Today’s piece will be somewhat short and sweet. One of the most important things you need to do to be successful when short term trading for income is to have proper focus. What I mean is this… as a short term income trader, all you need to do each day is look at a chart, apply the Supply/Demand strategy and focus on where banks are buying and selling that day. The hard part is to only focus on that.

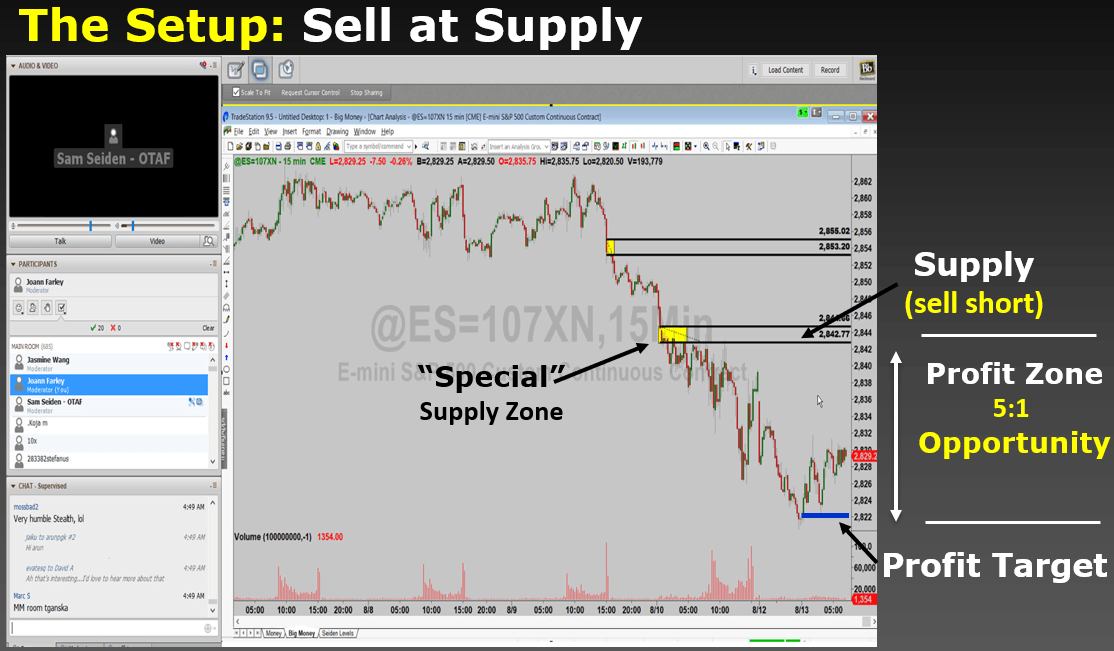

Below is an S&P trade that we took in my live trading session with our members. One of the levels we focused on was the supply zone highlighted as special. These buy and sell areas are found by locating on a chart exactly where banks and financial institutions are willing buyers and sellers. The key is to follow our rules and perform our rule-based analysis well before the market gets going and well before our trades take place.

Bank supply that day in the S&P was in the range you see above. With an entry at the supply zone, a protective buy stop above it and a profit target at the blue line below, this was a 5:1 trading opportunity (risk 1 to make 5).

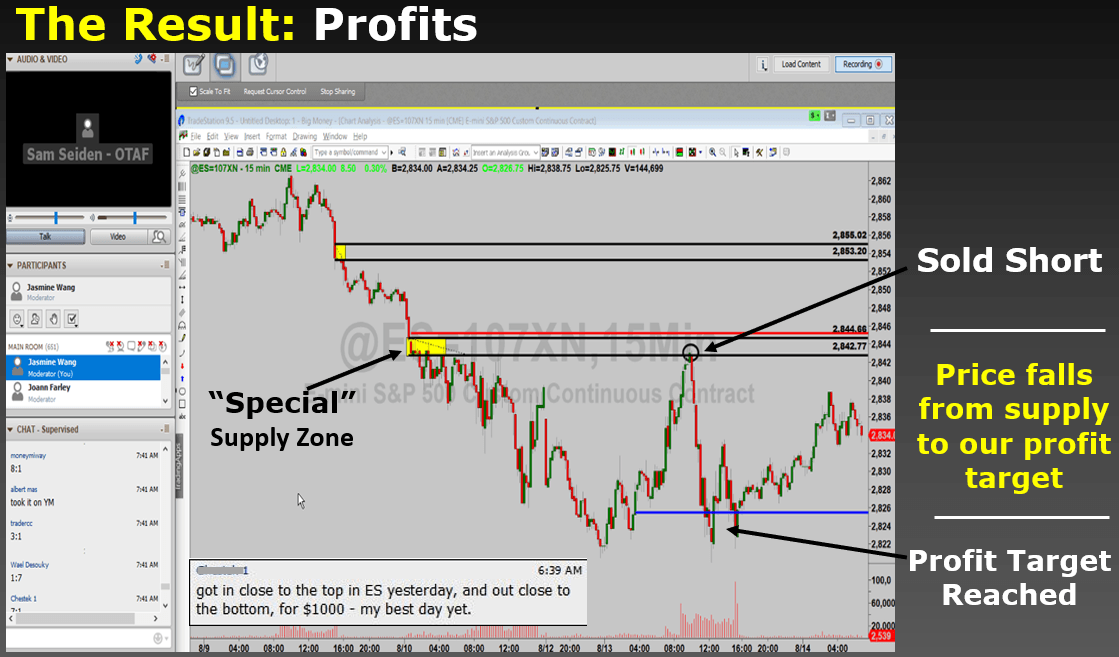

On the chart below, once the market got going, price rallied to our supply zone and then proceeded to decline from that level to our profit target, risking 1 to make at least 5. Had the trade not worked out, not a big deal, it was a risk we were willing to take because the chart suggested a high probability opportunity.

What makes this focus so hard for most people is all the other things they let sneak into their decision making process. They also let emotion play into the trade which will typically lead to a smaller trading account. They overcomplicate what is really not that complicated. The focus needs to be 100% on where the bank and financial institution’s buy and sell orders are that day and then buying and selling there, nothing else. When it comes to profitable trading, knowing the details of what is happening to the European economy or with the Fed is as important as knowing which black socks I’m going to wear that day, who cares…

When people use the term 100%, most of the time it’s a figure of speech, I am not using it as a figure of speech. Profitable trading goes hand in hand with profitable thinking, 100% of your focus needs to be on one thing and one thing only: where the significant institutional buy and sell orders are, period. As I always write about, we do this by learning how to identify supply and demand zones on a chart. We look for the picture that represents a major supply and demand imbalance and then take action at that zone. Some people will want to also include some indicators: Fibonacci levels, maybe the latest oscillator… wrong again… you need to have a razor sharp focus on where the major buy and sell orders are, nothing else matters.

Now that I have repeated myself a few times, hopefully you get the point and I will not waste your time with more repetition. This is just my opinion, of course, but from my experience nothing else matters when you know where institutions are buying and selling in a market, and that’s the focus of Supply and Demand. If you don’t agree, that’s fine as well, this is what makes a market. Next week we will focus on why that zone was special and how the order flow behind the candles work.

Read the original article here - Focus on Making Money

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.