in a rally the markets will swing both up and down, so correctly timing the markets during those down swings typically yields much better returns.

Active investors employ various trading strategies designed for up, down and sideways markets to work towards their retirement goals. In contrast, most investors are just anxiously waiting for bear markets to turn so they can recoup their losses and get back to break even. When you consider that the average yearly return for the past thirty years is only 7.5% despite the fact that the broad markets have been experiencing the greatest bull run in history, its easy to understand why having a real retirement plan is essential.

401k Plans and Financial Advisors

You probably have a 401k retirement plan through your work. Have you ever wondered how the mutual funds that are offered in your 401k plan got in there? Here’s how it works. Your company will contact a brokerage to help them set up the retirement plan. Mutual fund companies will pay these brokerage firms a finder’s fee in order to be placed on your retirement plan list. The more money that gets placed into the fund from your paycheck, the more of a kickback the broker will receive. This is perfectly legal but not usually disclosed to you, the investor. Instead, those costs get buried in hidden fees that eat away at your returns. Over time this could subtract tens or hundreds of thousands of dollars from your retirement.

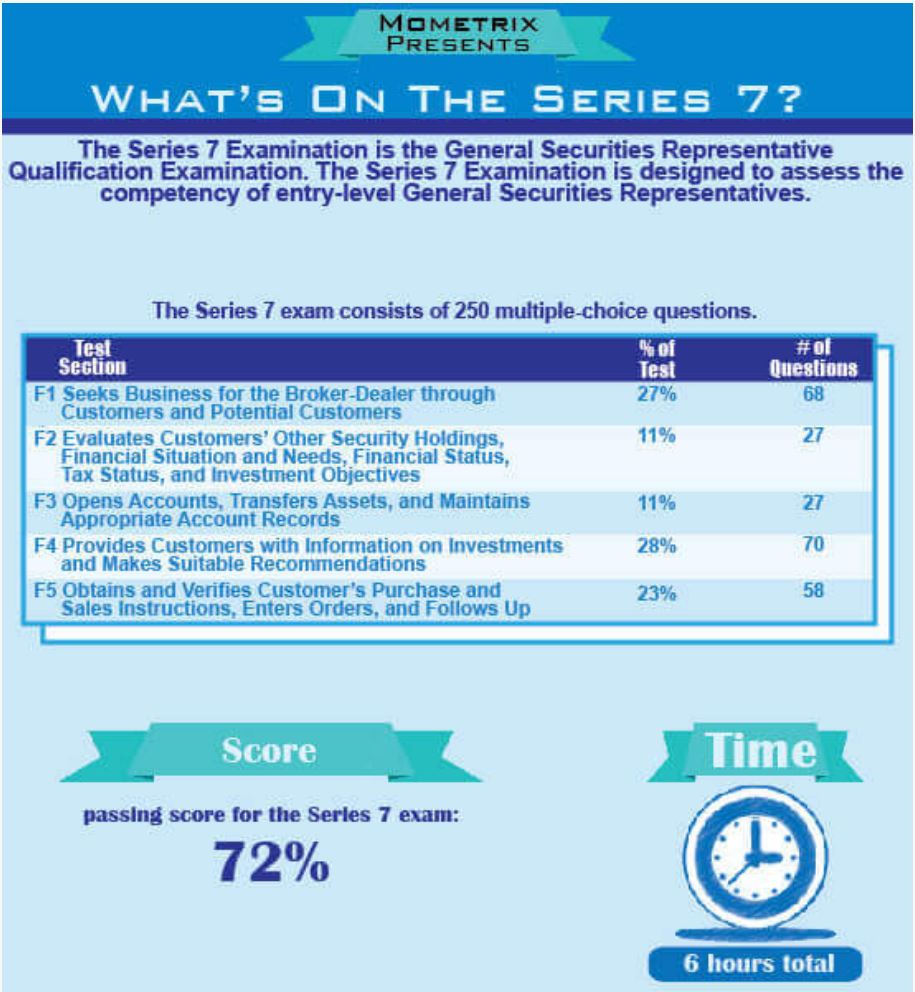

Financial advisors, brokers, wealth advisors or whatever you want to call them are a problem too. There is only a low bar to pass in order to become one. There are some advisors that complete further training, however, in order to make financial recommendations one must only pass two exams called the Series 7 and Series 63. There is no college requirement, and anyone sponsored by a brokerage who passes with a 72% score can call themselves a financial advisor, wealth advisor, broker or any other similar title.

