Whistleblower claims DoKwon, Kanav Kariya and Sam Bankman-Fried were involved in Terra’s LUNA and UST collapse

- A Terra community member, FatMan, has been active in governance groups since UST’s colossal crash.

- Approached by several whistleblowers, he revealed a chain of events that led to the TerraUSD blowup.

- In a series of tweets, he implicated Do Kwon, Kanav Kariya and Samuel Bankman-Fried in insider deals that destroyed UST’s peg.

Whistleblowers from the Terra community have made allegations that some of the most prominent figures in the cryptocurrency industry, like FTX CEO Samuel Bankman-Fried and Jump Crypto CEO Kanav Kariya, were responsible for TerraUSD’s (UST) colossal crash and de-peg.

Also Read: Another Terra’s LUNA price failed recovery attempt

LUNAtic community member accuses co-founder of insider deals

Whistleblowers in the Terra community have come forward with details of an insider deal that destroyed stablecoin UST’s peg. FatMan is an active member of the LUNAtic community and its governance groups.

Following LUNA and UST’s crash which wiped out $39.1 billion in market value, FatMan came forward to criticize the workings of insiders involved in the collapse. Terra co-founder Do Kwon, Jump Crypto President Kanav Kariya, and FTX CEO Samuel Bankman-Fried were some of the insiders named by FatMan.

The community member told his Twitter followers that he had received tips from whistleblowers. FatMan accused Terra’s co-founder of paying Jump Capital a fixed fee of LUNA tokens every month to pay off their debt.

In the past 48 hours I have been contacted by several whistleblowers. These people would like to and will stay anonymous. I have learned some deeply troubling things and there is a lot more to come - this is just the very beginning. Here is some of what I can tell you.

— FatMan (@FatManTerra) May 23, 2022

Following the first tweet, FatMan raised questions on Serum, the non-custodial DEX’s handshake with Jump Capital, and the firm’s bailout of Solana’s Wormhole for $320 million.

Jump Crypto has been a leading investor for projects in the crypto and blockchain ecosystem for the past nine years. The crypto VC firm had jumped in to rescue Wormhole, in one of the largest DeFi hacks of 2022. After being hit by a $322 million hack, the firm revived Wormhole by depositing 120,000 Ethereum and replenishing the supply.

FatMan considers Jump Crypto’s involvement was deeper than the Wormhole rescue and there was an insider deal between Samuel Bankman-Fried, founder and CEO of FTX exchange and Kanav Kariya. FatMan is yet to furnish evidence on these allegations.

Jump Capital’s LUNA connection

Upon further investigation, FatMan connected with a verified insider and high-level Terraform Lab’s advisor and whistleblower, who said:

Do Kwon knows the builders are important, but it looks like he doesn't want to relinquish control. Three major protocols were strong-armed into supporting the new fork and many of us don't like it.

FatMan accused Terraform Labs and Do Kwon of strong-arming groups of developers and builders to compromise and accept a lower stake than they asked for and then publicly support it.

The advisor added:

Build teams negotiated a 25% stake in Terra 2 but were forced to accept a 10% compromise and were cut out if they didn't support it publicly.

The whistleblower unearthed a connection between Jump Capital’s purchase of part of $1 billion in LUNA tokens in February 2022. Jump Capital was joined by Three Arrows Capital and Defiance Capital in their purchase of LUNA sold by the Luna Foundation Guard (LFG).

FatMan makes startling revelations, Terra is far from decentralized

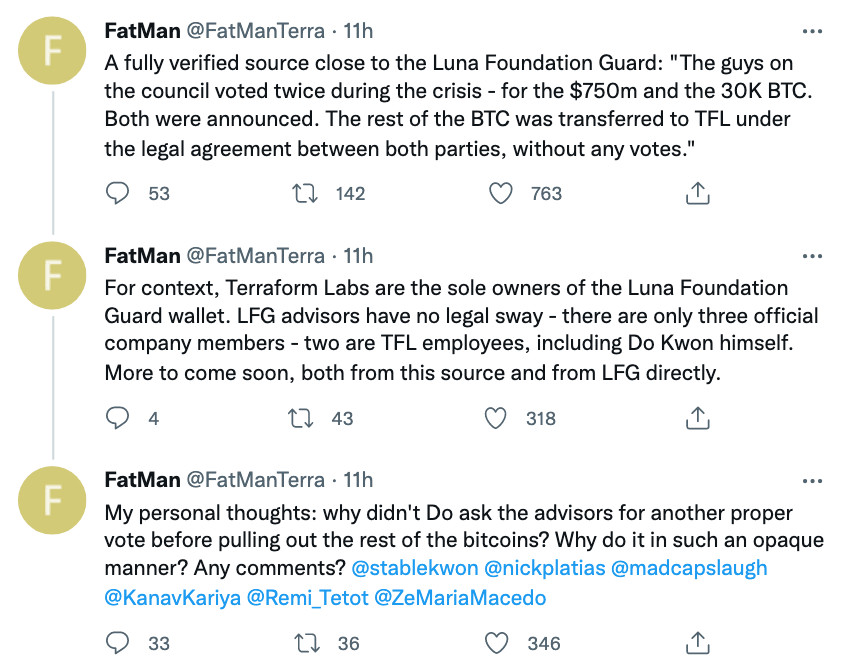

According to a fully verified source close to the Luna Foundation Guard the council voted twice during UST’s crash and the crisis situation. After deploying $750 million worth of Bitcoin and another 30,000 BTC from LFG’s reserves to reestablish UST’s peg, the remainder was transferred to Terraform Labs through a legal agreement without any council votes.

The whistleblower stressed the fact that this was a unilateral decision and didn’t involve members of the council, which begs the question how decentralizad LFG is? LFG advisors have no say in decisions made by Terraform Labs, as the firm is the sole owner of the LFG wallet. Therefore the three advisors, which include two TFL employees and Do Kwon himself have failed to hold proper voting before pulling out Bitcoin from LFG’s reserves.

While FatMan has called Do Kwon and Terraform Labs for comments, they cannot be reached for a response.

FatManTerra whistleblower tweets

Three cryptocurrencies attempt a bullish breakout

While Terraform Labs’s attempt to revive demand for LUNA and plan a recovery for the token, the broader crypto market has attempted to make a comeback after the recent bloodbath. FXStreet analysts have identified three cryptocurrencies that show a bullish setup and are likely to offer significant gains this week.

Disclaimer: FXStreet has reached out to Terraform Labs, Jump Crypto and Serum to get an official statement about the recent developments, but it has yet to hear back.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.