What Are Correlations?

A correlation is a measure of the strength of the relationship between two variables, in currency trading correlations measure the strength of the relationship between two currency pairs.Correlations are assigned a numerical value between -100 and + 100 where 100 = a strong positive correlation ( they move in the same direction) and -100 = a strong negative correlation ( they move in different directions). Values around 0 such as -30 or + 40 indicate no real relationship between the two currency pairs and as such they are weakly correlated. Correlations above +70 and below -70 are found to be significant in terms of establishing the presence of a clear correlation.

Using a Forex correlations dashboard such as the one on Myfxbook.com is a great way to keep abreast of the various Forex correlations as shown below.

_20150918080907.png)

How Can We Use Correlations

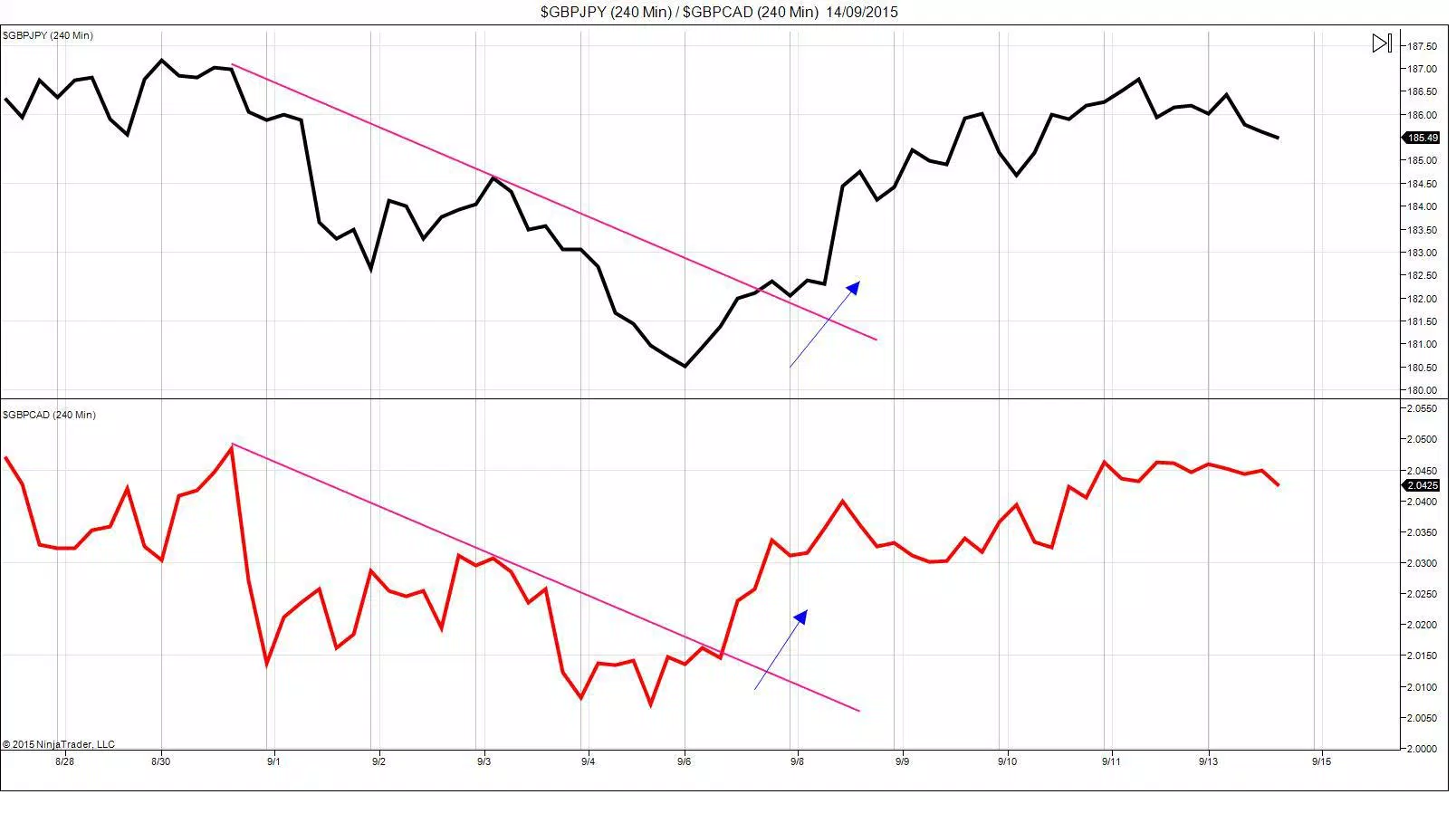

Understanding and learning to use correlations can create a wealth of opportunities for traders. Where we identify a clear trade setup or clear directional bias in one currency pair, we can then create further opportunities by looking to the currency pairs that display strong correlations with our base pair and trading in the anticipated direction suggested by the correlation.For example, over the last month GBPJPY AND GBPCAD have displayed an 89.1% correlation showing that the two pairs are strongly correlated, as shown in the chart below.

correlations.

_20150918081110.png)

Knowing that these two pairs are tending to move in a very correlated manner over the last month we could wait until we have a clear directional setup in one pair and look to trade the other pair in the same direction also, profiting from the similar directional move.

Movement Not Magnitude

Correlations measure relationships in terms of whether the two pairs trade in the same direction, however they do not measure magnitude and so they won’t necessarily move at the same rate. To get an idea of magnitude of moves, look to use classic volatility measures such as ATR or ADX.Identifying a strong correlation can also allow us to confirm our setups by identifying similar directional setups n both pairs.

