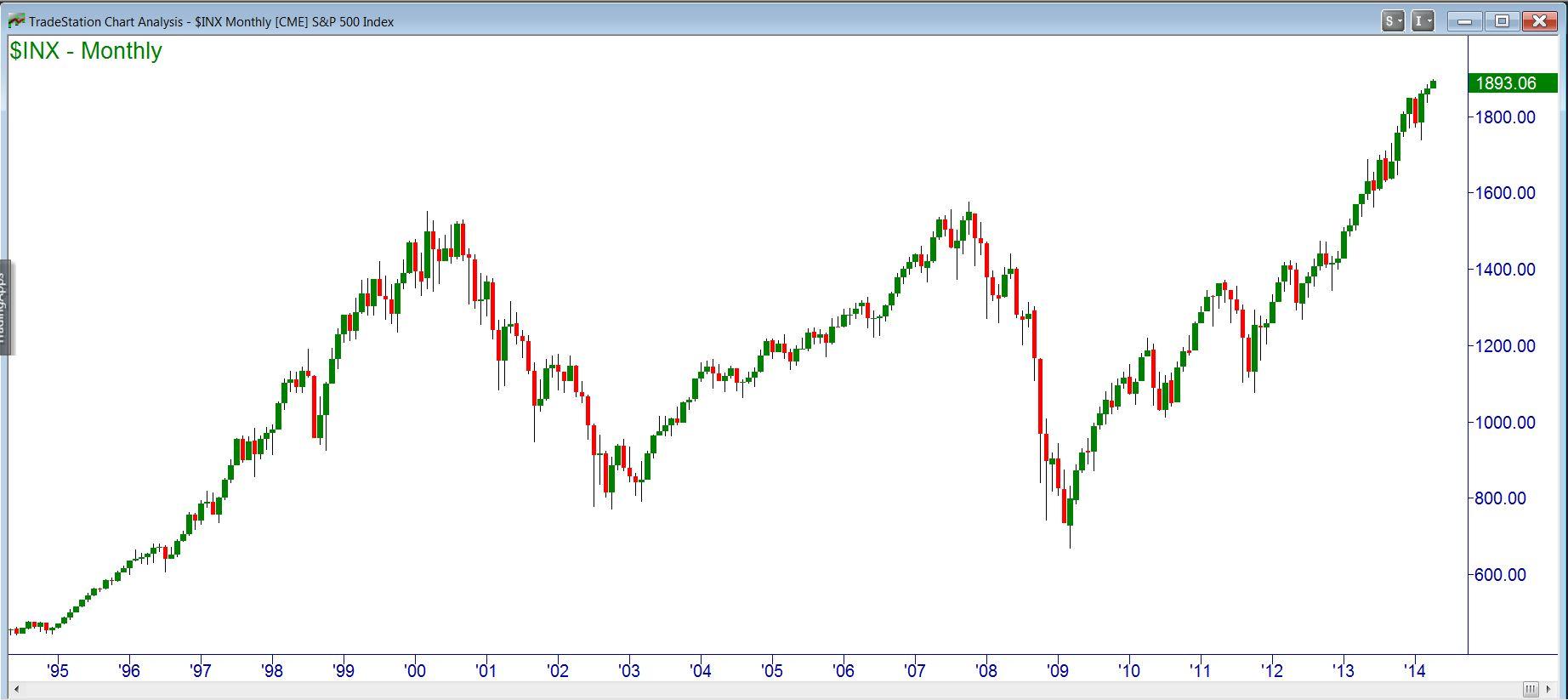

On April 2, 2014, the S&P 500 Index notched yet another all-time high, closing in on the 1900 mark (points, not the year). From the lows following the 2008-09 crash, the index has climbed by over 180%. It has exceeded the 2007 high by over 20% (in nominal terms).

Here is the chart of the S&P 500 as it stood on April 2, 2014:

In real (inflation-adjusted) terms, the index had exceeded the 2007 high, and was within a hair of exceeding the real all-time high, which was made in 2000.

The following chart, from multpl.com, shows the long-term inflation-adjusted chart for the index:

After a run like this, an increase of 180% from the 2009 lows, could the top be far away?

Well, yes, it could. Or not.

When the great bull market of 1982-2000 had come this far, it was just getting started. Anyone who got out after “only” 180% missed most of a bull market that eventually saw over a 1200% gain.

So where are we now? Standing on the brink of a great crash, as in 2007? Or just in the warm-up stages of another epic bull, as in the 80’s?

I don’t know. Neither do you, nor does anyone else. There are excellent, nearly irrefutable arguments for both sides of that question. You hear them every day from all of the talking heads.

