XRP Price Prediction: XRP overtakes USDT after Ripple unlocks 500M ahead of Trump inauguration

- Ripple (XRP) price surged 22% in 3 days to hit $2.47 on Friday, as crypto markets started 2025 on a positive note.

- On-chain data shows the price rally coincided with a cryptic Trump-related message embedded in Ripple’s latest 500 million XRP escrow transaction on January 1.

- XRP Weighted Sentiment turned increasingly negative on Tuesday, signaling room for further upside as market sentiment rebounds from the holiday sell-off.

Ripple (XRP) price reached a 14-day peak of $2.5 on Friday, as the mega-cap altcoins make a positive start to 2025.

With market sentiment still trending cautious, on-chain data suggests XRP price could potentially score larger gains as the United States (US) President-elect Donald Trump inauguration nears.

XRP starts 2025 with a 23% rally as Ripple’s Trump reference ruffles feathers

On Wednesday, Ripple unlocked another 500 million XRP tokens from its escrow account as a part of Ripple’s monthly schedule to manage the token supply.

However, a cryptic message referencing Trump's upcoming inauguration embedded in Ripple’s latest transaction has sparked a positive market reaction.

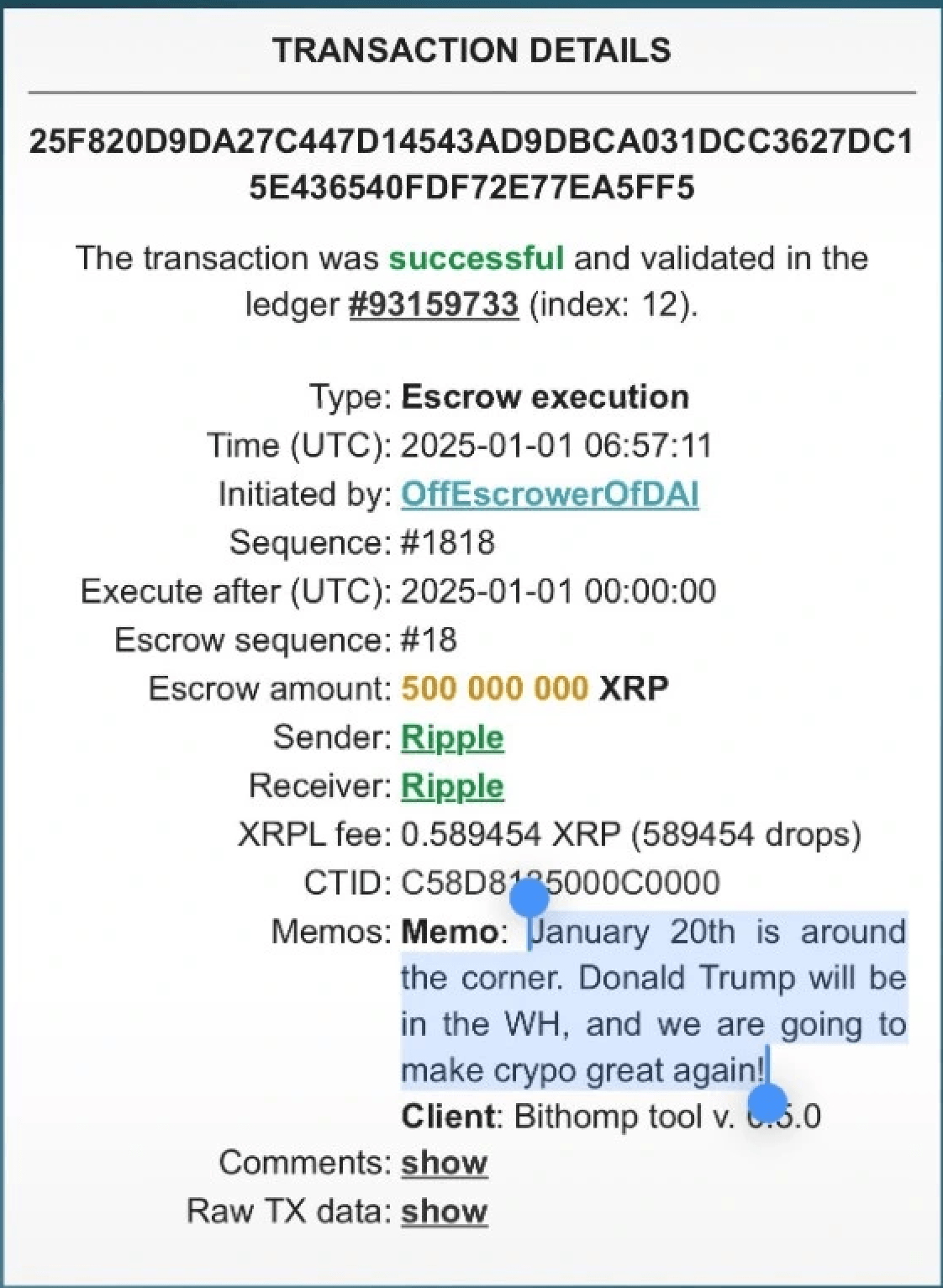

XRP community influencer JackTheRippler alerted his 302,400 followers on X to a memo accompanying Ripple’s latest transaction details.

Transaction details of the 500M XRP Tokens (Source: X Post)

The meme read: “January 20th is around the corner. Donald Trump will be in WH [Whitehouse], and we are going to make crypto great again.”

Hinting at potential transformative changes in crypto under the Trump administration, this transaction meme has ignited optimism within the XRP spot markets.

As seen in the chart above, XRP opened trading at $2.1 on Wednesday. But since the Trump reference embedded in Ripple’s latest escrow transaction, XRP price has surged by 23% to hit the $2.5 level on Friday, overtaking Tether (USDT) as the third largest cryptocurrency project by market capitalization.

