Ripple rallies on hope of lawsuit win, XRP extends gains to $0.65

- Ripple issued a new release for XRP Ledger software version 2.2.1, urging servers to upgrade.

- SEC vs. Ripple lawsuit ruling is awaited this week, traders keep eyes peeled for developments in the legal battle.

- XRP breaks sticky resistance at $0.65, extends gains by nearly 3%.

Ripple (XRP) is making headlines for the anticipated final ruling in the Securities & Exchange Commission (SEC) lawsuit. The lawsuit and SEC’s stance on XRP has acted as an influential market mover for XRP since the beginning.

XRP traders are awaiting the lawsuit’s outcome, either a settlement or Ripple’s win. The hope is fueled by the SEC’s recent move to back down on its request to treat Solana (SOL), Cardano (ADA) and Polygon (MATIC) as securities.

XRP changes hands at $0.6481 at the time of writing.

Daily digest market movers: Ripple lawsuit ruling expected soon, developers issue XRP Ledger upgrade

- US financial regulator SEC alleges that Ripple sold unregistered securities (XRP token) to institutional investors. The firm is faced with fines to the tune of $2 billion. Judge Analisa Torres is expected to rule on this issue soon.

- XRP traders have their eyes peeled for the final ruling in the Ripple lawsuit for two reasons:

- XRP has legal clarity as a non-security in its secondary market transactions (trade on exchanges)

- If the SEC chooses to appeal the ruling it could influence XRP negatively

- Ripple has proposed $10 million in fines for the alleged securities law violations, while the SEC says even by the payment remittance firm’s logic (in its letter comparing the lawsuit to Terraform Labs’ case) the fines should be $102.6 million.

- Pro-crypto attorney Fred Rispoli predicts that the Ripple lawsuit could end this month.

- XRP continues to enjoy the spotlight, as talks of further altcoin ETFs, likely Solana, XRP do the rounds. Franklin Templeton recently tweeted about a Solana ETF. XRP proponents argue that it is likely XRP Ledger’s native token gets a spot ETF product of its own.

- Analyst behind the X handle @CryptoKaleo said in a recent tweet:

Why is XRP starting to trade like it’s about to be announced for an ETF

— K A L E O (@CryptoKaleo) July 31, 2024

- XRP Ledger developers continue to ship updates to the latest version 2.2.1 and urge those running a server to upgrade it at the earliest opportunity.

A new release for rippled 2.2.1 is now available!

— RippleX (@RippleXDev) July 31, 2024

This core XRPL software update contains two minor bug fixes. If you operate an XRPL server, please upgrade at your earliest convenience to ensure service continuity.

Find out more about the update: https://t.co/CtGhxOOqqE

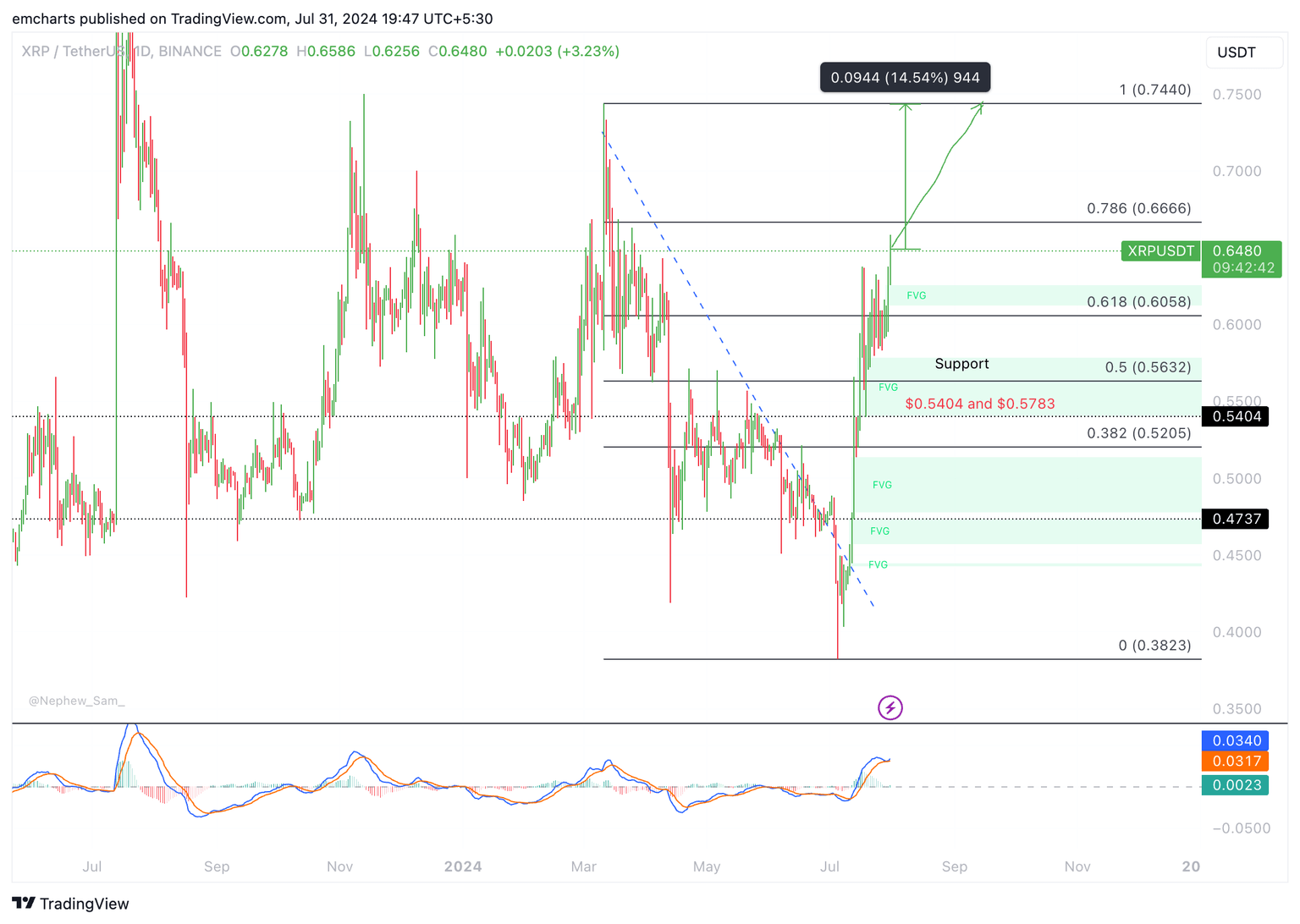

Technical analysis: XRP could extend gains by nearly 15%

Ripple broke out of its multi-month downward trend and is rallying toward its first target of $0.6666, the 78.6% Fibonacci retracement level of the decline from March 11 to July 5. Ripple could target the 2024 peak of $0.7440, the March 11 top for the altcoin. This marks a 14.5% rally from the current price.

XRP could find support in the Fair Value Gap (FVG) between $0.6256 and $0.6379. If there is a correction in the altcoin, it could sweep liquidity in this imbalance zone before resuming its rally toward its 2024 peak.

The Moving Average Convergence Divergence (MACD) indicator supports the thesis, and it shows underlying positive momentum in Ripple price.

XRP/USDT daily price

A daily candlestick close under $0.60 could invalidate the bullish thesis, and XRP could find support at $0.5632, the 50% Fibonacci retracement level.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.