“The U.S. apartment sector is still the best and the brightest of all property types.” This is according to Peter Muoio PhD, chief economist for Maximus Advisors. Dr. Muoio goes on to say, “If the apartment sector were a train, it would be moving down the tracks at a good speed with plenty of continuing momentum. From an owner’s perspective, this is a very solid place to be. The current conditions allow owners to not only increase rental ranges but also improve the profile of their tenant base because there’s not a lot of choice for renters.”

Reis (provides data and services to the commercial real estate market) data shows nearly 39,000 units of absorption over the past 12 quarters. It has also forecast vacancies to hit a bottom of 3.8 percent by the end of 2016.

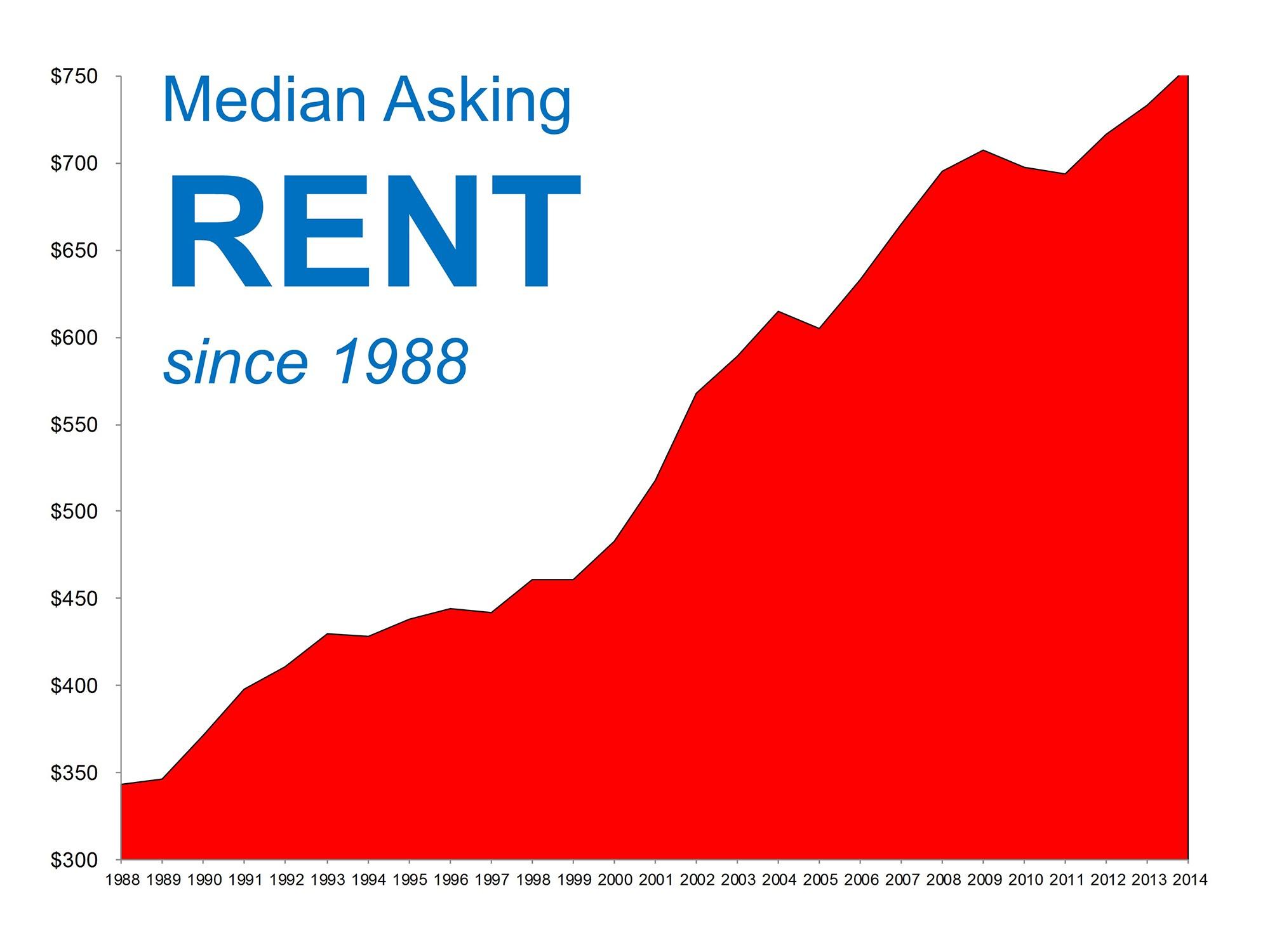

There are more units being rented (higher demand) which in turn increases rents. In fact, according to Dr. Muoio, effective rents are now nearly 10 percent above their pre-recession peak.