Market sentiment remains cautious despite recent gains

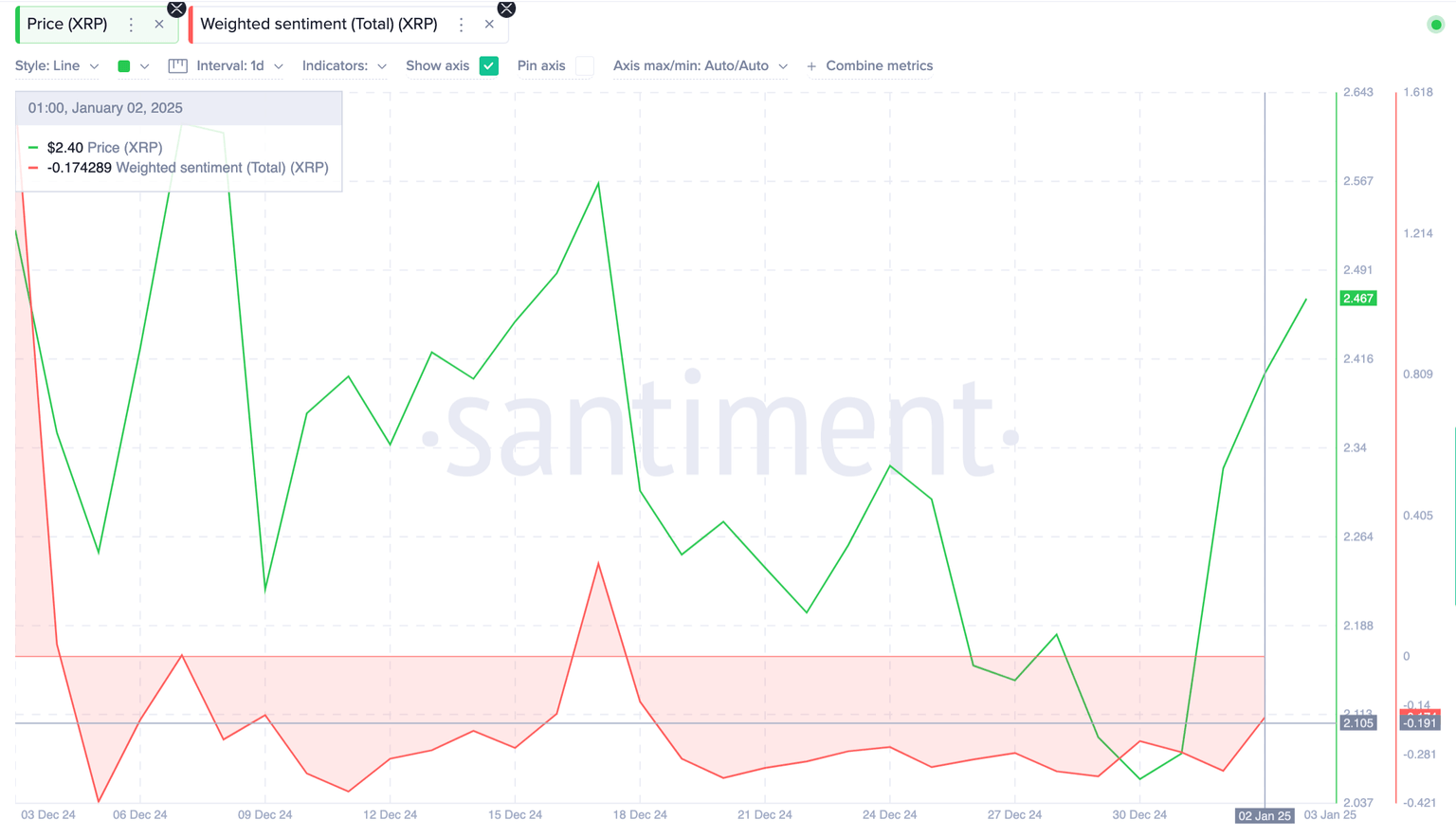

Despite the recent price surge, on-chain data aggregates show market sentiment is yet to recover from the US Federal Reserve (Fed)-induced bearish headwinds in the second-half of December.

Affirming this narrative, Santiment’s Weighted Sentiment chart below tracks the incidence of positive and negative discourse around XRP.

As seen above, XRP Weighted Sentiment still trends in negative values of -0.2 as of Friday, showing that negative comments still outpace the positives.

This implies that despite the 23% gains in the first three days of 2025, the majority of traders still maintain a cautious outlook.

Essentially, this hints at further XRP price upside potential for two reasons.

First, the lingering negative sentiment suggests that many traders may still be on the sidelines, providing room for fresh capital inflows as confidence improves.

Second, such an accelerated price rally amidst cautious aggregate market sentiment reflects underlying buying pressure from XRP whales and large institutional players.

If the current market dynamics persist, XRP price could potentially advance further towards $3 ahead of Trump’s inauguration slated for January 20.

XRP Price Forecast: Community hints $3 rally ahead of Trump inauguration

Ripple’s cryptic Trump-related message embedded in its Wednesday transaction memo sent XRP rallying 23% to $2.5 within three days, outperforming BTC and ETH as the crypto markets began 2025 with bullish momentum.

Despite the price surge, cautious market sentiment persists, reflected in XRP’s weighted sentiment remaining negative.

This indicates potential for further upside as sidelined traders may re-enter the market, fueling more gains in the days leading to Trump’s inauguration.

XRP’s bullish outlook is supported by rising trading volumes and four consecutive green candles, signaling strong buyer interest.

However, the Parabolic SAR remains above the current price, suggesting upside potential before market saturation.

A close above the $2.67 level could set the pace for the next breakout attempt toward the next major resistance at $3.

On the downside, support is seen at $2.30, with a critical level at $2.10 if bearish pressures escalate.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.