The Capital Market is a jungle, and everyone is on a hunt for yield. Every investor is trying to maximize the return and minimize the risk, that goes without saying. But what happens when the “safe” yields are at zero (or below)?

As investors, our goal is to earn the highest yield possible, given our risk appetite. The more risk-averse we are, the less yield we can get, as our scope of our investment will be narrowed down to the “safest” assets, such as High Graded Government Bonds (US, Germany, Canada, and Switzerland). The problem nowadays, is that most yields (in the developed countries) are either near or below zero, which means that we are better off putting our money under the mattress. The very abnormal loose monetary policy by central banks around the world sent investors seeking yields somewhere else, but that comes with at cost, a cost of high volatility and possibly, significant losses.

Generally speaking, in periods of calm markets and positive risk sentiment, investors will put Carry Trades. A Carry Trade is a very simple trade to comprehend: Investors will borrow money at a low rate and invest in an asset that will pay higher interest (either via Dividend, Coupon, or Interest Rate). Carry Trades are very common in Emerging Markets and commodity-exporting countries, where typically the interest rate is higher in these markets (due to inflation and political risks, which usually hover above these markets).

By now you are probably asking yourself: “That sounds like a no-brainer, why doesn’t everyone go and invest in Carry Trades?” Well, there are no free lunches in capital markets, that’s the harsh truth. Let me tell you a little story, about a very famous Carry Trade that was the darling of the hedge fund community back in the 1990’s – “Short Japanese Yen”. During the 1990’s the Bank of Japan cut its interest rate to near zero rate (something which is quite usual nowadays). But back in the 1990’s it was very unusual, which made the Yen a very good candidate to be a funding instrument. Investors would borrow in Yen, invest in high-yielding assets, and profit the spread between the yields that they earn compared to the interest they pay on the Yen loan. One doesn’t need to be a genius to understand why investors fell in love with the Yen Carry Trade - borrow for cheap, and invest in yielding assets (or, in other words : “buy low, sell high…”)

Hedge Fund started putting on huge carry trades in 1995, and that has worked amazingly, until it didn’t… In 1997-1998 the financial market experience was a very volatile period, which sent investors seeking shelter (in the form of safe-haven assets).The great fear of a market meltdown caused the funds’ investors to withdraw the money from their accounts. As investors sought the safe haven assets, they unwound the Carry Trades and liquidated their portfolios. This triggered a massive appreciation of the JPY.

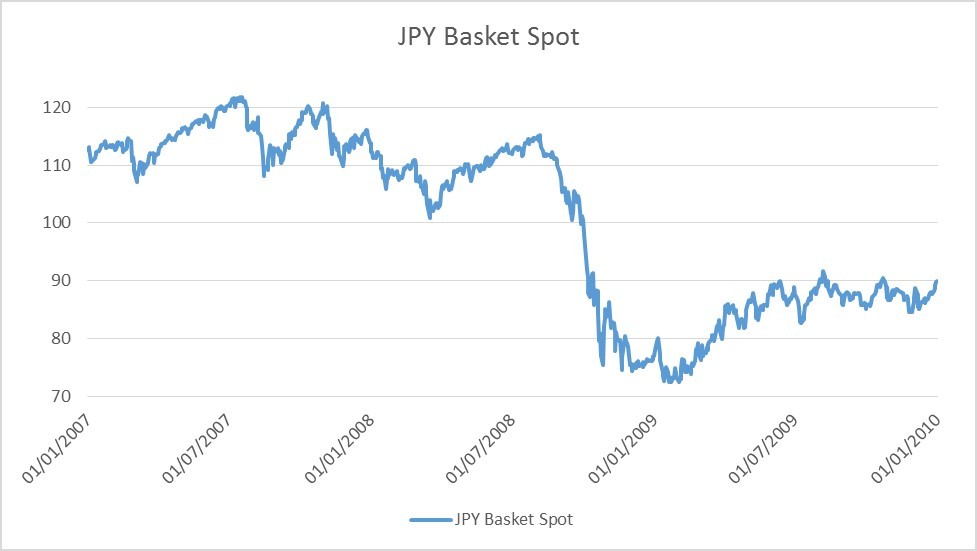

As we all know, the markets’ memory is sometimes short-lived, and greed usually overcomes fear. The following time investors began putting Carry Trades was in 2003, when the Federal Reserve cut its interest rate extreme low (relative to that period). The lack of alternative, in conjunction with stable markets, sent investors seeking yields elsewhere, and the easiest trade was again, the Yen Carry Trade. That trade, as it happens every time, ended with investors’ tears once the cracks in the US housing market started surfacing (and once the Federal Reserve raised its interest back to “normal”). During the years 2007-2009, the Yen appreciated about 40% against a basket of high-yielding G10 and Emerging Market currencies. Needless to say that the carry investors’ earnings did not compensate for the loss…

So we understand what happens when a Carry Trade goes wrong, but we need to ask ourselves: “why does this happen over and over again?

