A Guide To Setting Up Your Trading Goals Today: Did you know that we just wrapped up a first in the U.S. Economies’ history?

When the ball dropped and we rolled into 2020, it capped off the first decade in U.S. history that didn’t have a recession in it.

Take a minute to let that sink in….

So what does this mean for your trading goals?

I hate to so quickly dampen that warm and fuzzy feeling… but something tells me that 2020 may not be just any walk in the park.

Here’s just a taste of what’s in store for us this year:

- Brexit…now what?

- Coronavirus

- Something about a peach

- Presidential Election

- China Trade War

- Hong Kong Protests

- Are we about start a war with Iran?

…to just name a few off the top of my head!

Whether you’re for, against, or neutral on these things, I think we can all agree they’re likely to produce one thing in bulk quantity: VOLATILITY!

Now by no means am I calling for the end just yet (I’m actually quite the optimist!). As the saying goes, “Bull Markets Don’t Die From Old Age.” But let’s be honest, if just a few of those things go a direction the market doesn’t like, the bull “gravy train” may finally run out of steam.

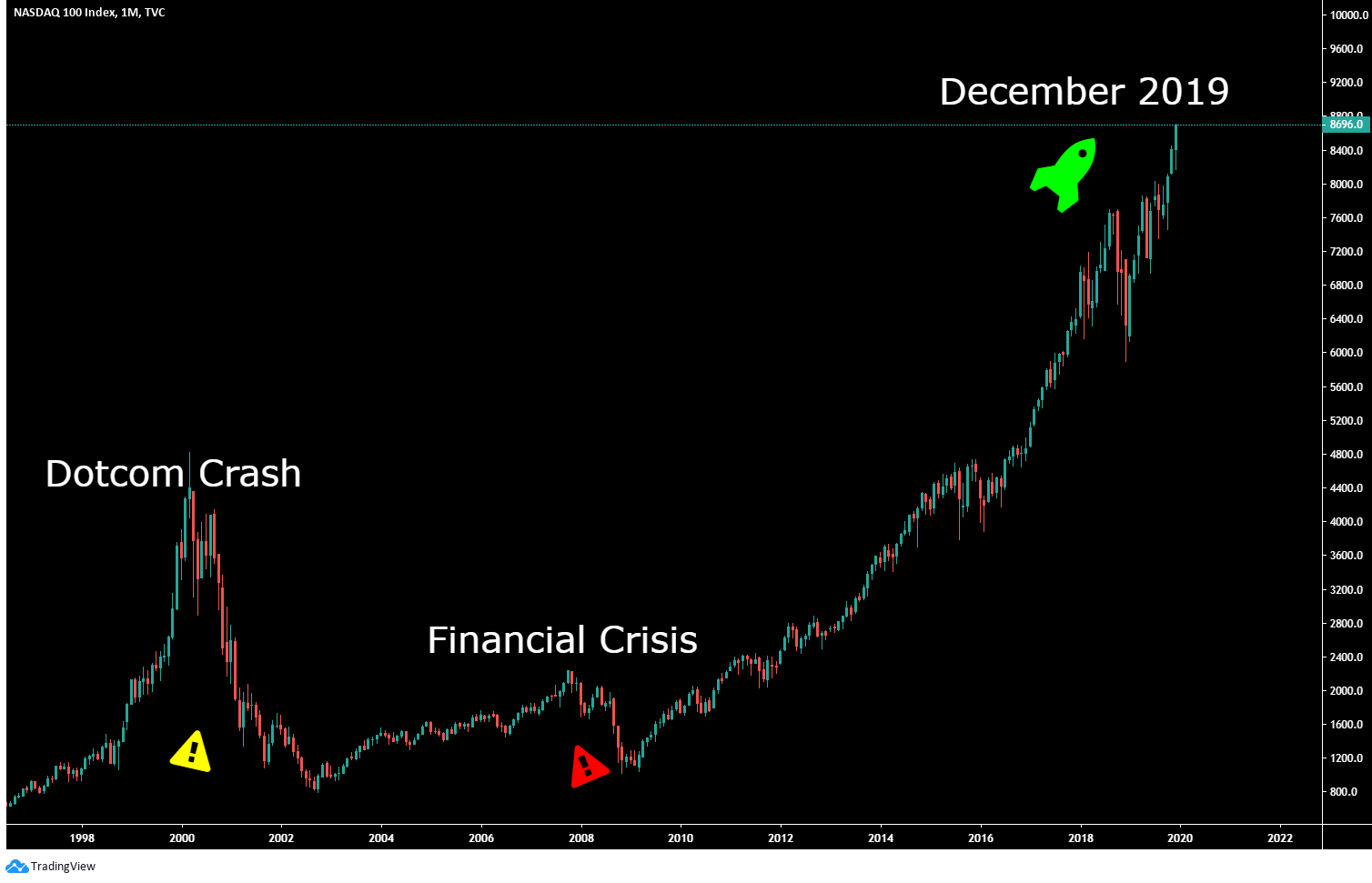

Let’s turn to the charts to visualize the biggest expansion in U.S. History:

Pretty crazy to look at it from this perspective!

