I’m Markus Heitkoetter and I’ve been an active trader for over 20 years.

I often see people who start trading and expect their accounts to explode, based on promises and hype they see in ads and e-mails.

They start trading and realize it doesn’t work this way.

The purpose of these articles is to show you the trading strategies and tools that I personally use to trade my own account so that you can grow your own account systematically. Real money…real trades.

I want to do a follow-up video on GameStop (GME), because this stock is just going absolutely bonkers.

On January 26th, two days ago, I did a video explaining exactly what’s happening on GME stock.

And it looks like the madness for GME stock isn’t stopping just yet.

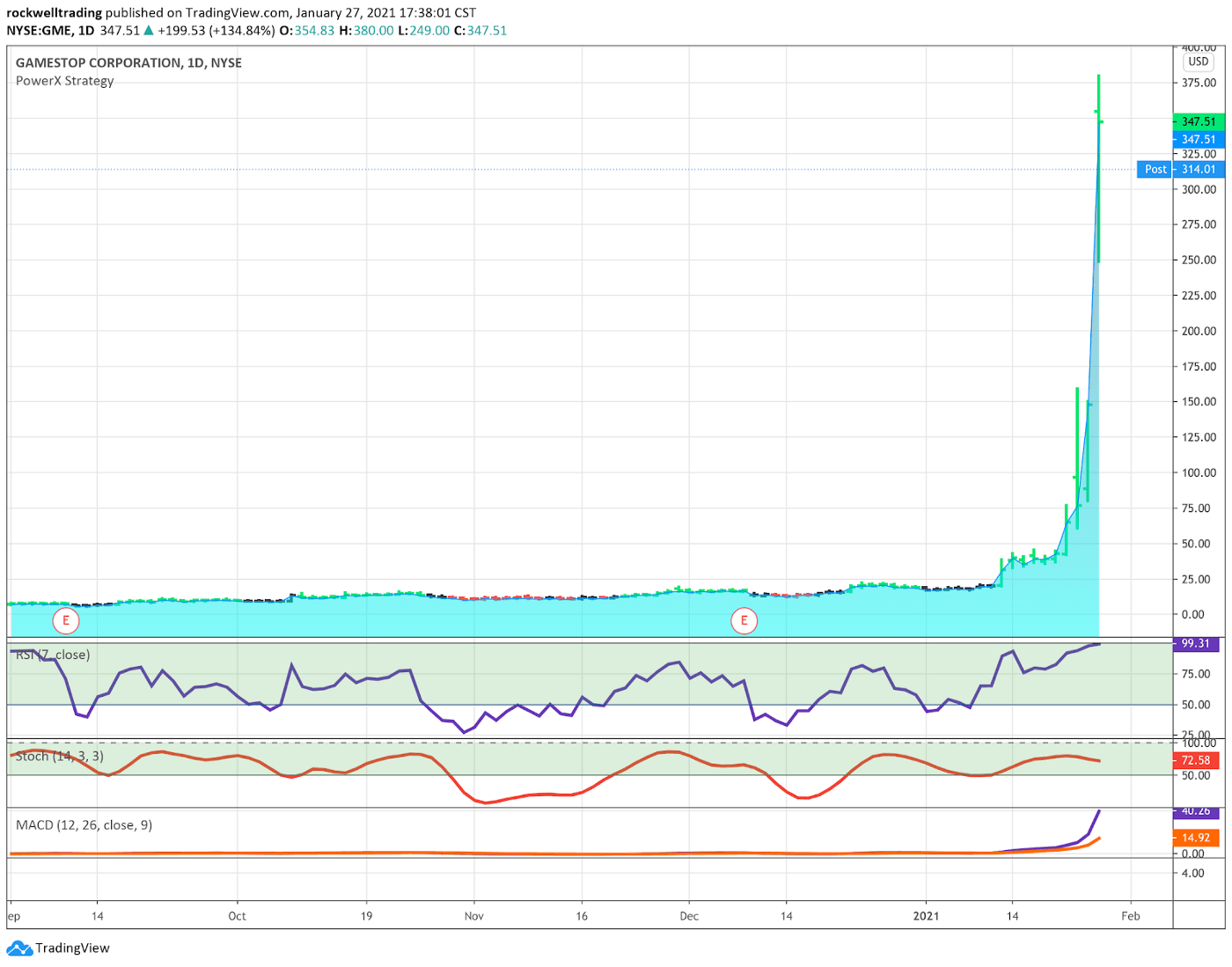

I mean, check out this chart:

On the 26, the day everything started, the stock closed yesterday up almost 93% at $147.98, and today, it rose as high as $380!

I’ve seen crazy things in this market, but a Reddit crowd squeezing shorts to this extent? It’s just crazy.