So, in practical terms, how can we continue to participate in further upside moves, while protecting ourselves in the event of a crash?

Here are a few alternatives using options:

Hold long-term positions, and buy put options as insurance.

Add covered calls to the long stock and puts, creating collars.

Substitute bullish vertical spreads for the collars, reserving the excess cash.

Convert most of a portfolio to cash. Use a small percentage to buy long-term call options to maintain exposure.

Let’s look at each one briefly today. In the future we’ll explore them in more detail.

1. Hold long-term positions, and buy put options as insurance.

This is a very straightforward way to buy protection. In this simplest of all uses of options, we just buy ourselves an insurance policy. If the bull market continues, we participate fully, minus the cost of the insurance. Here are two slightly different ways this could work:

First alternative: With the SPY (the exchange-traded fund that tracks the S&P 500 index) around 189, options are available as far out as December, 2015. We could buy a zero-deductible policy by buying the December 190 puts for about $18. The 9.6% cost , over the 623-day term of the puts, amounts to an annual premium rate of about 5.6%.

Second alternative: Buy a cheaper policy with a higher “deductible.” If we are willing to absorb a 10% loss in our portfolio before our insurance kicks in, the cost will be less. The December 2015 puts at the 170 strike would cost about $10.50. This amounts to an annual premium cost of about 3.2%

With both of these alternatives, our upside profit is unlimited, while our downside is protected. Which of the two will pay off better depends on how severe any downturn might prove to be. If there is no downturn, then no insurance would have been best. If losses turn out to be only minor, then the cheap insurance will have been adequate. If the market tanks severely, the buyer of the zero-deductible policy will look like the genius.

2. Add covered calls to the long stock and puts, creating collars.

In this variation, we add short calls to our long stock and long puts. The calls pay part or all of the cost of the puts. The tradeoff is that our upside is now limited.

For example, a December 2015 call at the 210 strike would bring in about $4.50, covering a quarter of the cost of the zero-deductible 190 puts, bringing their net cost down to $13.50, or about a 4.2% annual rate. The real cost, though, is the opportunity cost. If SPY increases beyond 210, we do not participate. We have limited ourselves to, at most, a $21 gross gain (210 – 189). After subtracting our net insurance cost of $13.50, our maximum net gain would be $7.50. Calls at higher strikes would reduce cost less, but provide more upside headroom.

We could improve the performance of the collar by diagonalizing it – buying the puts now, and then selling individual one-month calls each month. Each month’s call strike could be determined by chart technical indications at that time. Ideally, we would keep the call strike just out of reach each month, and end up with both the stock and some call premium in our pocket.

3. Substitute bullish vertical spreads for the collars, reserving the excess cash.

You may have worked out that the collar strategy is just a variation on a bull call spread. The collar uses puts to limit downside risk, and also has limited upside because of the short calls. This is exactly what a bull call spread does. In the first collar example above, we own the SPY and also puts at the 190 strike, at a total cost of 189 + 18 = 207. We are short the 210 calls, allowing for a $3 maximum profit.

We could substitute the 189 December 2015 calls for the SPY stock and puts. The calls give the same risk profile as the protected stock: unlimited upside and limited downside. The difference is that the protected stock costs $207 per share, while the 190 calls cost $12.50. (There are other differences, too – the protected stock will still be there when the put options expire. The calls will not. The protected stock will also pay dividends).

With the bull call spread using long December 2015 190–strike calls at $12.50 and short December 2015 210-strike calls at $4.50, we risk a net of $12.50-4.50 = $8.00. Our maximum profit is the $20 difference between the strikes (210 – 190), less the $8.00 cost of the spread, or $12.00. This is a better profit at lesser cost than the collar. It would also allow us to take most of our money off the table now, using just a fraction of it to buy the spreads ($8.00 per share in place of $189 for the unprotected stock).

Which brings us full circle to:

4. Convert most of a portfolio to cash. Use a small percentage to buy long-term call options to maintain exposure.

We could simply sell here to preserve our profits, converting our stock positions to cash. We could then use a fraction of the proceeds to buy call options to regain our upside potential. In fact this option is really very similar to option 1 (keep the stock and buy puts), but with most of our cash in our pockets. We have limited downside (the cost of the calls), and unlimited upside. The main difference is that our calls will expire, while the stock will not. In times of “normal” interest income from cash holdings, this is a very attractive strategy.

Which of these is best? As is often the case, there is no way to know ahead of time. The more conservative your stance, the less profit potential you have. Each one of these would turn out to be the perfect strategy with a particular market – we just don’t know which market we’ll have.

This has been an introduction to basic profit preservation strategies. In future articles we’ll explore them more deeply.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.