Today, the Bank of England (BoE) decided not to affect interest rates. They based this on their inflationary outlook of the economy. If interest rates had been raised (they weren’t), it would have been seen as good for the economy and bullish for the market. Then, the GBP may have become stronger against other currencies.

This afternoon’s announcement from the BoE was pre-scheduled and the consensus was that the interest rate would stay at 0.5%. This is what the BoE did announce. But as we had seen from Australia earlier this week, when the Reserve Bank cut interest rates and devalued the Australian dollar (AUD), countries are looking to their long-term economic policy which can lead to unforeseen announcements and market movements.

As a company, investor, or trader, how can you protect yourself if you know an interest rate announcement is coming? You can hedge using option contracts.

What is a hedge?

A hedge is an investment position intended to offset potential losses which may be incurred by an adverse move in the market.

A good hedging tool is a vanilla option. You would use the option to neutralize your overall risk. For example, if you had an open long position in GBP/USD before the announcement, you could open a buy Put in GBP/USD. If the market rate falls, the Put will payout covering any loss from the long GBP/USD position. On the other hand, if you have an open short position in GBP/USD before the announcement, you could open a buy Call in GBP/USD. If the market rate rises, the Call will payout covering any loss from the short GBP/USD position.

For more information on the payouts of Puts and Calls visit my lessons: The Call Option and The Put Option.

How to execute a hedge using options?

Most interest rate announcements are scheduled and if you want to protect your foreign-exchange investment with a hedge, it can be done. Just like taking out insurance against your investment, you can use options as insurance against a movement in the market shifting out of your favour.

Let’s look at both scenarios – You hold either a buy or sell position with a profit and don’t want to close it before the announcement. You pay a premium to buy an option for both Calls and Puts. The premium of the option is the cost of the hedge.

You have an open buy GBP/USD position:

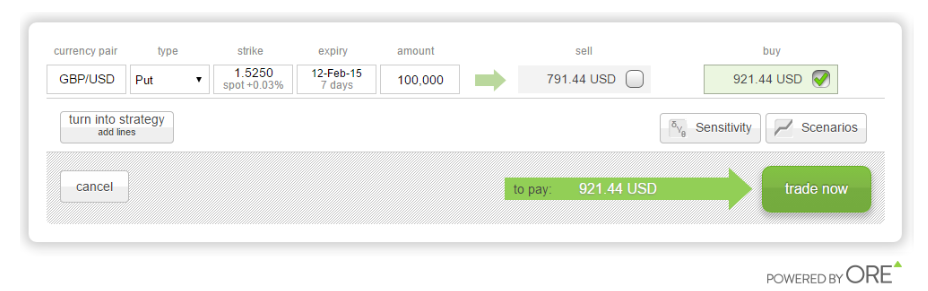

Assuming you held a long 100,000 GBP/USD spot position from 1.5000 and the current price is 1.5250, you would be in profit by $2500 (100,000 x 0.0250). To lock-in this profit without closing the trade, you could hedge by buying a Put with a strike of 1.5250 and amount of 100,000 as displayed in the diagram below.

If the market price continues to go up, your long 100,000 GBP/USD position will make $10 for every 1-point increase in the underlying market (100,000 x 0.0001 = $10). If the market falls, your GBP/USD position will lose $10 for every 1 point down, but the Put option will payout and cover (or hedge) any loss.

You have an open sell GBP/USD position:

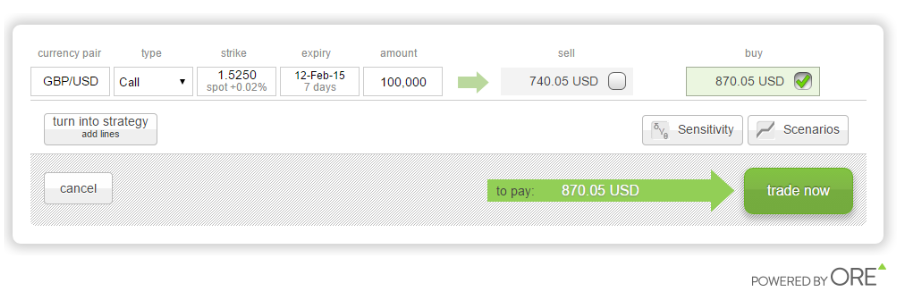

Assuming you held a sell 100,000 GBP/USD spot position from 1.5500 and the current price is 1.5250, you would be in profit by $2500 (100,000 x 0.0250). To lock-in this profit without closing the trade, you could hedge by buying a Call with a strike of 1.5250 and amount of 100,000 as displayed in the diagram below.

If the market price continues to go down, your short 100,000 GBP/USD position will make $10 for every 1-point decrease in the underlying market (100,000 x 0.0001 = $10). If the market rises, your GBP/USD position will lose $10 for every 1 point down, but the Call option will payout and cover (or hedge) any loss.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.