XRP Price Prediction: Bulls target $0.66 as Coinbase vows to support Ripple

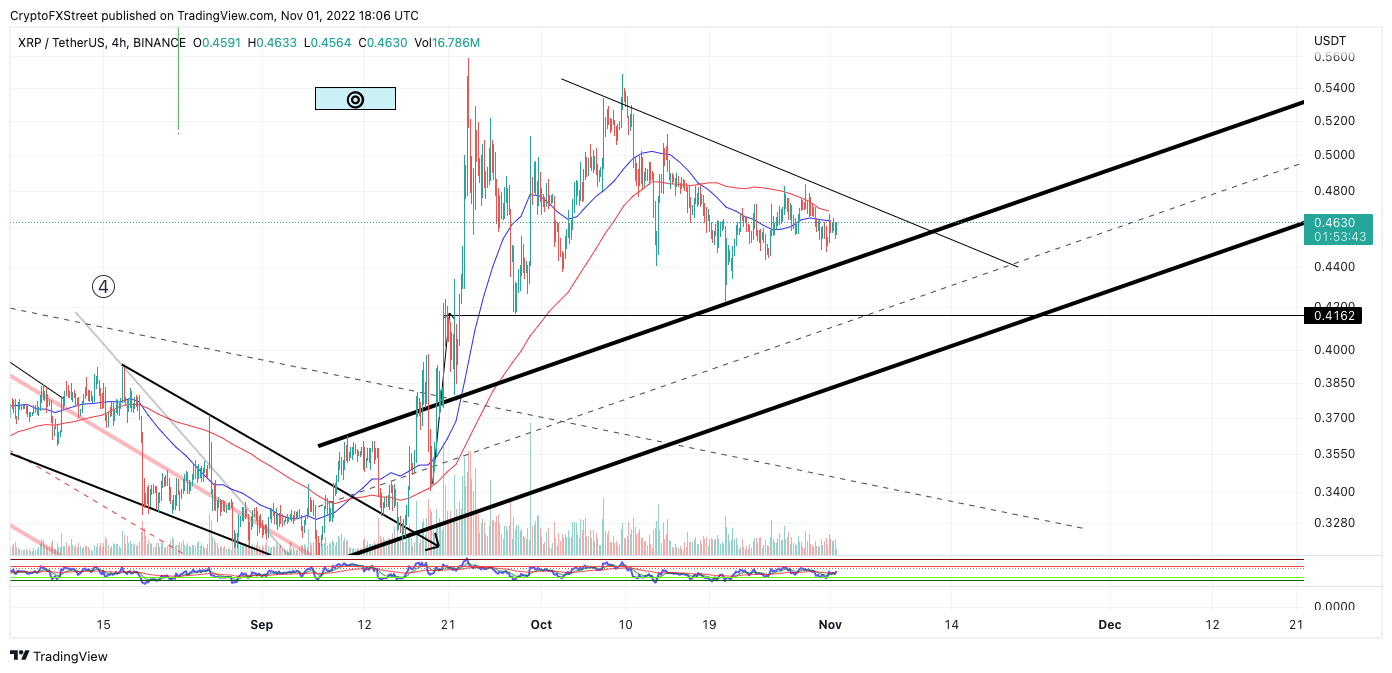

- Ripple price has been trading in a converging range for 40 days.

- The progressive lower highs and higher lows suggest a triangle trade setup could present itself.

- Invalidation of the bullish scenario is a breach below $0.42.

XRP price may be set up for a powerful rally in the days to come. Key levels have been defined.

XRP price has bullish undertones

XRP price should be on every trader's quick watch list as a profitable opportunity could present in the coming days. Ripple, the digital remittance token, has been coiling in a sideways fashion since September. The 40-day consolidation has led to consistent lower highs and higher lows, indicative of a symmetrical triangle pattern that confounds the bullish sentiment.

XRP price currently auctions at $0.46. A Fibonacci tool surrounding the strongest part of the rally before the 40-day consolidation shows the XRP price hovering above the 38.2% retracement level. The previous swing low landed directly on the 50% Fib level. The persistent higher lows above the Fib levels exemplify underlying market strength.

The bullish technicals come at an interesting time in the market as Coinbase has vowed to support XRP in the SEC vs Ripple lawsuit. According to FXStreet's News Journalist Ekta Mourya, Coinbase has "joined the long list of Ripple's allies and filed a plea with Judge Analisa Torres asking to file an amicus curiae brief." The plea argues that the SEC's case threatens the crypto industry as a whole.

XRP/USDT 4-Hour Chart

A crypto giant like Coinbase dialing-in support during the current XRP consolidation is certainly an optimistic gesture.

If the market is genuinely bullish, a breach above the recent higher low at $0.49 could be the triangle breakout investors have been waiting for. A rally towards the previous congestion zone at $0.66 would be an ideal target. XRP price would rise by 40% under said market conditions.

Invalidation of the bullish outlook could occur if the swing low at $0.42 is breached. In doing so, the triangle setup would be void. An additional decline targeting $0.38 would then be a likely outcome. Such a move would result in an 18% decrease from the current Ripple price.

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.