You would think that the exam and licensing process would test the broker’s knowledge of the financial markets and their ability to evaluate customers’ needs. You would be wrong! Looking at the Series 7 exam breakdown, the largest portion of the exam is on procuring business and clients for the brokerage. The evaluation of customer’s needs and goals is the smallest portion! So, sales and preventing lawsuits are more important than getting great returns and meeting your goals.

Brokers are paid based on their sales, not performance, so they don’t really have an incentive to seek out the best investments for their clients.. While a broker or financial advisor may tell you they are seeking out the best opportunities for you, they are often putting you into investments that are simply suitable for your portfolio. It’s possible they receive a kickback from the fund for referring you or they simply may not know any better.

In my workshops, I ask prospective students to bring in their account statements. I cannot and do not recommend securities, but we look to expose the many hidden fees and underperformance that could be poisoning their retirement portfolio.

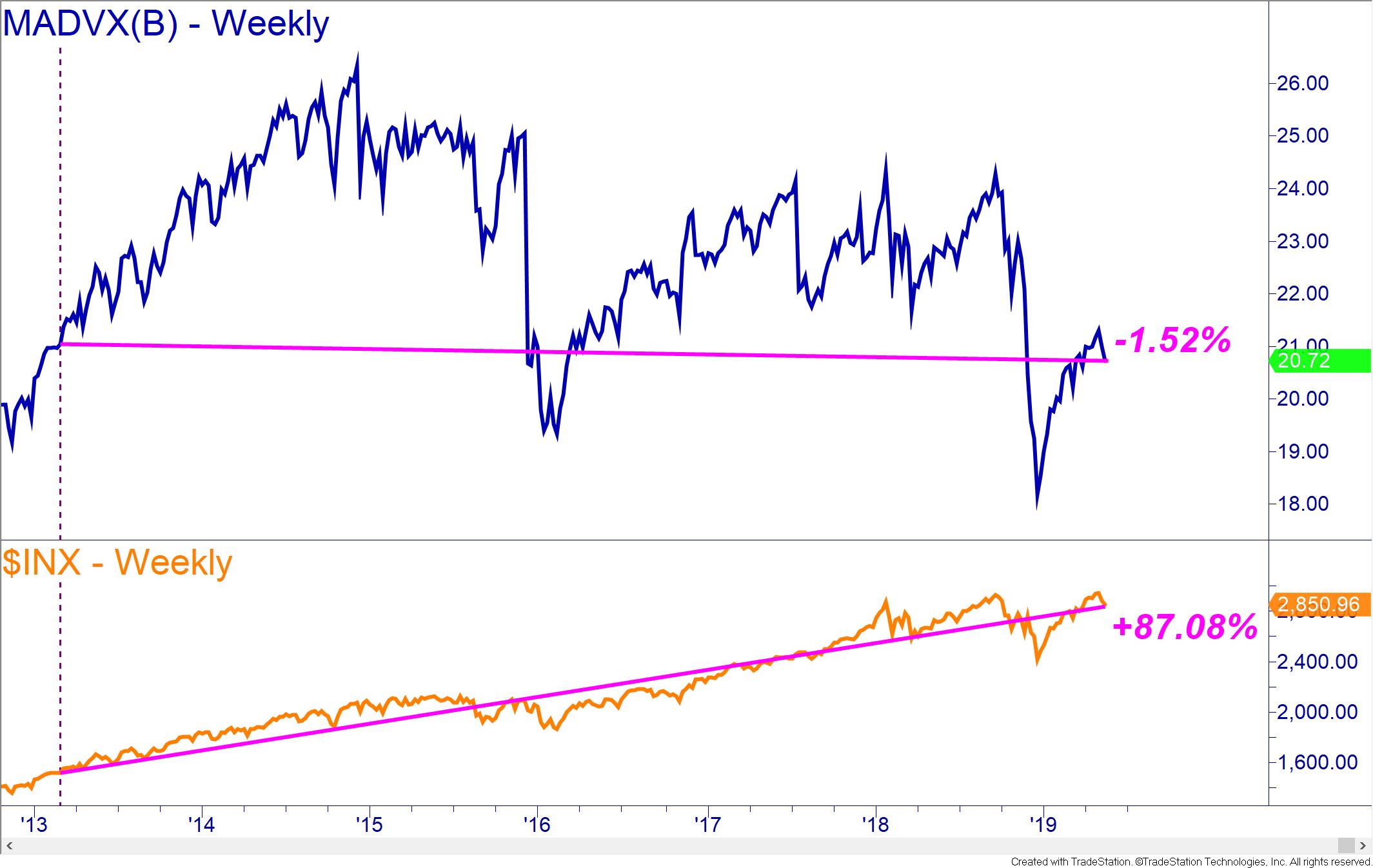

Recently I was meeting with a couple of students at the Online Trading Academy Philadelphia campus. They had told their financial advisor that they wanted safety but also some growth in their portfolio. The advisor put them into Blackrock Equity Dividend Fund (symbol: MADVX). The advisor appeared to be trying to get their money into large cap dividend paying companies. While this seems to be in line with what the client wanted, it is obvious that the advisor had not bothered to look at the performance of the portfolio for some time.

