This simple, corrective Elliott price pattern helps you anticipate reversals instead of getting run over by them

Often, as traders and investors we start off with an open mind about playing the field, so to speak. We watch the news, listen to friends and colleagues – and we try to apply what’s known as “fundamental” market analysis to make our trading decisions.

Soon, though, we start to realize that the “bullet-proof” logic of “fundamental” analysis is not Kevlar, but a piece of cardboard. We see markets fall after good news; rally after bad; and go sideways, defying both bulls and bears.

That’s when we realize that trading is not as easy as it seems.

At that point, serious traders start to turn to technical market analysis. It doesn't look at the news, or events, or politics, or what the Fed Chairman had for breakfast. It doesn't even look at the name besides the ticker symbol. It looks at the price charts, at the market itself, to determine internal strength, momentum – and, ultimately, the trend.

One of the leading technical models today is Elliott wave analysis, which teaches that market prices are not random, but patterned. These patterns are constantly unfolding in all liquid markets, on all time frames -- bullish, bearish, lasting over the next few minutes or the next few months.

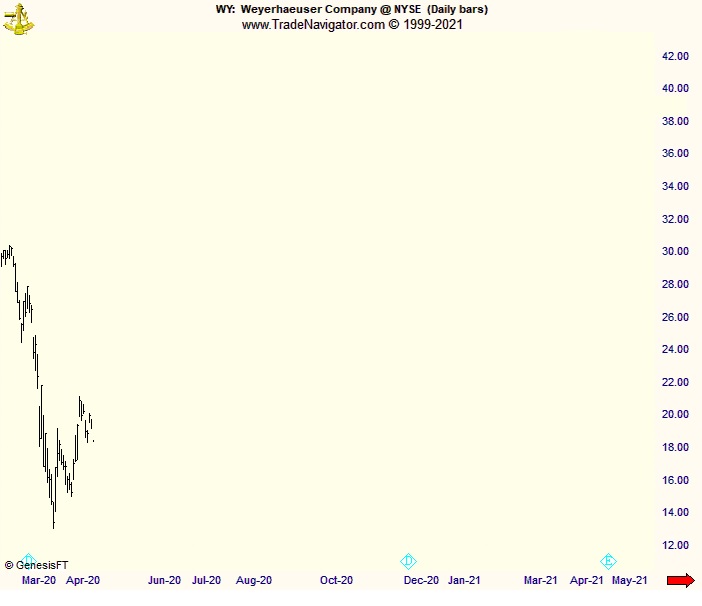

Take, for instance, this chart below of a venerable Big Board stock, global timberland producer and real estate investment trust, Weyerhaeuser Company (ticker symbol WY) -- in May 2020, at the start of the pandemic.

If you'd been tied to the name Weyerhaeuser or the news surrounding its name at that time, you'd would've likely done one of two things: Shorted the stock or made a hard pass talk to the hand.

Remember, this was May 2020. The world was two months into the worst pandemics in centuries. The global economy had come to a crashing halt, and the future of real estate seemed doomed.

In fact, the mainstream consensus about companies associated with the constructing, buying, and selling of property was terminal. On May 1, 2020, Motley Fool described a single-day bloodbath in Weyerhaeuser and wrote:

"WY plunged 15% in a matter of seconds... Any company's cutting its dividend is unwelcome, but a REIT's doing so is particularly bad since the REIT structure was created specifically to pass income on to shareholders."

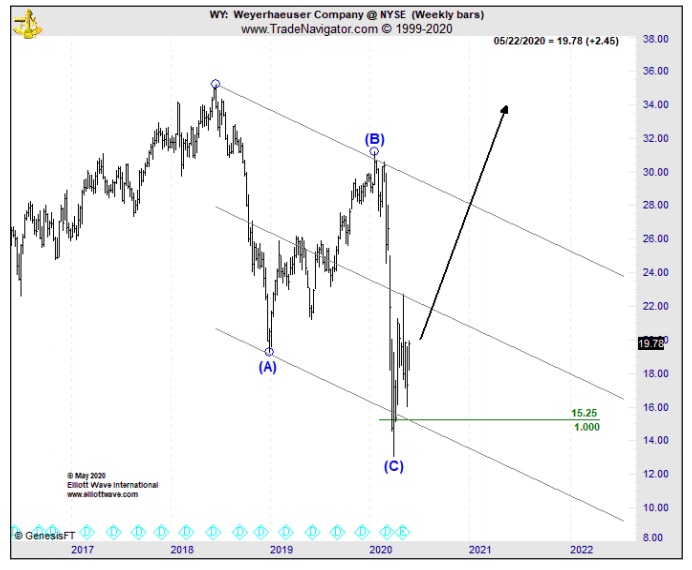

But on May 26, 2020, Elliott Wave International’s Trader's Classroom editor Jeffrey Kennedy showed subscribers this bullish chart of Weyerhaeuser:

Why was Trader's Classroom turning bullish when the rest of the world all but wrote WY off?

