The following is a list of the most frequently traded currencies, their trading symbols, their nicknames and major characteristics:

USD (US Dollar)

The US Dollar is by far the most transacted currency in the world. This is due to several factors as you have already learned in the last chapter. First, it's the world's primary reserve currency, which makes this currency highly susceptible to changes in interest rates. Second, the USD is a universal measure to evaluate any other currency as well as many commodities such as oil (hence the term "petrodollar") and gold.

Today's other major currencies like the Euro, the British Pound, the Australian Dollar and New Zealand Dollar are moving against the American currency, and so do the Japanese Yen, the Swiss franc and Canadian Dollar.

70% of the U.S economy depends on domestic consumption, making its currency very susceptible to data on employment and consumption. Any contraction in the labor market has a negative effect on this currency.

All US Dollar denominated bank deposits held at foreign banks or foreign branches of American banks are known as "Eurodollars". Some economists maintain that the overseas demand for Dollars allows the United States to maintain persistent trade deficits without causing the value of the currency to depreciate and the flow of trade to readjust. Other economists believe that at some stage in the future these pressures will precipitate a run against the US Dollar with serious global financial consequences.

Nickname: Buck or Greenback

EUR (Euro)

The European Monetary Union is the world's second largest economical power. The Euro is the currency shared by all the constituting countries which also share a single monetary policy dictated by the European Central Bank (ECB).

This currency is both a trade driven and a capital flow driven economy. Before the establishment of the Euro, central banks didn't accumulate large amounts of every single European national currency, but with the introduction of the Euro it is now reasonable to diversify the foreign reserves with the single currency. This increasing acceptance as a reserve currency makes the Euro also very susceptible to changes in interest rates.

The effect of the Euro competing with the Dollar for the role of reserve currency is misleading. It gives observers the impression that a rise in the value of the Euro versus the US Dollar is the effect of increased global strength of the Euro, while it may be the effect of an intrinsic weakening of the Dollar itself.

Nickname: Fiber or Single Currency

JPY (Japanese Yen)

The Japanese Yen, despite belonging to the third most important single economy, has a much smaller international presence than the Dollar or the Euro. The Yen is characterized by being a relatively liquid currency 24 hours.

Since much of the Eastern economy moves according to Japan, the Yen is quite sensitive to factors related to Asian stock exchanges. Because of the interest rate differential between this currency and other major currencies that preponderated for several years, it is also sensitive to any change affecting the so-called "Carry Trade". Investors were then shifting capital away from Japan in order to earn higher yields. However, in times of financial crisis when risk tolerance increases, the Yen is not used to fund carry trades and is punished accordingly. When volatility surges to dangerous levels, investors try to mitigate risk and are expected to park their money in the least risky capital markets. That means those in the US and Japan.

The concept of carry trade will be disclosed later in this chapter, but a short definition would be: a strategy which involves buying or lending a currency with a high interest rate and selling or borrowing a currency with a low interest rate.

Japan is one of the world's largest exporters, which has resulted in a consistent trade surplus. A surplus occurs when a country's exports exceed its imports, therefore an inherent demand for Japanese Yen derives from that surplus situation. Japan is also a large importer and consumer of raw materials such as oil. Despite the Bank of Japan avoided raising interest rates to prevent capitalflows from increasing for a prolonged period, the Yen had a tendency to appreciate. This happened because of trade flows. Remember, a positive balance of trade indicates that capital is entering the economy at a more rapid rate than it is leaving, hence the value of the nation's currency should rise.

GBP (Pound Sterling)

This was the reference currency until the beginning of World War II, as most transactions took place in London. This is still the largest and most developed financial market in the world and as a result banking and finance have become strong contributors to the national economical growth. The United Kingdom is known to have one of the most effective central banks in the world, the Bank of England (BOE).

The Sterling is one of the four most liquid currencies in the Forex arena and one of the reasons is the mentioned highly developed capital market.

While 60% of the volume of foreign exchange are made via London, the Sterling is not the most traded currency. But the good reputation of the monetary policy of Great Britain and a high interest rate for a long time contributed to the popularity of this currency in the financial world.

Nickname: Cable or simply Sterling

Even though the economic unit using the Pound Sterling is technically the United Kingdom rather than Great Britain, the ISO currency code is GBP and not UKP as sometimes abbreviated. The full official name of the currency "Pound Sterling", is used mainly in formal contexts and also when it is necessary to distinguish the United Kingdom currency from other currencies with the same name such as the Guernsey Pound, Jersey Pound or Isle of Man Pound.

