US debt ceiling impasse to devastate crypto markets as Bitcoin and Altcoin volumes plummet

- The Biden administration and Republican Kevin McCarthy resumed the debt ceiling discussion hinting at a "positive outcome".

- If the US defaults on its debt, nearly 8 million job losses could be observed.

- Bitcoin and Ethereum trading volumes fall to the lowest for the second time since 2019.

The world economy is currently bracing for a terrible blow from the United States. As the Biden administration continues to negotiate with Congress to reach common ground, the stock market sits in a worry of impending doom. This fear is potentially also spreading to the crypto market.

US government nears defaulting on its debt

US President Joe Biden and top Republican Kevin McCarthy recently engaged in discussions regarding the debt ceiling on May 22. Both parties are optimistic about reaching common ground to bring an end to the deadlock over the federal debt.

Earlier this week, US Secretary of the Treasury Janet Yellen issued a warning stating that the US debt could default within the next ten days by June 1 if the talks fail to result in a favorable decision. She stated,

"It is highly likely that Treasury will no longer be able to satisfy all of the government's obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1.

Additionally, Yellen noted that even a last-minute solution must be avoided as it damages the economy at the consumer, business, and government levels.

However, McCarthy, ahead of the meeting, reiterated that while the Republicans and Biden administration still have "disagreements," they will reach a decision soon.

This needs to take place as soon as possible since it would take at least another three days to write down the agreement, read and vote on it.

The global economy is on edge as fears grow over the impending week, with the failure to raise the debt ceiling beyond the current cap of $31.4 trillion potentially leading to a US debt default.

Impact of debt default on crypto

According to a White House report, it was highlighted that a debt default could lead to over 8 million job losses. Unemployment rising by such a huge figure in an instant could negatively impact not only the stock market but the crypto market as well.

The reason behind this is that the US accounts for 10% of the worldwide crypto users. Amounting to 45 million out of the 420 million crypto users, the country’s troubles present a significant threat as crypto users who lose their job could be forced to sell their holdings prematurely.

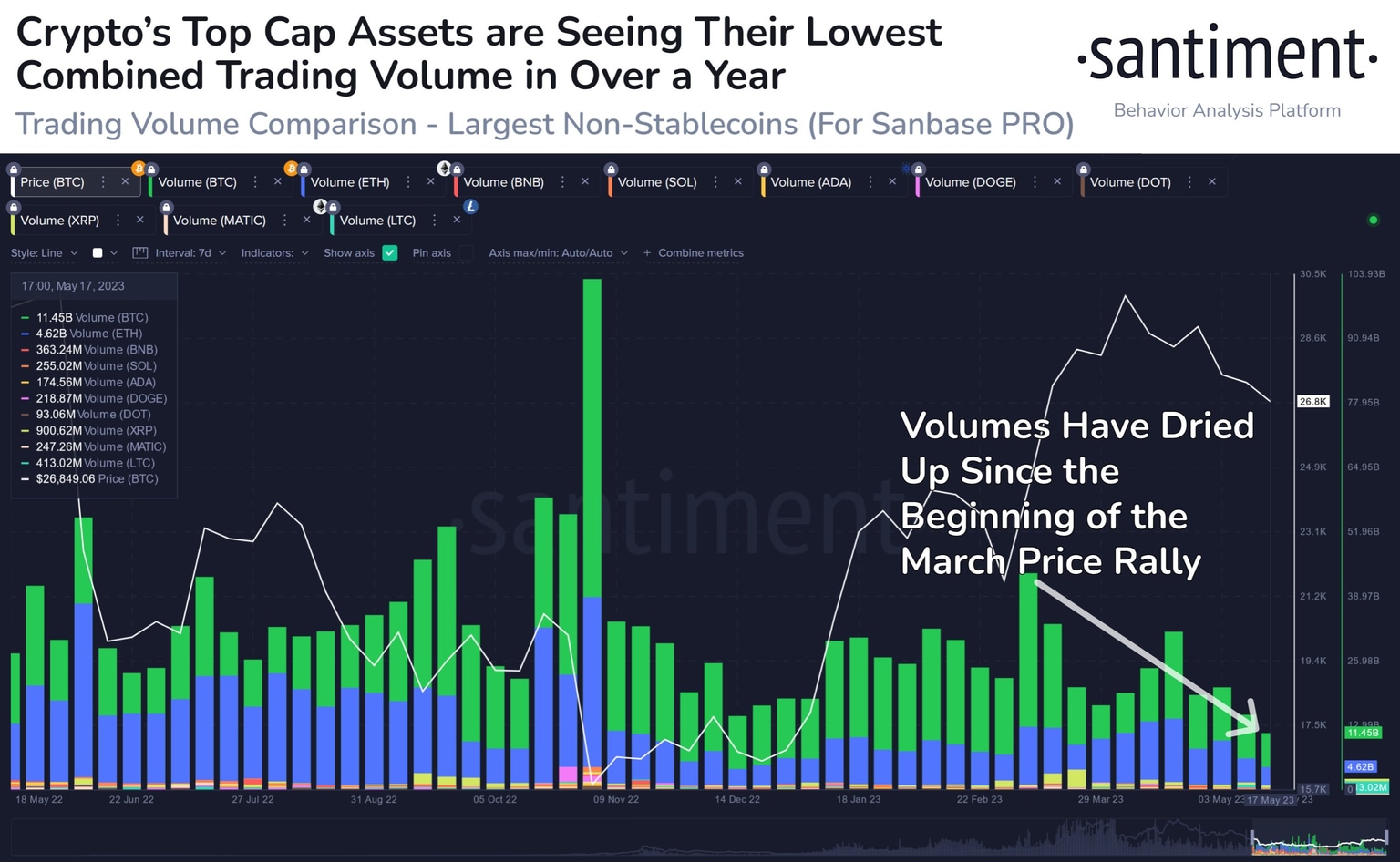

As it is, the crypto market trading volume is currently running dry, with weekly volumes noting historical lows. Santiment noted that Bitcoin and Ethereum volumes alone combined are observing the second lowest threshold since September 2019.

Crypto market trading volume

For the same reason, Bitcoin price and Ethereum price, along with the rest of the market, have been observing sideways movement for the last few days. Investors are preparing for a move in either direction post-June 1 as the result of the talks would determine profits or losses for crypto asset holders.

BTC/USD 1-day chart

The crypto market is still rooting for the talks to reach a conclusion, as even at the risk of losing some investment, the market would be safe from severe bearishness.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.