Were Ripple and SEC about to settle in a “secret meeting”? Pro-XRP lawyer says this

- Ripple and SEC are expecting Judge Torres to provide the summary judgment this week.

- Rumors about an undisclosed meeting between Ripple and the regulatory body were dismissed by lawyer Jonh Deaton.

- Ripple is losing traction and investors’ confidence owing to the delayed judgment.

Ripple vs. Security and Exchange Commission (SEC) is scheduled to come to a conclusion sometime soon, but the constant delays are putting a strain on Ripple. Investors are losing conviction, and the effects of the same can be seen on-chain as well as in rumors noted on Twitter.

Ripple and SEC secret meeting rumor circulate ahead of summary judgment

Rumors of Ripple and the regulatory body about to meet secretly began making rounds on Twitter earlier today. Initial claims came from an account called Blockchain Daily that tweeted,

JUST IN: REPORTEDLY RIPPLE AND SEC TO HOLD UNDISCLOSED MEETING ON MAY 8TH - UNCONFIRMED SOURCE pic.twitter.com/LNrUVCloQ1

— Blockchain Daily (@blckchaindaily) May 1, 2023

Not too late after the tweet, pro-XRP lawyer John Deaton dismissed these rumors calling them seemingly false. He further added,

“The SEC lawyers and Ripple lawyers could meet anytime they so desire. I don’t think they would pick a date a week from now and then leak it out.

Following these comments, Blockchain Daily too concurred with Deaton’s opinion saying that it made sense and that the page did not make the story up. Whether or not there is truth to the situation remains unknown, given the consistent delays in the summary judgment.

Some on social media channels have even begun speculating that the regulatory body got their hands on the summary judgment, which is expected to arrive on May 6 and found out they were losing and resorted to settling instead.

The initial expectation from the report was for Judge Torres to make the final decision in April. However, supporters and investors now await the judgment this month, as stated by John Deaton last month,

“We are about five weeks since she delivered the Daubert ruling, and the Summary Judgement could come out any time now. May 6 would put us at 60 day mark, before which there is a possibility of the judgement.”

This could, in return, have a huge impact on Ripple as well as XRP, which is currently not doing all that well.

XRP in the weeds

The delay in the summary judgment has caused many investors to pull back for now. This has resulted in the network adoption tanking to a two-month low. The overall network growth is determined by the number of new addresses formed on the network in a given period of time. This figure has declined from 2,593 to 1,217, noting a 53% decline in the span of a month.

Ripple network growth

However, not only is the case with the new investors, but the ones already existing are also turning towards pulling out due to the fall in the daily active addresses, observing a downward slope. Between the end of March and the start of May, the total presence of investors has declined from over 35,000 to less than 15,000 at the time of writing, registering a 57% drop.

Ripple active addresses

Nevertheless, Ripple is still optimistic about the upcoming summary judgment and continues to expand its reach. Launching its premier On-Demand Liquidity (ODL) services in India, Ripple’s services are now active in the second biggest country by crypto users, exposing itself to 27 million people as well as multiple banks across the states.

India is a constantly developing country in the global crypto market, with a 25% adoption rate. If the plan succeeds and XRP follows these bullish cues, the altcoin might be able to recover its recent 15% losses and climb back to $0.533.

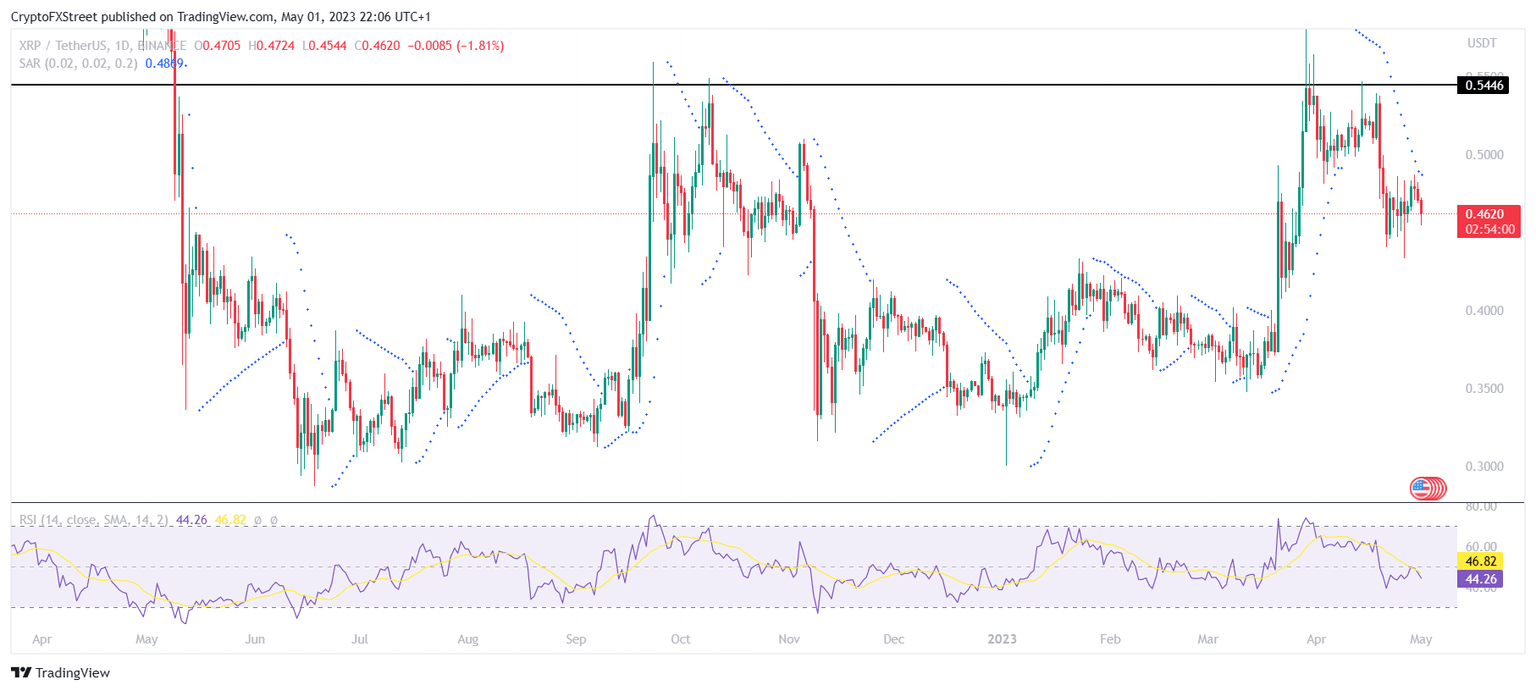

XRP/USD 1-day chart

A further rise from this point onwards would be supporting the altcoin to mark the new year-to-date high as well as a year-long high.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B02.37.11%2C%252002%2520May%2C%25202023%5D-638185732904761359.png&w=1536&q=95)

%2520%5B02.36.23%2C%252002%2520May%2C%25202023%5D-638185733112898875.png&w=1536&q=95)