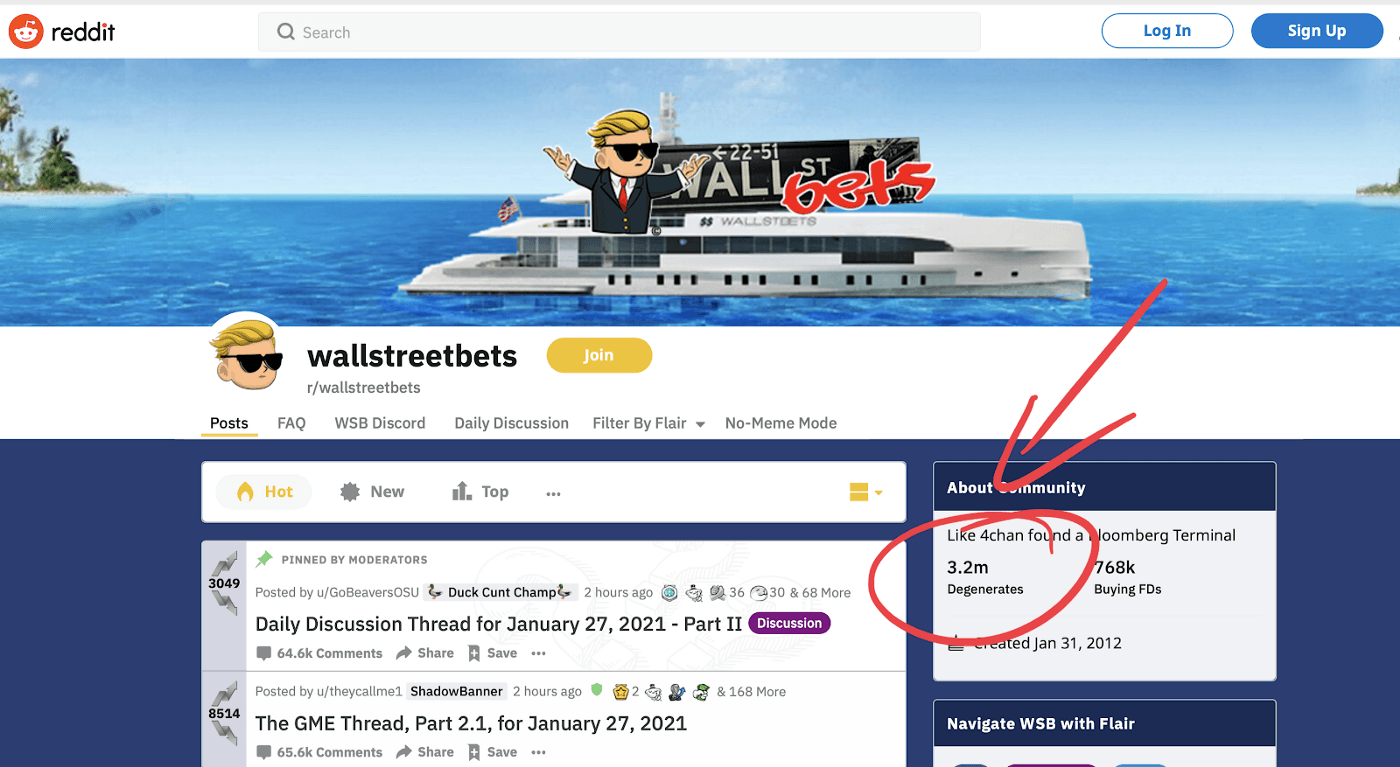

And the WallStreetBets group on Reddit — the one whose purpose is “making money and being amused by it,” their words, not mine — is growing by leaps and bounds.

Tuesday, it had 2.3 million users, but looking at it yesterday, there were 3.2 million users!

Even Elon Musk is chiming in:

Musk, who has clashed with Tesla shorts in the past, tweeted a link to the Reddit thread, saying “Gamestonk!”

This has caused such crazy trading volume that a bunch of online brokers crashed yesterday.

TD Ameritrade is actually restricting trading on GME and AMC stocks because of this insane volume!

They said they’re doing this out of an “abundance of caution amid unprecedented market conditions and other factors.”

It will be interesting to see if other online brokers do the same.

It seems like the Reddit crowd may have won the battle.

I saw lots of headlines today that GameStop’s biggest shorts — Melvin Capital and Citron — said they covered most or all of their positions.

And yes, that’s what they said… but did they?

It will be interesting to see when short interest data is updated at the end of the month whether this is true or not.

