Unless Chainlink price marks a 500% rally, these LINK holders will suffer losses

- Chainlink price has been in the sub $10 zone since May 2022, failing attempts to breach the resistance at $9.29.

- The cohorts that bought their LINK around 20% of the all-time high prices of May 2021 will find profits only when the altcoin charts a 650% rally.

- These holders represent nearly 2% of all investors with a balance, suggesting the FOMO at the time of highs drove investors to load up on the token.

-637336005550289133_XtraLarge.jpg)

Chainlink price is in the weeds struggling to post a decent recovery due to the mixed signals coming from investors. But as some investors continue to exhibit issues at this stage, it would have been difficult for the project to survive had they chosen to leave the cryptocurrency network two years ago.

Chainlink price all-time high - The impossible dream

Chainlink price has been performing decently on the micro-scale, but on the macro, the altcoin stands far away from its all-time highs. Hitting the highs of $52 back in May 2021, LINK observed extreme bullishness at that time, with investors gobbling up the token due to the cryptocurrency hype FOMO.

With time as the prices began declining, investors decided to limit their losses and sold, but some decided to hang on to their LINK. This was done in the hopes of the cryptocurrency eventually regaining its bullish momentum and charting a rise that would push Chainlink price even higher.

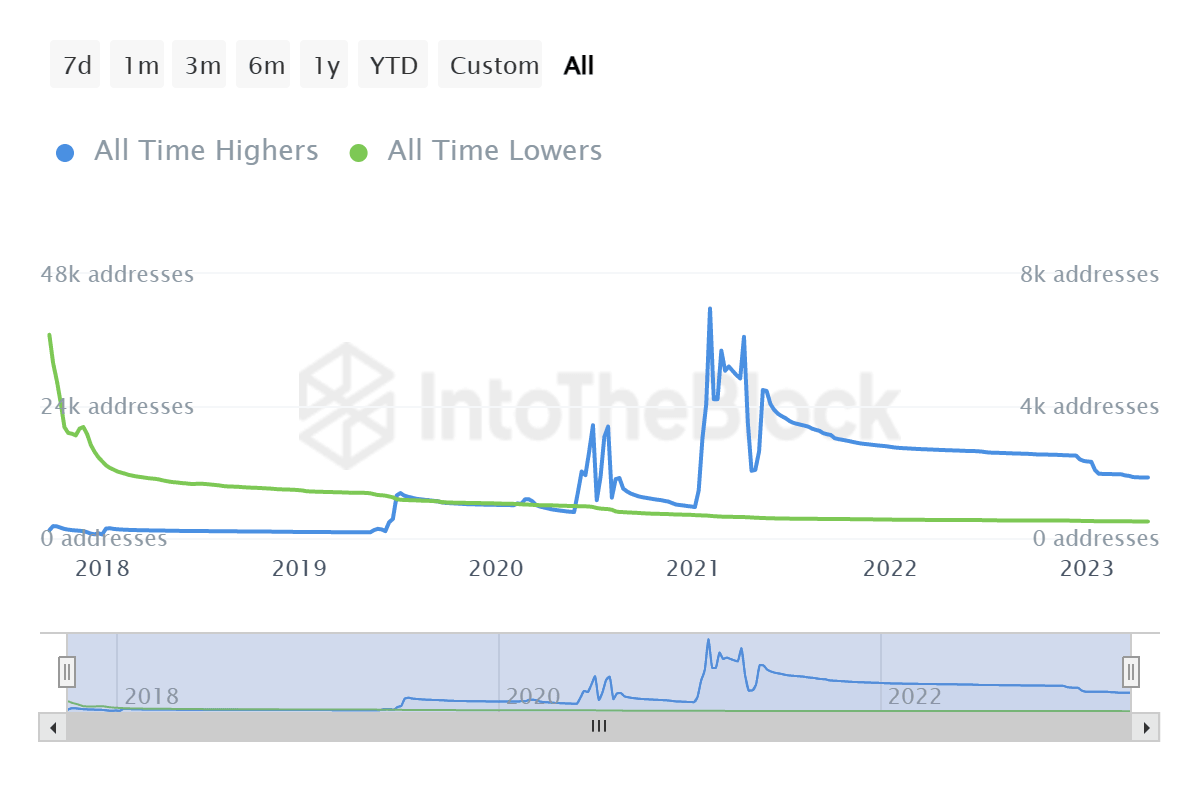

But the altcoin never climbed back to its all-time high prices, and, to date, these investors have been holding on to their assets awaiting recovery. The all-time highers are the investors that bought their supply around 20% off the all-time high prices. In the case of LINK, this stands to be the range between $41.86 to $52.33.

Chainlink All time highers

At the time of the ATH, these addresses came up to nearly 30,000 but have significantly declined since then. Today about 11,010 addresses remain that hold tokens bought in the aforementioned range. These holders represent nearly 1.8% of all the addresses holding any amount of LINK right now.

Thus for their supply to turn profitable and flow back into the market, Chainlink price would need to chart a 500% rally to $41.86 and a 650% rise to touch $52.33.

LINK/USD 1-day chart

Even if the altcoin does follow the broader market cues and churns green candles somehow, the chances of a rally this massive are very low. The reason behind this is the lack of hype at the moment, unlike in May 2021.

Chainlink as a project is losing traction among the people. This is resulting in a decline in network adoption, i.e., the rate at which new addresses are formed, as noted on the chart where network growth is at a six-month low of 483.

Chainlink network adoption

Since the conviction is not as strong, any rally would be proceeded with profit-taking, limiting its rise no matter how bullish the crypto market is.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B00.12.47%2C%252028%2520Apr%2C%25202023%5D-638182181633614683.png&w=1536&q=95)