In Capital Markets, investors are always on a scale, ranging between “Greed” and “Fear”. The greedier we are, we will seek higher return (and take more risk). The more cautious we are, the safer investment we will seek. In quiet periods where volatility is low, investors will be inclined to seek risky investments. While in volatile periods, investors will most likely cash out of the market. This behavior of investors is the main risk factor of the Carry Trade. When things hit the fan, no one wants to earn yield, they all just want to run for cover.

How can we use Carry Trade in our portfolio, but still make it work?

1. Firstly, we need to establish one thing – Carry Trade is NOT a bad investment. In most days it will be yielding profits, and it is a relatively easy investment (as easy as going LONG yielding currency, while going SHORT low-yield/funding currency).

2. Secondly, when we analyze the return of a Carry Trade, we need to assess the “Risk Adjusted Return”. Meaning the return compared to the risk (or volatility). A good measurement of that would simply be to divide the return by the volatility (preferably using a 3-month historical volatility). Once you use that, you can compare different investments and rank them.

3. Thirdly, set a portion of your portfolio to Carry Trades. That way, even if you experience a turbulent period, you will not suffer great losses and you can still can hold the position.

4. Lastly, don’t get too GREEDY. Set your expectations with regards to how much you want to earn and stick with that. Timing the markets is extremely difficult, and as we saw, markets tend to be very brutal when it comes to steep declines. If you see that everyone around you is getting too comfortable and greedy, you should start planning your exit strategy….

1. Introduction This risk disclosure and warning notice is provided to you (our Client and prospective Client) in compliance to the Provision of Investment Services, the Exercise of Investment Activities, the Operation of Regulated Markets and Other Related Matters Law 144(I)/2007, as subsequently amended from time to time (“the Law”), which is applicable in WGM Services Limited (“the Company”). All Clients and prospective Clients should read carefully the following risk disclosure and warnings contained in this document, before applying to the Company for a trading account and before they begin to trade with the Company. However, it is noted that this document cannot and does not disclose or explain all of the risks and other significant aspects involved in dealing in Binary Options. The notice was designed to explain in general terms the nature of the risks involved when dealing in Binary Options on a fair and non-misleading basis.

2. Risks 2.1. Trading in Binary Options is VERY SPECULATIVE AND HIGHLY RISKY and is not suitable for all members of the general public but only for those investors who: (a) understand and are willing to assume the economic, legal and other risks involved. (b) taking into account their personal financial circumstances, financial resources, life style and obligations are financially able to assume the loss of their entire investment. (c) have the knowledge to understand Binary Options trading and the underlying assets and markets. 2.2. The Company will not provide the Client with any advice relating to Binary Options, the underlying assets and markets or make investment recommendations of any kind. So, if the Client does not understand the risks involved he should seek advice and consultation from an independent financial advisor. If the Client still does not understand the risks involved in trading in Binary Options, he should not trade at all. 2.3. Binary Option are derivative financial instruments deriving their value from the prices of the underlying assets/markets in which they refer to (for example currency, equity indices, stocks, metals, indices futures, forwards etc.). Although the prices at which the Company trades are set by an algorithm developed by the Company, the prices are derived from the underlying assets /market. It is important therefore that the Client understands the risks associated with trading in the relevant underlying asset/ market because fluctuations in the price of the underlying asset/ market will affect the profitability of his trade.

Editors’ Picks

EUR/USD stays below 1.1850 as Fed policy signals weigh on sentiment

EUR/USD edges modestly higher after opening with a downside gap, trading near 1.1840 during Monday’s Asian session. However, the pair remains vulnerable to further downside as the US Dollar finds support following President Donald Trump’s nomination of Kevin Warsh as the next Federal Reserve Chair.

Bitcoin slips below $75,000 as selling pressure accelerates

Bitcoin (BTC) price falls below the $75,000 mark on Monday, having corrected nearly 11% in the previous week and reaching level not seen in nearly 10 months. Market momentum has clearly turned bearish, with technical indicators pointing to further downside toward the next key support at $70,000.

Gold: Will it defend 21-day SMA on a daily closing basis?

Gold halts its correction as sellers take a breather, with the NFP week kicking in. The US Dollar fades its recovery stint as markets weigh a Fed under Warsh. Geopolitical tensions seem to ease. Technically, RSI flirts with midline on the daily chart; Gold is at a critical crossroads.

GBP/USD holds steady near 1.3700 as markets assess Warsh's Fed outlook

The GBP/USD pair trades on a flat note near 1.3695 during the early Asian session on Monday. Traders weigh what a Federal Reserve under Kevin Warsh might look like. The US ISM Manufacturing Purchasing Managers Index report will be published later on Monday.

Global central banks hold steady as EMs signal easing ahead

Central banks across both G10 and emerging markets met this week, with most opting to keep policy rates unchanged. Canada, Sweden, Brazil and Chile all held rates steady. Beyond central bank decisions, the Eurozone's solid Q4 GDP growth bolstered the case for the ECB to keep policy rates unchanged next week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.