In the chart above we can see that both pairs broke out of a bearish trend line at roughly the same time which is a clear indication of bullishness. If one pair was breaking out of a trend line but the other wasn’t this would raise a question mark over the strength of the signal (potential false breakout) and so where we have strongly positively correlated pairs, identifying similar setups allows us to confirm the strength of the move and increase the chances of success in trading the subsequent move.

Whilst we can clearly profit from correlations in the market place, correlations can also help us to protect against losses.

Using GBPJPY and GBPCAD as the example we can see that as they are so strongly correlated our trade is really a position based on GBP and so we can look to monitor the correlations of our trades to ensure we don’t take on unnecessary exposure to one currency. It may be appropriate to have two GBP based trades on at one time but we wouldn’t want five trades on as that would leave us wide open to taking a large loss on an adverse move in GBP. However, strong positive correlations don’t just occur among pairs sharing a base currency. There are a wide number of drivers behind correlations in the Forex markets such as currencies; relationship with the US Dollar, relationship with risk appetite and relationship with commodity flows, to name but a few, so it is important to always check the correlations of trades in your portfolio to make sure you don’t become over-exposed holding a basket of trades all with strong positive correlations.

Useful For Hedging

Leading on from the last point, we can also use correlations to hedge our positions. Where we identify strongly positively correlated pairs as trading in the same direction and so offering the opportunity to increase profits on a move, strongly negatively correlated pairs offer the capacity to provide effective hedging.