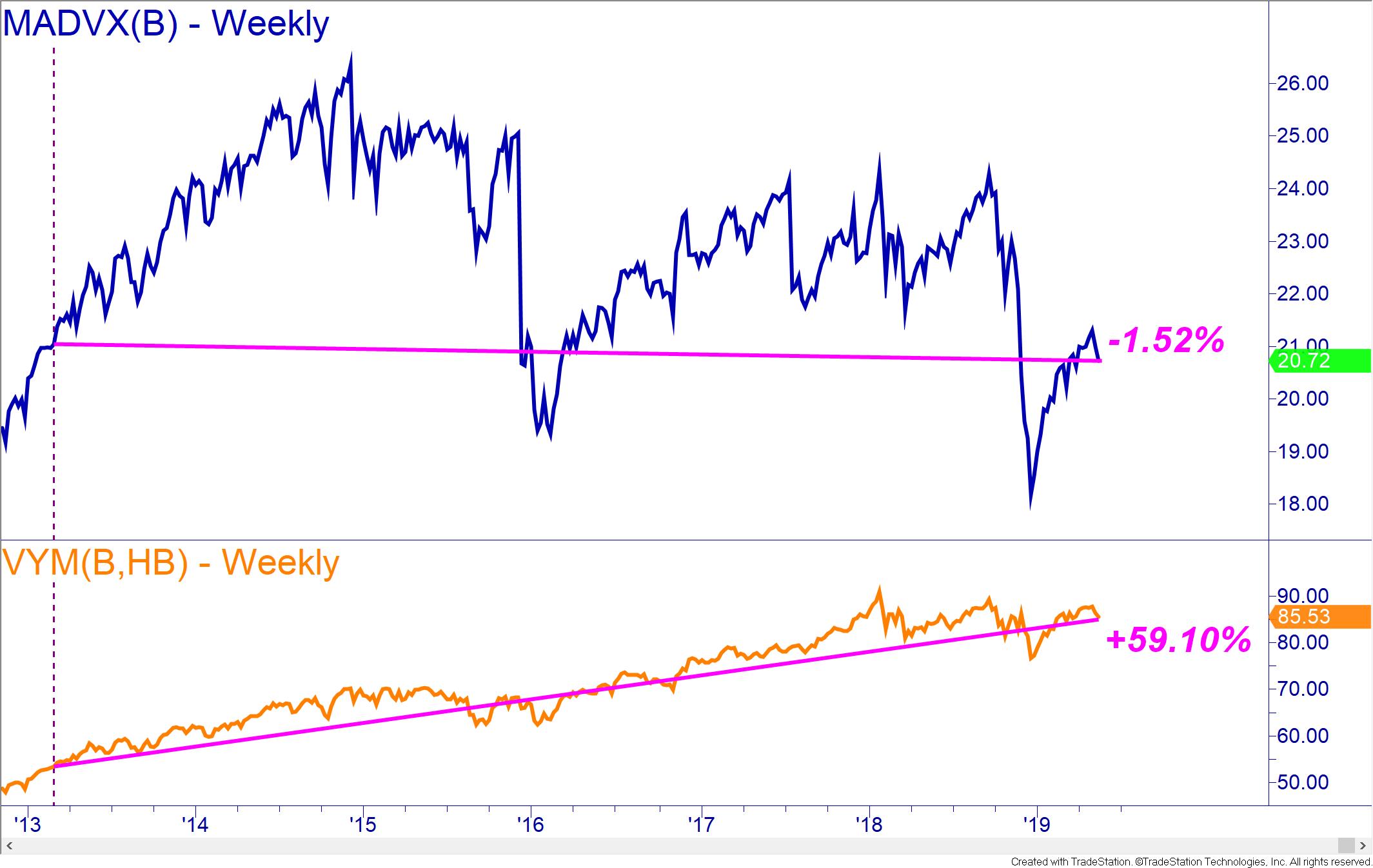

The mutual fund underperformed the market by an incredible amount. This is disturbing enough, but it is worse when you realize that there were additional fees tacked onto this investment. An alternative for them was the Vanguard High Dividend Yield Index Fund ETF Shares (VYM), which is an ETF that also invests in dividend paying large cap stocks. However, the yield is 3.05% versus the 1.91% of MADVX and the price is up over 59% in the same holding period.

You, too, may be holding poison in your portfolio. However, if your money is in a company 401k plan, you are likely limited in your choices of where you can invest. If that is the case, make sure you learn how to analyze the funds properly so you can choose the best of the bunch. Many bond funds contain stock and vice versa. You may think you have a balanced, diversified portfolio only to find out when the market crashes that your holdings overlapped, and you lost more than you should have.

It is advisable to only contribute what your company will match in your 401k. Any monies above that should be self-directed in securities that are better performing. If you do not know how to do this, get educated immediately! The Proactive Investor Program at Online Trading Academy can help you learn strategies that could increase your rate of return while minimizing risk in the markets.

In the course, there are four main strategies taught. First, you will learn strategies to properly analyze the mutual funds offered in your 401k, TSP or 429 retirement plans. You will also learn strategies to time when to enter the funds and when to go to cash for safety. The next step is understanding how fixed income products fit into your portfolio. Additionally, you are shown how to create your own annuity type product that could protect your principal and earn steady growth without the high fees of the insurance products. Finally, you will learn option strategies to take advantage of moves regardless of market direction. This added leverage with controlled risk is a key missing piece for many investors desperately trying to achieve their goals.

