Zcash and Dash price crash by 10% after crypto exchange OKX announces their delisting

- Dash price dropped by 10.4%, falling to $33 at the time of writing.

- Zcash price witnessed a near-equal drop as well, with the altcoin trading below $30, losing the support of all three EMA.

- The world’s fourth largest crypto exchange, OKX, announced the delisting of all privacy tokens, which are set to be taken off the site by January 5.

Ahead of the anticipated bull run in January 2024, most people are looking to capitalize on the hype, but by the looks of it, OKX is taking a different route. The result of the cryptocurrency exchange’s recent decision was significant for Zcash and Dash price action.

Zcash and Dash price crash

OKX, the world’s fourth largest cryptocurrency exchange, announced it will soon be delisting about eight crypto tokens. These include the likes of FSN, ZKS, CAPO, CVP, XMR, DASH, ZEC, and ZEN. These crypto assets represent nearly all the major privacy tokens listed on the exchange.

By January 4 and 5, all of these tokens will be delisted, and the deadline has taken a toll on the cryptocurrencies. Notably, Zcash (ZEC) Dash (DASH) took the biggest hit, crashing by nearly 10%.

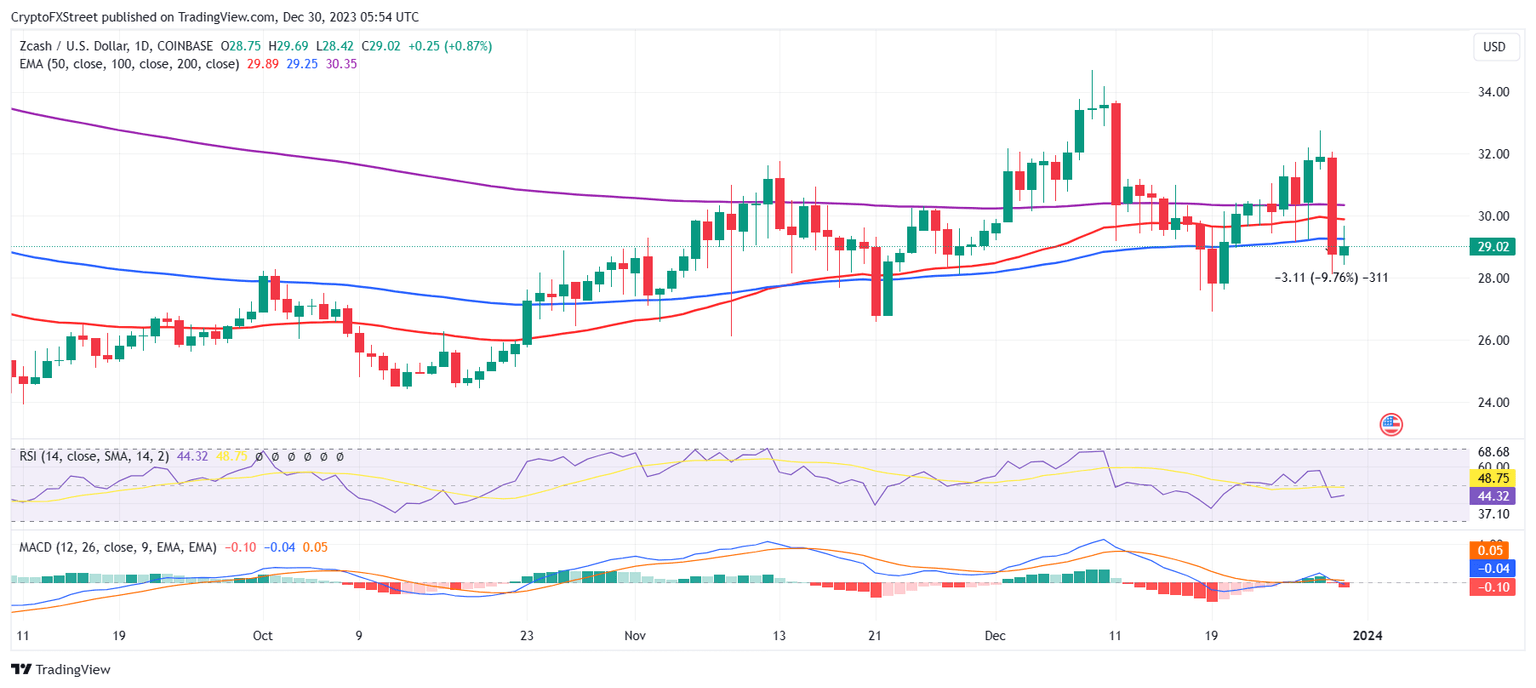

Zcash price at the time of writing fell below the $30 mark and could be seen trading at $29.02. The single day’s 9.8% dip resulted in the altcoin falling through all three 50, 100 and 200-day Exponential Moving Averages (EMA).