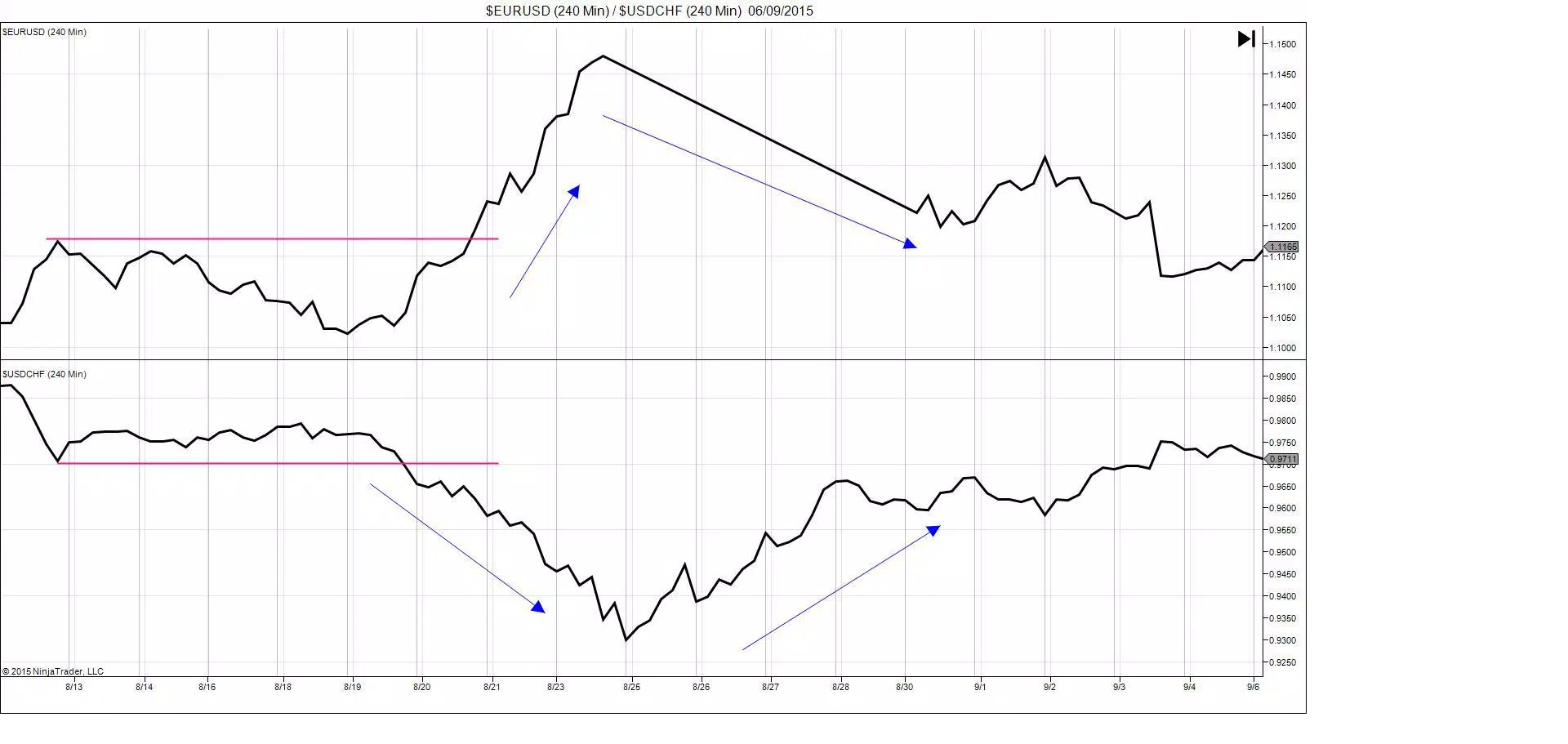

The chart above shows EURUSD & USDCHF, two currency pairs which are traditionally strongly negatively correlated. Let’s think about a scenario where we can use this to our advantage.