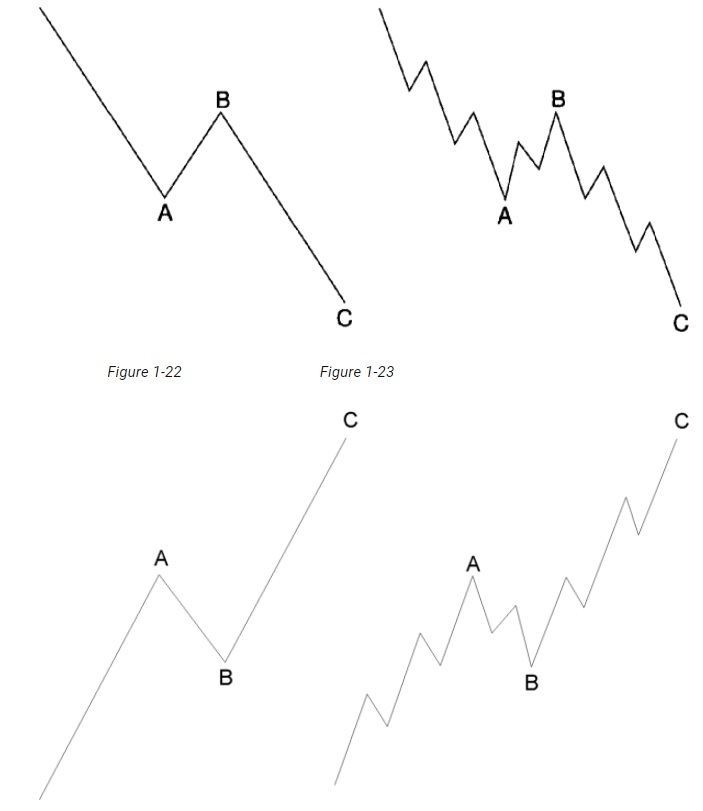

Because the decline in WY had a signature look of one key Elliott wave pattern: a zigzag. Here, the Elliott Wave Principle -- Key to Market Behavior offers this definition and idealized diagram:

"A single zigzag is a simple three-wave pattern labeled A-B-C. The subwave sequence is 5-3-5, and the top of wave B is noticeably lower than the start of wave A."

Zigzags are corrections -- i.e., countertrend moves, and signify a temporary break in the larger trend. The significance of WY's completion of this countertrend move was clear: The stock was headed for a powerful rebound.

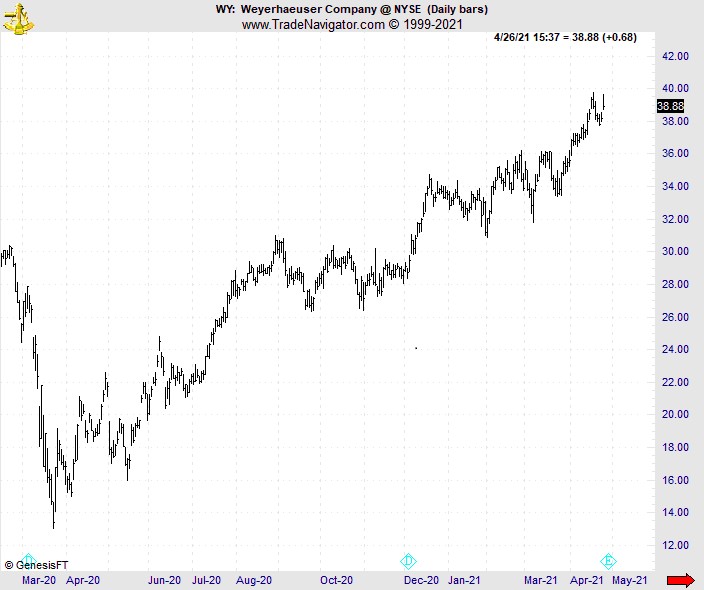

The next chart captures what followed: WY indeed caught a powerful upwind and rode the current to its highest price level in its 121-year history, a comeback that shocked much of the mainstream financial world and those traders betrothed to a narrow view of market behavior.

In the end, Elliott wave analysis proves that finding opportunity in financial markets is truly unlimited.

It starts with learning the five core Elliott wave patterns. Once you identify a pattern using the Wave Principle, you can then confidently anticipate the direction prices will most likely move next.

Elliott Wave International does not provide investment advice. All rights reserved.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.