Where is the demand coming from? It’s coming from slowly increasing household formation. We continue to see improvement in the job market and consumer confidence increasing. This leads to household formation. The demand is coming mostly from the Millennials and Generation Y (Millennials and Generation Y are children of baby boomers). This segment is around 80 million people with most in their 20’s and early 30’s, the prime time for establishing households.

“We continue to view this large cohort of young adults as a key source of demand for apartments over coming years…” Muoio says.

So, you may not be in the position to invest in units right now, but there are several ways for you to capitalize on this rental boom. One of them may be as simple as renting out your current home.

Here is the scenario– you are considering moving up to a larger home or downsizing and you have equity and a down payment for your next home. So, you retain your current home as a rental and purchase the new one as your residence. Why would you considering doing this?

To move into the rental market slowly

The loan on your existing home will remain an owner occupied loan which is financially the most advantageous

Continue to build equity in the existing home and a new home

This strategy will also benefit you from a tax perspective. What was your home will now be an investment which means that now the interest on the loan is deductible, improvements will be deductible and you can depreciate the property. You need to check with you tax accountant about the legality of the deductions for your individual case.

You may also consider starting a partnership to purchase rental units. It is the perfect storm – prices on units are still reasonable, interest rates are low, rents are increasing and demand is high.

Want to know where the best places to purchase rentals are? According to Realty Trac these are the top 10 rental markets:

10. Hernando County, Florida • Annual gross rental yield: 17.29% • Vacancy Rate: 5.1%

9. Pasco County, Florida • Annual gross rental yield: 17.30% • Vacancy Rate: 8.9%

8. Columbia County, Florida • Annual gross rental yield: 18.42% • Vacancy Rate: 11.3%

7. Wayne County, Michigan • Annual gross rental yield: 19.88% • Vacancy Rate: 8.9%

6. Spalding County, Georgia • Annual gross rental yield: 20.35% • Vacancy Rate: 12.3%

5. Putnam County, Florida • Annual gross rental yield: 22.63% • Vacancy Rate: 6.3%

4. Howard County, Indiana • Annual gross rental yield: 24% • Vacancy Rate: 6.6%

3. Duplin County, North Carolina • Annual gross rental yield: 24.4% • Vacancy Rate: 8.8%

2. Clayton County, Georgia • Annual gross rental yield: 26.88% • Vacancy Rate: 16.9%

1. Edgecombe County, North Carolina • Annual gross rental yield: 41.57% • Vacancy Rate: 11.1%

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD off highs, back to around 1.1900

EUR/USD keeps its strong bid bias in place despite recedeing to the 1.1900 zone following earlier peaks north of 1.1900 the figure on Monday. The US Dollar remains under pressure, as traders stay on the sidelines ahead of Wednesday’s key January jobs report, leaving the pair room to extend its upward trend for now.

USD/JPY bounces off lows, back above 156.00

USD/JPY is starting the week markedly on the defensive, sliding back toward the 155.50 area where it has met some decent contention for now. The move lower in spot follows FX intervention chatter after PM S. Takaichi scored a landslide win in Sunday’s election..

Gold picks up pace, retargets $5,100

Gold gathers fresh steam, challenging daily highs en route to the $5,100 mark per troy ounce in the latter part of Monday’s session. The precious metal finds support from fresh signs of continued buying by the PBoC, while expectations that the Fed could lean more dovish also collaborate with the uptick.

Crypto Today: Bitcoin steadies around $70,000, Ethereum and XRP remain under pressure

Bitcoin hovers around $70,000, up near 15% from last week's low of $60,000 despite low retail demand. Ethereum delicately holds $2,000 support as weak technicals weigh amid declining futures Open Interest. XRP seeks support above $1.40 after facing rejection at $1.54 during the previous week's sharp rebound.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.