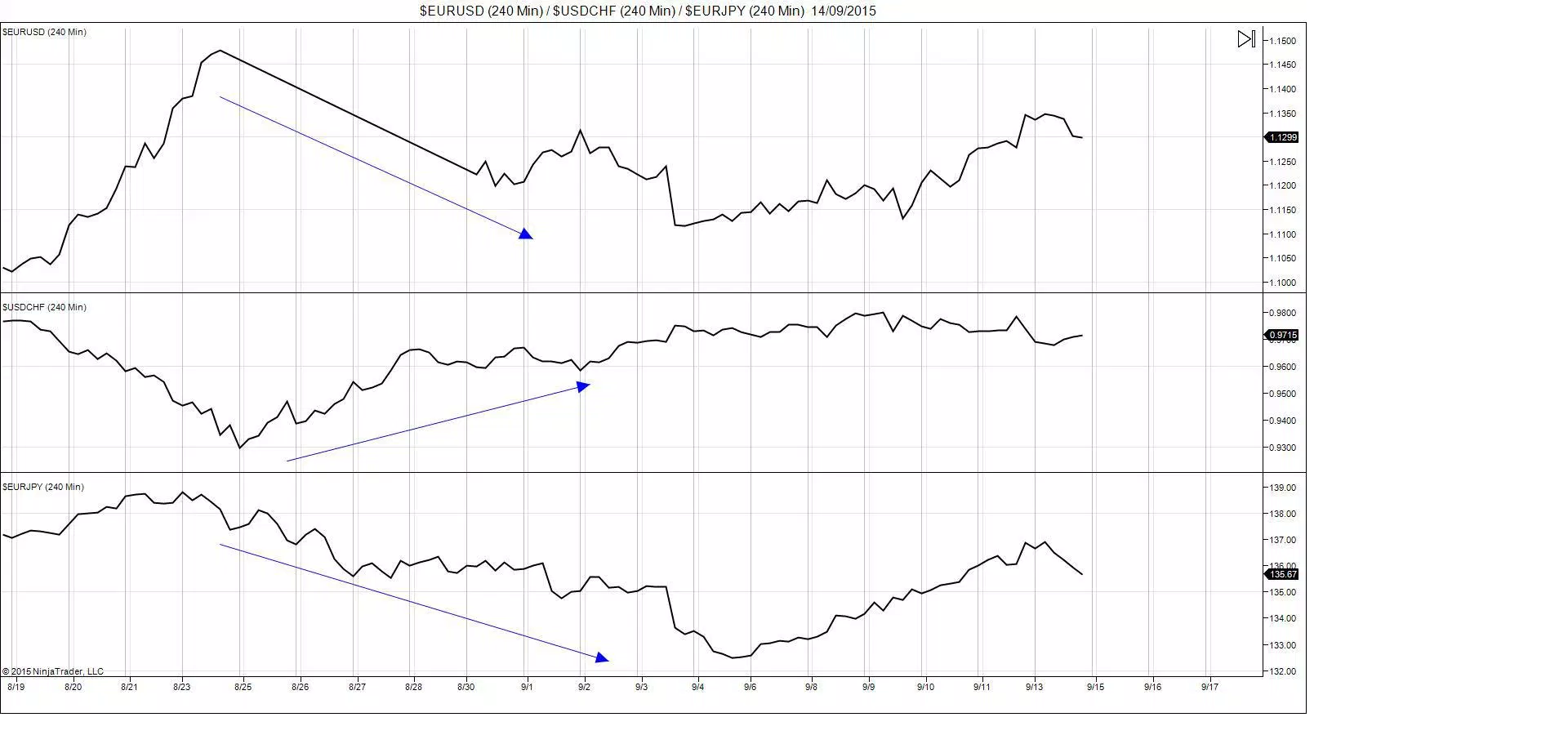

In the chart above we can see that if we were short EURUSD & EURJPY in the last week of August, we could have used a short USDCHF to hedge some of our risk on those trades expecting that if we had been wrong and EURJPY & EURUSD had in fact moved higher, USDCHF would have moved lower as per the strong negative correlation we identified earlier and thus would mitigate part of our loss so we didn’t take a full hit.

As you can see, there are many ways to use correlations in Forex to assist you in trading whether in targeting higher profits or looking to protect against and limit losses. One important point to note is that correlations are changeable, they are not fixed and so two currency pairs that share a strong positive correlation one month, may indeed lose that correlation the next so it is important to constantly monitor correlations.