If you are comfortable with your accounts and where you are financially, congratulations. But if you are like most people out there, perhaps it’s time to take a hard look at where you are for your income and wealth levels. If you are not where you want to be, you must make a change to get there. Doing nothing will keep you heading down the wrong path. Act and commit to working toward your goals. It is easier than you think, and you are worth it.

Read the original article here - Poison in Your Portfolio?

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

AUD/USD bulls pause amid post-NFP USD rebound

AUD/USD is trading with a mild negative bias during the Asian session on Thursday, below a three-year high set the previous day. The US Dollar looks to build on Wednesday's upbeat US NFP-inspired bounce from an over one-week low, acting as a headwind for spot prices. However, the divergent Fed-RBA expectations, along with the underlying bullish sentiment, should help limit any meaningful corrective fall for the risk-sensitive Aussie.

USD/JPY strengthens above 153.00 despite stronger US jobs data

The USD/JPY pair attracts some sellers to around 153.20 during the early Asian session on Thursday. The Japanese Yen strengthens against the US Dollar in the aftermath of Prime Minister Sanae Takaichi's landslide election victory. The attention will shift to the US Consumer Price Index inflation report, which is due later on Friday.

Gold posts modest gains above $5,050 as US-Iran tensions persist despite strong labor data

Gold price trades in positive territory near $5,060 during the early Asian session on Thursday. The precious metal edges higher despite stronger-than-expected US employment data. The release of the US Consumer Price Index inflation report will take center stage later on Friday.

Bitcoin holds steady despite strong US labour market

Bitcoin briefly bounced from $66,000 to above $68,000 but slightly reversed those gains following Wednesday's US January jobs report. The top crypto is hovering around $67,000, down 2% over the past 24 hours as of writing on Wednesday.

The market trades the path not the past

The payroll number did not just beat. It reset the tone. 130,000 vs. 65,000 expected, with a 35,000 whisper. 79 of 80 economists leaning the wrong way. Unemployment and underemployment are edging lower. For all the statistical fog around birth-death adjustments and seasonal quirks, the core message was unmistakable. The labour market is not cracking.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.