Other Stocks To Look At

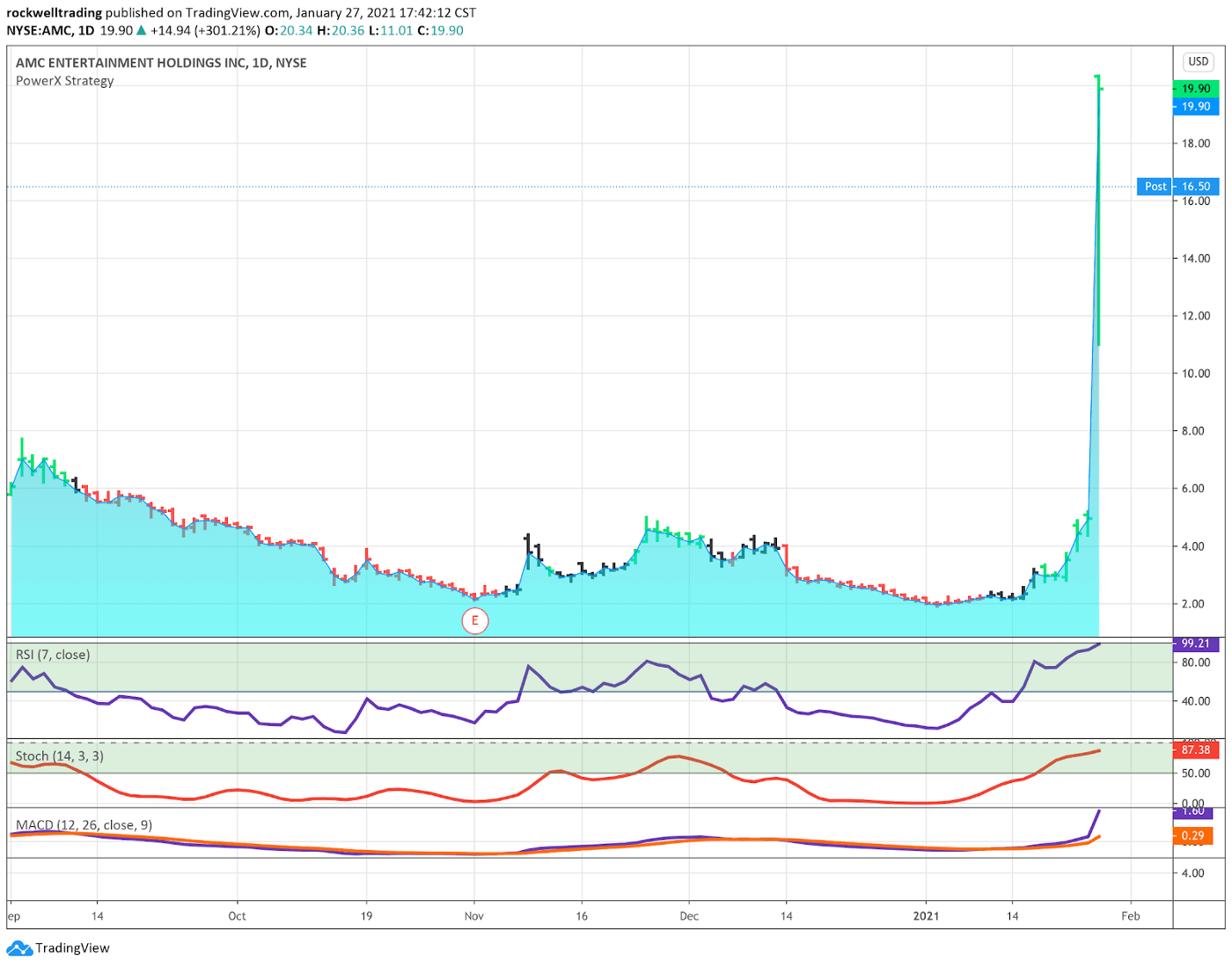

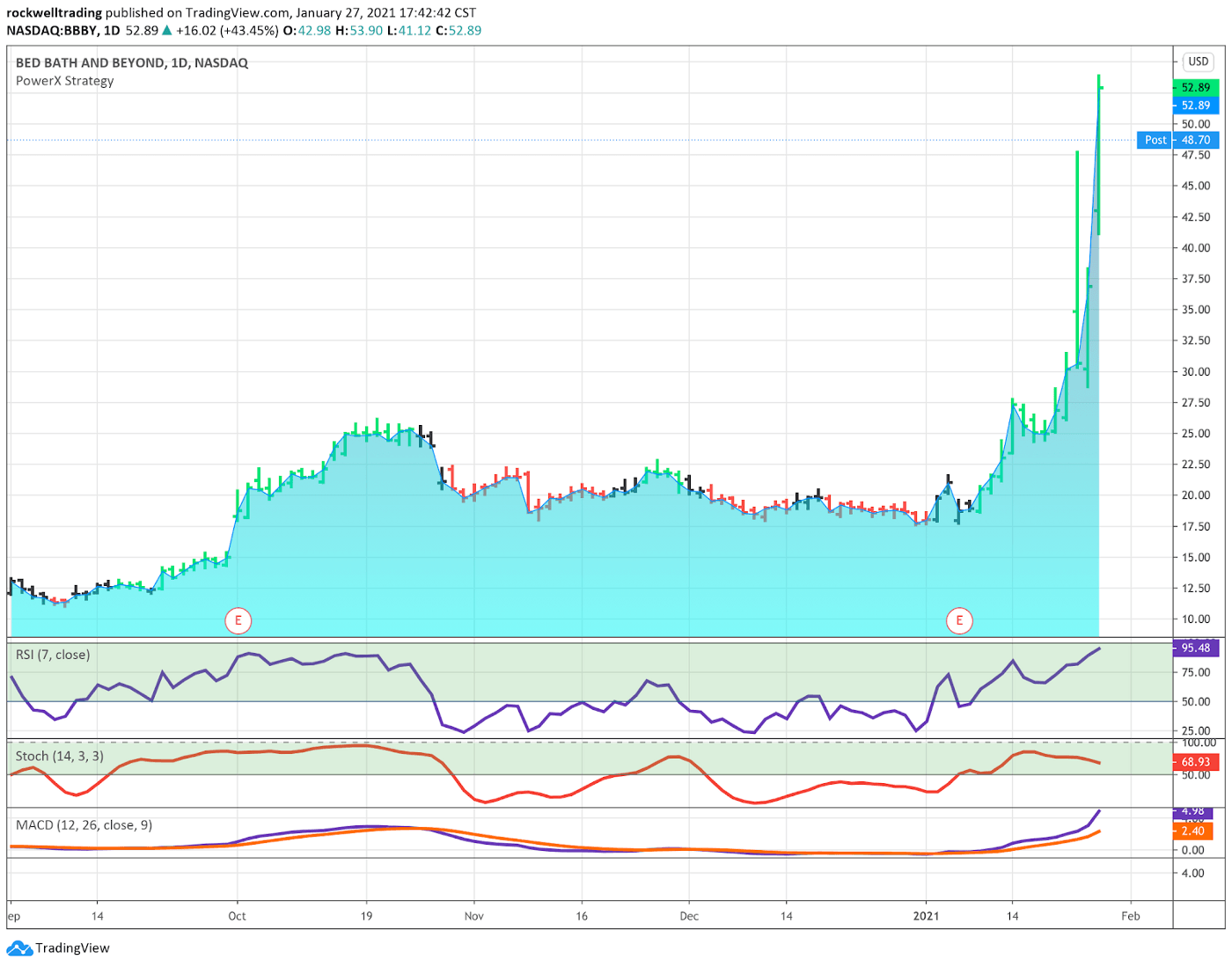

This Reddit crowd is targeting some other highly shorted stocks, too, so I want to take a quick look at their charts.

First up is AMC (AMC). On Tuesday, the 26th, they closed at $4.96, and hit a high of $20.36 earlier. Yesterday they were up 229% at $16.27.

Next is Bed Bath & Beyond (BBBY). It traded as high as $53.90 yesterday — its highest level since 2015! Right now, BBBY closed up 24% at $45.79.

And finally, there’s BlackBerry (BB). BB hit a nine-year high of $23.94 yesterday, and was last seen up 23.4% at $23.31.

Summary

Now, I’m personally not trading any of these stocks, it’s too risky, but I’m certainly watching!

And before we go, I want to make a correction. In my previous article on GameStop, I mentioned that this was a similar situation to Kodak’s (KODK) volatility last summer.