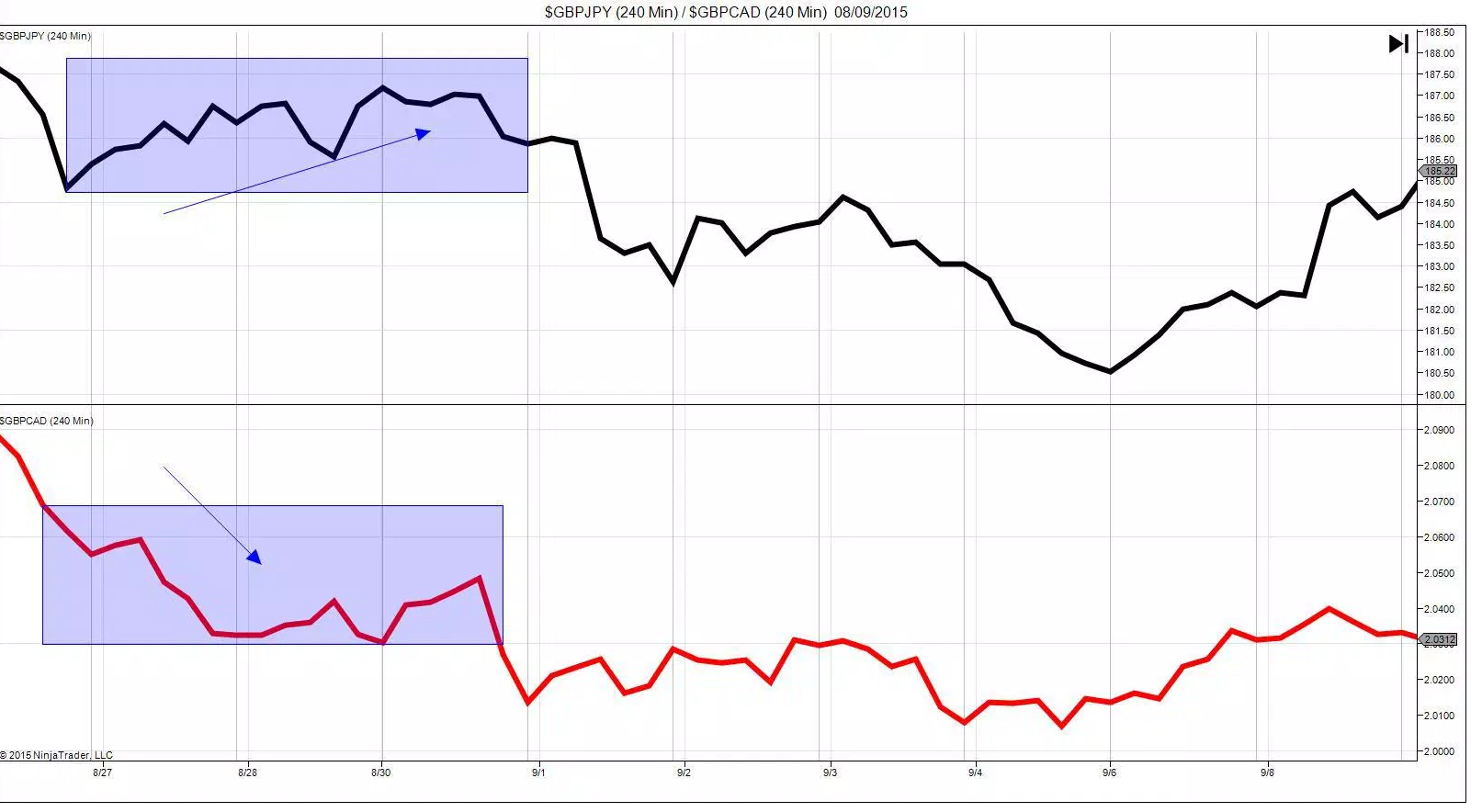

In the chart below we can see a period of “de-correlation” between GBPJPY & GBPCAD where GBPJPY trades higher and GBPCAD trades lower before they return to sharing a strong positive correlation.

Correlations are also different on different time frames and so whilst two currency pairs may share a certain correlation on the 60 minnute charts they may share an entirely different correlation on the weekly timeframe and so again it is important to always monitor correlations specific to your time frame

Forex correlations can be an incredibly useful tool for traders and is certainly an interesting subject, if you want to keep up-to-date on the key fundamental issues shaping these correlations make sure to check out of Forex Morning Report where we highlight the market drivers affecting currencies on a daily basis.

All comments, charts and analysis on this website are purely provided to demonstrate our own personal thoughts and views of the market and should in no way be treated as recommendations or advice. Please do not trade based solely on any information provided within this site, always do your own analysis.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.