US CPI annual inflation comes in at 3.2%, below expectations; Bitcoin price cements $36,500 as support

- The Consumer Price Index (CPI) of the United States grew by 3.2% year on year in October, slowing down from the 3.7% rate in September.

- A decline in inflation is a positive sign for the crypto market as risk-on assets would not be left out of the investors’ basket of investment.

- Bitcoin price, along with the rest of the market, reacted positively to the CPI data release, trading at $36,650.

The United States Consumer Price Index (CPI) data, which is a measure of retail inflation, came in slightly below the market’s expectations. The impact of a lower headline CPI inflation will not only be visible on the stock markets but also on the value of cryptocurrencies such as Bitcoin.

Read more - Breaking: US CPI inflation declines to 3.2% vs. 3.3% expected

US CPI annual inflation comes in at 3.2% in October

The US Bureau of Labor Statistics (BLS) released the CPI data for October, with the headline inflation falling from 3.7% in September to 3.2% for October. Core CPI, on the other hand, rose by 0.2% month on month against the expectation of 0.3%. The year-on-year core CPI grew by 4.0%, slightly below the estimation of 4.1%.

The stock market is set to witness significant growth in the coming trading sessions, while the US Dollar Index (DXY) is expected to witness another blow. This is in line with the expected impact of decreased inflation forecasted by FXStreet analyst Yohay Elam. Elam stated,

“If the data surprises to the downside, the party on Wall Street would continue, while the US Dollar would suffer another blow. In case data comes out as expected, the drop in headline inflation will likely trigger an immediate positive impact on equities and put pressure on the US Dollar – even if Core CPI remains stubbornly elevated.”

The impact of decreased inflation on the crypto market will also be positive. Generally, risk-on assets such as cryptocurrencies tend to react in a bullish manner when the US CPI indicates low or lower-than-expected inflation.

Bitcoin price rises in response to the CPI data

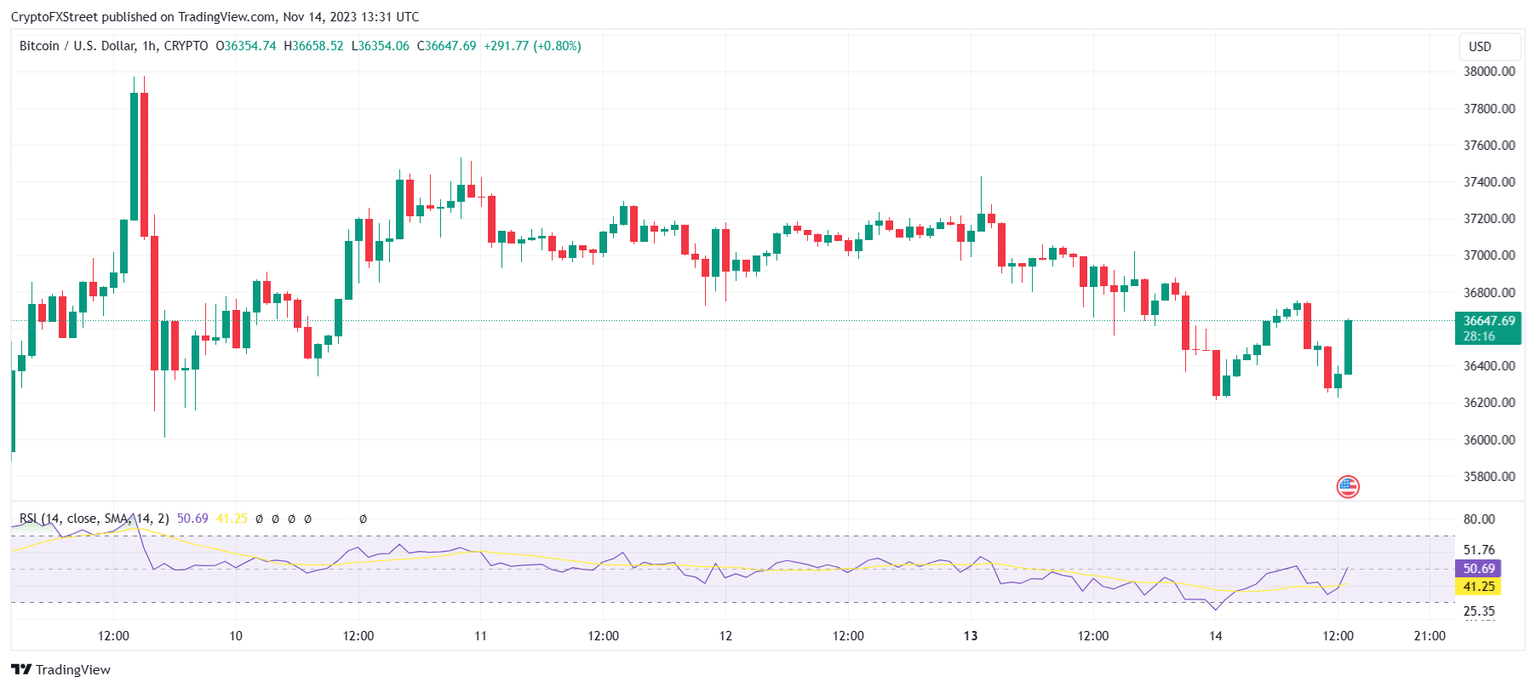

Bitcoin price is hovering around $36,647 at the time of writing, rising by 0.8% on the day, following the release of the CPI data. While the lower-than-expected inflation rate won’t necessarily initiate a rally in BTC price, it could contribute to countering the broader market bearishness witnessed in the last few days.

BTC/USD 1-hour chart

The rest of the crypto market, i.e., altcoins, also noted a similar bullish reaction, with Ethereum rising by 0.74% to trade at $2,039. XRP price increased by 1.26% in the past hour to bring the altcoin to $0.658, and Solana did not fail to surprise either, rising by nearly 4%, bringing the trading price to $54.47.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.