So in the era of the FED printing press (i.e. quantitative easing) and easy money, does your portfolio reflect this historic run?

How would a crash like the one in 2000 or 2008 affect your financial goals over the next year or decade?

Would it prevent you from doing anything you wanted to achieve/accomplish:

– Buying a house or maybe paying one off?

– Telling your boss to shove it (i.e. quitting the day job)

– Retiring early… or just on time?

You don’t have to answer me, but at least be honest with yourself: Now knowing (if you weren’t already aware) that we’re capping off the greatest bull market in history, are you satisfied with the things you’ve accomplished over the last year and preceding nine?

Are you consistently hitting the (trading) goals you’ve set for yourself?

You may possibly be thinking “Umm, what trading goals?”

If “YES!” don’t worry, I was there at one point in time too.

Like any successful business, goals should be laid out for the short and long term.

Show me a single business with any kind of long-term success that doesn’t do some sort of FPA (Financial Planning and Analysis) every quarter, if not more frequently… let me save you the trouble in thinking or looking for one, they don’t exist!

And like any successful business, a successful (or aspiring) trader should be doing the same thing with their trading account.

Otherwise, you’re flying blind and far more likely to make impulsive and costly mistakes.

In 1990 Dr. Edwin Locke and Gary Latham published “A Theory of Goal Setting and Task Performance.” Dr. Locke is basically the godfather of goal setting! Their book outlines five principles of effective goal setting, aimed towards setting goals in a workplace but they obviously can apply elsewhere (i.e. your trading):

- Clarity: A goal must be specific and clear (Why are you trading? Monthly, Quarterly & Annual Return Goals? Income or Wealth?)

- Challenge: If you set the bar too low it can be demotivating, but it’s important to keep things realistic. (i.e. Turning $10,000 into $1,000,000 probably isn’t going to happen in year 1 …sorry!)

- Commitment: You have to believe in the goal from the onset and commit to achieving it.

- Complexity: Once again, you need to be realistic with what’s possible. Trading isn’t easy by any stretch of the word. Which makes it even more important to break down your goals as granular as possible (i.e. If your goal is to make 10% a month, how many trades are you going to have to take while not breaking any rules?).

- Feedback: You need to track your performance regularly. Do you have a trading partner/community keeping you accountable to your goals? Have you mapped out your goals for 2020 (or the next decade)?

Now with that last part in mind, I’ll let you in on a little secret… You don’t actually need to be overly concerned about Brexit, Trade Wars, wild Tweets or anything along those lines as a technical trader.

No matter if the market goes up, down or sideways it doesn’t really matter! I learned a long time ago that I need to “Trade What I See, Not What I Think.” And that’s exactly what my software The PowerX Optimizer does for me (and could for you too)!

Regardless of what party is currently in power, or if we’re in the middle of the greatest bull market or the worst bear market, it sets me up to find high-probability trade setups in any market condition.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

GBP/USD holds above 1.3600 after UK data dump

\GBP/USD moves little while holding above 1.3600 in the European session on Thursday, following the release of the UK Q4 preliminary GDP, which showed a 0.1% growth against a 0.2% increase expected. The UK industrial sector activity deteriorated in Decembert, keeping the downward pressure intact on the Pound Sterling.

EUR/USD stays defensive below 1.1900 as USD recovers

EUR/USD trades in negative territory for the third consecutive day, below 1.1900 in the European session on Thursday. A modest rebound in the US Dollar is weighing on the pair, despite an upbeat market mood. Traders keep an eye on the US weekly Initial Jobless Claims data for further trading impetus.

Gold sticks to modest intraday losses as reduced March Fed rate cut bets underpin USD

Gold languishes near the lower end of its daily range heading into the European session on Thursday. The precious metal, however, lacks follow-through selling amid mixed cues and currently trades above the $5,050 level, well within striking distance of a nearly two-week low touched the previous day.

Cardano eyes short-term rebound as derivatives sentiment improves

Cardano (ADA) is trading at $0.257 at the time of writing on Thursday, after slipping more than 4% so far this week. Derivatives sentiment improves as ADA’s funding rates turn positive alongside rising long bets among traders.

The market trades the path not the past

The payroll number did not just beat. It reset the tone. 130,000 vs. 65,000 expected, with a 35,000 whisper. 79 of 80 economists leaning the wrong way. Unemployment and underemployment are edging lower. For all the statistical fog around birth-death adjustments and seasonal quirks, the core message was unmistakable. The labour market is not cracking.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.