VeChain Price Forecast: VET at risk of a 30% downswing, according to technical analysis

-

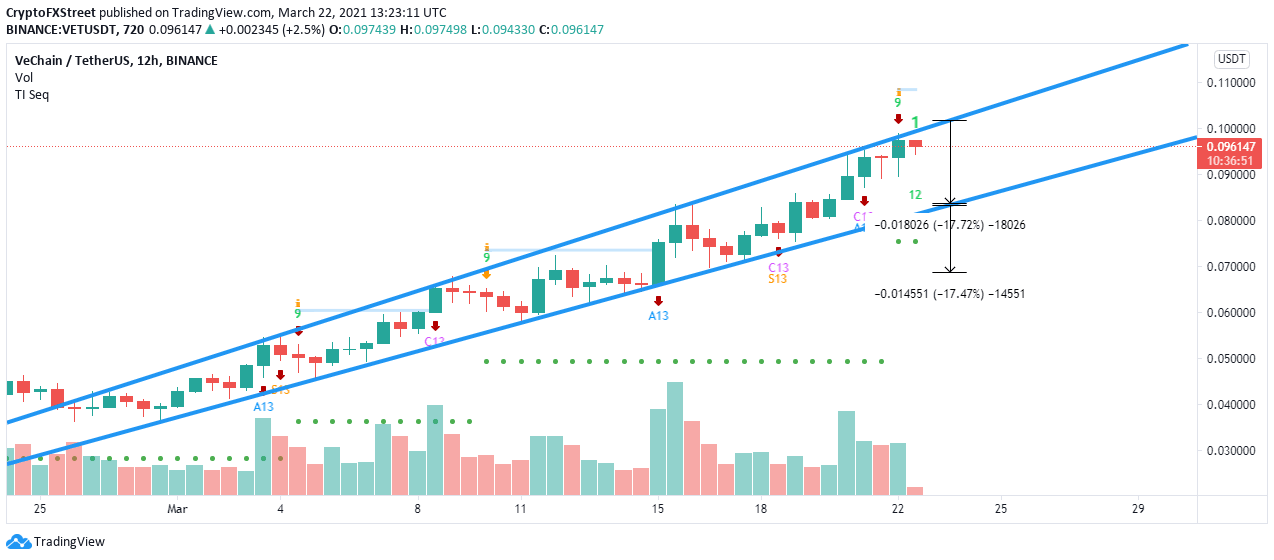

VeChain price is contained inside a broadening wedge pattern on the 12-hour chart.

-

The digital asset faces strong selling pressure in the short-term, according to a key indicator.

-

VET faces only one crucial resistance level before a potentially massive breakout.

VeChain has been trading inside an uptrend on the 12-hour chart, but a key indicator just presented a sell signal, increasing its selling pressure. The digital asset will likely see a pullback before a potential new leg up.

As of writing, VET is trading at $.095.

VeChain price on the verge of a major correction

VeChain has established an ascending broadening wedge pattern on the 12-hour chart. The digital asset is trading right at the top trendline, but the TD Sequential indicator has just presented a sell signal.

The confirmation of this sell signal has the potential to drop VeChain down to $0.084 in the short-term, at the lower boundary of the pattern. A breakdown below this point would drive the VeChain price towards $0.07.

To invalidate the bearish outlook, bulls will need to push the VeChain price above 0.098, which will also invalidate the sell signal. A breakout above the upper trend line resistance of the pattern will promptly drive VeChain towards $0.12.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.