ZEC/USD 1-day chart

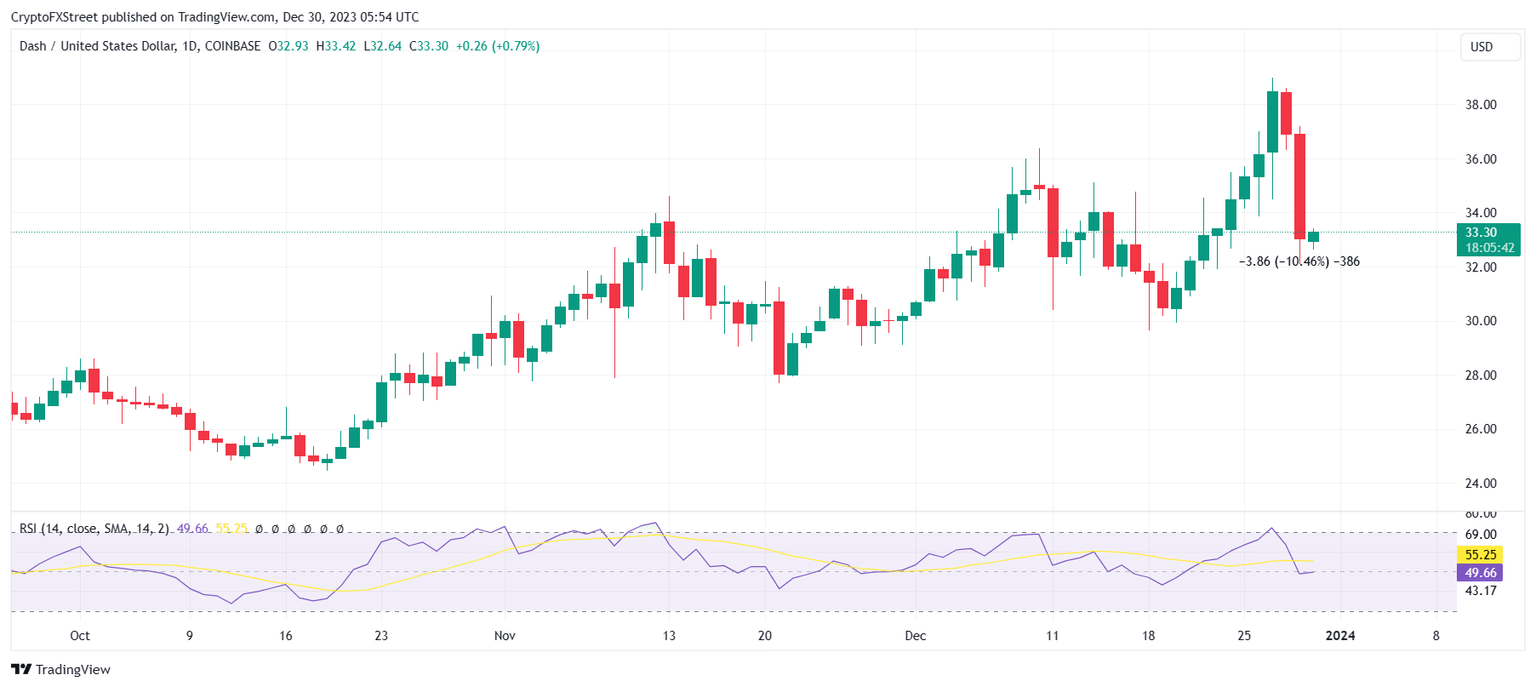

Dash price had a similar reaction as the cryptocurrency fell by more than 10% on the chart, declining to trade at $33.30.

DASH/USD 1-day chart

DASH did not see much recovery at the time of writing, but the presence of the Relative Strength Index (RSI) above the neutral line at the 50.0 mark is an optimistic sign for investors.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.