That was not the case. Kodak moved because it was awarded a government contract to make generic drug ingredients. The deal was later halted pending an investigation.

You guys were right, and I was wrong. Thank you for correcting me.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

EUR/USD remains apathetic near 1.1770 post-US PCE

EUR/USD trades slightly on the back foot on Friday, hovering around the 1.1770 area as the US Dollar trims its advance on Friday. Data wise on the US docket, inflation tracked by the PCE rose a tad in December, while the flash GDP showed the economy is seen expanding below estimates at 1.4%YoY in Q4 2025.

GBP/USD clings to daily gains around 1.3470 after US data

GBP/USD keeps the bid tone unchanged near 1.3470 amid increasing upside momentum in the US Dollar, particularly after the release of US PCE and GDP figures.

Gold trims gains on US data, flirts with $5,000/oz

Gold clings to daily gains just over the key $5,000 region per troy ounce on Friday. The modest gains in the yellow metal come despite the Greenback’s recovery is picking up pace following US data releases.

Crypto Today: Bitcoin, Ethereum, XRP rebound as risk appetite improves

Bitcoin rises marginally, nearing the immediate resistance of $68,000 at the time of writing on Friday. Major altcoins, including Ethereum and Ripple, hold key support levels as bulls aim to maintain marginal intraday gains.

Week ahead – Markets brace for heightened volatility as event risk dominates

Dollar strength dominates markets as risk appetite remains subdued. A Supreme Court ruling, geopolitics and Fed developments are in focus. Pivotal Nvidia earnings on Wednesday as investors question tech sector weakness.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.