zkSync Era revenue aggregator protocol Kannagi Finance has reportedly rug pulled over $2 million

- A Peckshield report has indicated that Kannagi Finance has rug pulled, making away with up to $2.13 million in investor funds.

- The platform runs on the zkSync Era, which is in the race for the best Ethereum Layer 2 network.

- The network has deleted its official website, including social media and communication accounts.

zkSync Era revenue aggregator protocol, Kannagi Finance, is the latest rug pull story after the project disappeared in the blue, leaving investors wondering what happened to their investments worth over $2 million.

zkSync Era-based Kannagi Finance rug pulls over $2 million

Investors in the Kannagi Finance project, which runs on the L2 network zkSync Era, suffer the latest crypto crime victims after the yield aggregator vanished in thin air.

#PeckShieldAlert #rugpull @zachxbt has reported that @Kannagi_Zksync on #zkSync has rugged for over ~$1M. @Kannagi_Zksync already deleted its social accounts/groups.

— PeckShieldAlert (@PeckShieldAlert) July 29, 2023

The scammer's address: 0x95ec03b821f164ce55cbb26f23f591a9bd40d6c1 pic.twitter.com/5FdyO94XZs

Kannagi Finance, whose ticker symbol is the KANA, was touted as a decentralized yield aggregator committed to empowering investors to reap compound interest from their cryptocurrency assets further.

The only remaining trace of the project is the number of investors who now cry wolf after losing their investments. Citing one victim in a Twitter post:

I was RUG about 200,000 U, is there a way to get it back?

The Total Value Locked (TVL) of Kannagi Finance was $2.13 million as of July 28, but the current TVL has almost returned to zero, recording a meager $0.17 at the time of writing. This translates to an estimated 100% user loss.

Kannagi Finance TVL

Notably, the Kannagi Finance contract code must be verified open-source, underscoring the need for proper due diligence before investing in cryptocurrency projects.

zkSync Era suffers by association

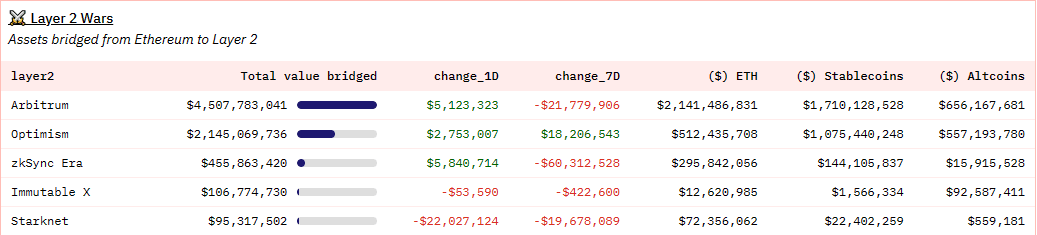

The rug pull has tarnished the reputation of zkSync Era, threatening its position in the race for the best Ethereum L2 network. As reported, zkSync currently ranks third after Arbitrum (ARB) and Optimism (OP), with a total value bridge of $455,863,420 at the time of writing.

As the L2 wars continue, the loss of confidence resulting from exploits like the case in EraLend and now zkSync Era continues to pose as a detractor. As reported on July 25, zkSync Era lending protocol EraLend exploited for $3.4 million in USDC. The lending protocol has suspended all borrowing operations and advises users against depositing USDC. EraLend is also an Ethereum L2.

Also Read: zkSync Era lending protocol EraLend exploited for $3.4 million in USDC

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.