The currency name is sometimes abbreviated to just Sterling, particularly in the wholesale financial markets, while the term British Pound is commonly used in less formal contexts, although it is not an official name for the currency.

CHF (Swiss franc)

Several factors such as a lengthy history of political neutrality and a financial system known for protecting the confidentiality of its investors, have created a save heaven reputation for Switzerland and its currency. Being the worlds largest destination of offshore capital.

The Swiss franc moves primarily on external events rather then domestic economic conditions, and is therefore sensitive to capital flows as risk-averse investors pile into Franc-denominated assets, during global risk aversion times. Also much of the debt from Eastern European economies is denominated in Swiss Francs.

Nickname: Swissy

CAD (Canadian Dollar)

Canada is commonly known as a resource based economy being a large producer and supplier of oil. The leading export market for Canada is by far the United States making its currency particularly sensitive to US consumption data and economical health.

Being a highly commodity dependent economy, the CAD is very correlated to oil - meaning that when oil trends higher, USD/CAD tends to trend lower and vice versa.

Nickname: Loonie

The nickname "Loonie" is derived from the picture of a loon, a distinctive bird which appears on one side of the Canada's gold-colored, one Dollar coin.

If Canada is one of the world's largest producers of oil and is such a big part of the US economy, rising oil prices tend to have a negative effect on the USD and a positive effect on the CAD. Here you have two nice correlations.

But if you are willing to find a pair which is really sensitive to oil prices, then pick the CAD/JPY. Canada and Japan are at the extreme ends of production and consumption of oil. While Canada benefits from higher oil prices, Japan's economy can suffer because it imports nearly all of the oil it consumes. This is another interesting correlation to follow. A brent crude oil spot chart is available at our World Indexes section.

AUD (Australian Dollar)

Australia is a big exporter to China and its economy and currency reflect any change in the situation in that country. The prevailing view is that the Australian Dollar offers diversification benefits in a portfolio containing the major world currencies because of its greater exposure to Asian economies. This correlation with the Shanghai stock exchange is to be added to the correlation it has with gold. The pair AUD/USD often rises and falls along with the price of gold. In the financial world, gold is viewed as a safe havenagainst inflation and it is one of the most traded commodities. Together with the New Zealand Dollar, the AUD is called a commodity currency. Australia's dependency on commodity (mineral and farm) exports has seen the Australian Dollar rally during global expansion periods and fall when mineral prices slumped, as commodities now account for most of its total exports.

The interest rates set by the Reserve Bank of Australia (RBA) have been the highest among industrialized countries and the relatively high liquidity of the AUD has made it an attractive tool for carry traders looking for a currency with the highest yields. These factors made the AUD very popular among currency traders. It's the 6th most traded currency in the world accounting for an estimated 6.8% of worldwide FX transactions in 2007, far in excess of the economy's importance (2% of global economic activity).

The AUD is under a free floating regime since 1983. Before that it was pegged to a group of currencies called the trade weighted index (TWI).

Nickname: Aussie

NZD (New Zealand Dollar)

This currency behaves similar to the AUD because New Zealand's economy is also trade oriented with much of its exports made up of commodities. The NZD also moves in tandem with commodity prices.

As per estimates from the last BIS triennal survey, in 2007 the NZD accounted for a daily transaction share volumeof 1,9% of total Forex transactions, after the Norwegian Krone, the Hong Kong Dollar and the Swedish Krone.

Along with the Australian Dollar, the NZD has been for many years a traditional vehicle for carry traders, which has made this currency also very sensitive to changes in interest rates. In 2007 the NZD was mainly used to conduct carry trades against the Japanese Yen accounting for a higher volume than the Australian Dollar against the Yen.

Nickname: Kiwi

Although there are many currencies worldwide, the vast majority of all daily transactions involve the exchange of the so called "major" currency pairs:

US Dollar / Japanese Yen (USD / JPY)

Euro / US Dollar (EUR / USD)

Pound Sterling / US Dollar (GBP / USD)

US Dollar / Swiss Franc (USD / CHF)

US Dollar / Canadian Dollar (USD / CAD)

Australian Dollar / US Dollar (AUD / USD)

The pair is always expressed with the convention: Base currency / Quote currency set by the Society for Worldwide Interbank Financial Telecommunication cooperative (SWIFT).

