This week, as I occasionally do, I’ll answer a couple of questions that readers have sent in regarding options.

The first has to do with setting stops on short put trades. Selling puts short is a strategy that takes advantage of time decay in cases where we are neutral to somewhat bullish on a stock. We select a demand zone (support area) that we believe the stock will remain above until a nearby option expiration, and sell puts with a strike price below that level. As long as the stock remains above it, we keep the money received for selling the puts, which expire worthless. Here is the question:

… there is the question of exactly where to set the stop… After determining the demand zone and selling the put, if the underlying drops in value, the quote on the puts will go up (other things being equal). Thus the open profit in the put trade will go down, as the cost to buy to close goes up, I believe.

Correct.

It would seem that I should place a fairly tight stop to avoid losses. It is my conclusion that the principle is to properly select the Demand Zone and place the stop very close to the lower limit of the DZ

Yes

or, if the underlying is out of the DZ, just below the price of the underlying, to minimize losses.

No! Whether the underlying is above the demand zone or in it, the stop still needs to be below the zone. This zone is by definition the barrier that we expect the stock to respect. We should not place the stop above this barrier if the stock is above the zone; and we would not take the trade at all if the stock was already below the zone, of course. If this stop is too far away from the current price to yield a good reward/risk ratio, then we need to look elsewhere.

Placing a firm stop would also have the advantage of setting the trade and leaving it to minimize future “emotional response.” Is this correct?

Absolutely. In options especially, it is vital to “plan the trade and trade the plan.”

Next, I had an interesting trade submitted for comments. Here it is:

My latest income strategy has 16 contracts on TSLA 2/21 chosen for volatility yet attempting risk management. I placed the trade at different intervals:

Sold 4 215 calls at $2.37

Bought 4 225 calls at $1.48 When market kept closing up

Sold 4 155 puts at $ 3.78 when trading above $200 last week

Sold 4 230 calls at $2.48 this along with the puts to hedge the 215 call risk

I would love your critique.

Let’s look at a chart of this stock as of the date of this message, February 18:

Now let’s unpack this trade. This is the first leg:

Sold 4 215 calls at $2.37

This was a bearish trade, a speculation that TSLA would remain below 215 until the Feb 21 option expiration. This trade was made late in January. At that time TSLA was making a run at its previous high around $195, but had not yet broken it. The $215 strike was more than 10% above the old high, and its upward momentum seemed to be flagging.

But there was one big issue with this trade: Tesla was scheduled to report earnings on February 19, two days before expiration. This alone made this an extraordinarily risky trade. If TSLA moved above $215, the potential losses on the short calls were unlimited. Realizing this, the trader added some additional elements. Let’s check them out.

Next leg:

Bought 4 225 calls at $1.48 When market kept closing up

Adding these long calls at a higher strike converted this trade from naked short calls (unlimited risk) into a bear call spread (limited risk.) At this point the net credit taken in was the original $2.37 less the $1.48 cost of the 225 calls, or $.89. That was the maximum profit, which would be made if TSLA stayed below $215. Maximum loss would occur with TSLA anywhere above $225 at expiration. In that case it would cost $225 – 215 = $10 per share to buy our way out of the spread. Subtracting our $.89 credit, that would mean a maximum loss of $9.11 per share. Our upside break-even price was now the short call strike, $215, plus the $.89 net credit, or $215.89. Adding the long calls had reduced the risk, but it was still quite high compared to the maximum payoff.

Then the following were added:

Sold 4 155 puts at $3.78 when trading above $200 last week

Sold 4 230 calls at $2.48 this along with the puts to hedge the 215 call risk

These additions hedged the risk in one sense – their added cash flow improved the maximum profit, and with it the upside break-even price. Having taken in another $6.26 per share, our total net credit was now $6.26 + $.89, or $7.15. Since our position would still begin losing to the upside as soon as the $215 lower short call strike was reached, our upside breakeven was increased by the additional $6.26 in credit received, from $215.89 to $222.15.

However, having sold puts, we now had a downside breakeven price as well. In the unlikely event that TSLA dived below the $155 put strike, all the calls would be worthless, but our short puts would begin to cost us money. We would lose our $7.15 credit at $155 – $7.15, or $147.85. Below that our losses would be unlimited (or close enough – IF TSLA went to zero, we’d have to pay $155 per share to buy the puts back).

Meanwhile, adding the short 230 calls had turned the trade back into one with unlimited risk to the upside. If TSLA went above the 230 strike, then we would have two short calls losing money (the 215s and the 230s), and only one making money (the 225s). The net result was unlimited upside losses above $230.

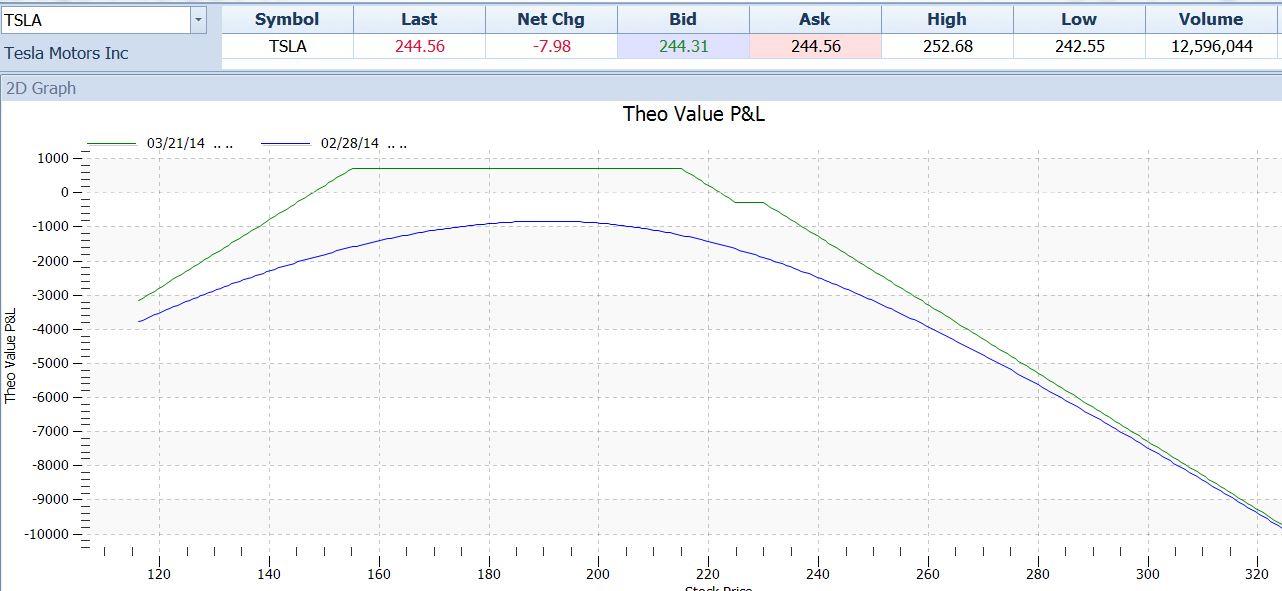

When all was said and done, the P/L picture for different prices at expiration looked like the diagram below. It resembled a sort of modified short strangle. Its main features were (all numbers are per share):

Maximum profit $ 7.15, at any price between $155 and $215

Maximum loss unlimited in both directions.

Upside breakeven $222.15

Downside breakeven $147.85

Was this a good trade?

First, the trader showed great ingenuity in adapting the trade to evolving conditions. Maintaining and evolving a position into one that will be profitable in case of what is considered the most likely price movement, is the mark of an experienced and resourceful trader.

BUT – the main criticism I have is the one I mentioned above. This stock was not likely to sit quietly until expiration, since it was going to report earnings just before then. For the same reason, implied volatility was almost certain to continue increasing right into the earnings date. Since the position was short a great deal of time value, this would hurt if it had to be closed out. Finally, betting against a company like Tesla which has been on a tear, was a very, uh, aggressive move.

All in all, not a trade I would have been comfortable taking.

So how did it work out?

At expiration on February 21, TSLA closed at $209.60, after topping out just a hair above $215. The trade made its maximum profit of $7.15. Which indicates that this trader is a genius at predicting price, and/or extremely lucky. I congratulate him on the win, though it’s not a trade for the faint of heart or wallet, and not one that I would have taken.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.