Other pairs where the US Dollar is not a member currency are called "crosses". Basically, a cross is any currency pair in which the US Dollar is neither the base nor the counter currency. For example, GBPJPY, EURJPY, EURCAD, and AUDNZD are all considered currency crosses.

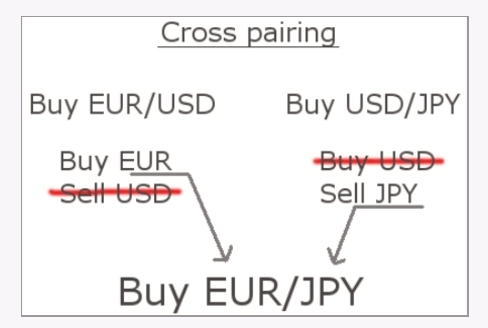

When you think about buying or selling a cross currency pair, don't forget that the US Dollar, despite not being a member within the pair, is still influencing the price behavior of the cross. Buying EUR/JPY is equivalent to buying the EUR/USD currency pair and simultaneously buying the USD/JPY. Knowing from the previous chapter how interbank platforms work, you also understand why cross currency pairs frequently carry a higher transaction cost. To build a cross, interbank dealers have to combine two orders on different platforms.

The figure below shows the process of creating a cross currency pair.

By knowing how currencies are related and transacted you will be given a basic understanding on how to analyze trading opportunities on majors as well as on crosses. The principles guiding you to profit from a trade with a cross should be technically the same as with the majors: basically you want to analyze which is the strong and which is the weak currency within the pair.

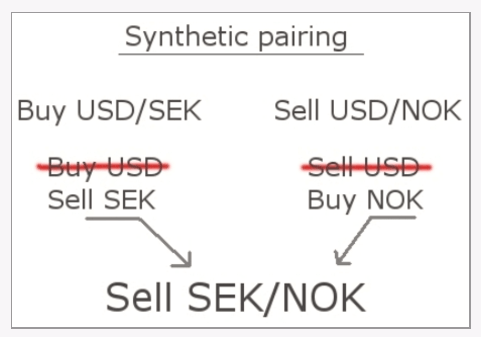

By the same token, as crosses are created at the interbank level, you can create your crosses if they are not available with your preferred broker-dealer's platform. We call that creating "synthetic" pairs.

Let's assume a trader believes, based on a previous analysis, that there is an opportunity to profit from a weak Swedish Krone (SEK) and a strong Norwegian Krone (NOK), but the broker-dealer which the trader is using doesn't enable to sell the pair SEK/NOK. In this case all it takes is the trader to buy USD/SEK and to sell USD/NOK with equal position sizes. The position size depends on the pip value of the pair you are trading, as you will see later in this chapter.

Too many new concepts to put down a profitable trade? Don't worry, we will get there in a moment.

The figure below illustrates the process of synthetic pairing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Editors’ Picks

EUR/USD: US Dollar to remain pressured until uncertainty fog dissipates Premium

The EUR/USD pair lost additional ground in the first week of February, settling at around 1.1820. The reversal lost momentum after the pair peaked at 1.2082 in January, its highest since mid-2021.

Gold: Volatility persists in commodity space Premium

After losing more than 8% to end the previous week, Gold (XAU/USD) remained under heavy selling pressure on Monday and dropped toward $4,400. Although XAU/USD staged a decisive rebound afterward, it failed to stabilize above $5,000.

GBP/USD: Pound Sterling tests key support ahead of a big week Premium

The Pound Sterling (GBP) changed course against the US Dollar (USD), with GBP/USD giving up nearly 200 pips in a dramatic correction.

Bitcoin: The worst may be behind us

Bitcoin (BTC) price recovers slightly, trading at $65,000 at the time of writing on Friday, after reaching a low of $60,000 during the early Asian trading session. The Crypto King remained under pressure so far this week, posting three consecutive weeks of losses exceeding 30%.

Three scenarios for Japanese Yen ahead of snap election Premium

The latest polls point to a dominant win for the ruling bloc at the upcoming Japanese snap election. The larger Sanae Takaichi’s mandate, the more investors fear faster implementation of tax cuts and spending plans.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.