Uniswap Price Prediction: UNI bears take control, 17% downswing on the horizon

- Uniswap price shows a local top formation after a 13% upswing in the last week.

- This uptick is likely to reverse as the RSI indicator hits a blockade at the midpoint and could trigger a 15% downswing.

- Invalidation of the bullish outlook will occur if UNI flips the $5.74 hurdle into a support level.

Uniswap price experienced a steady uptrend for the last week but this bullishness is likely going to end. Signs from the momentum indicator suggest that the bears are taking over. A retracement is likely, especially if Bitcoin price also undergoes a sell-off.

Uniswap price needs to cool down

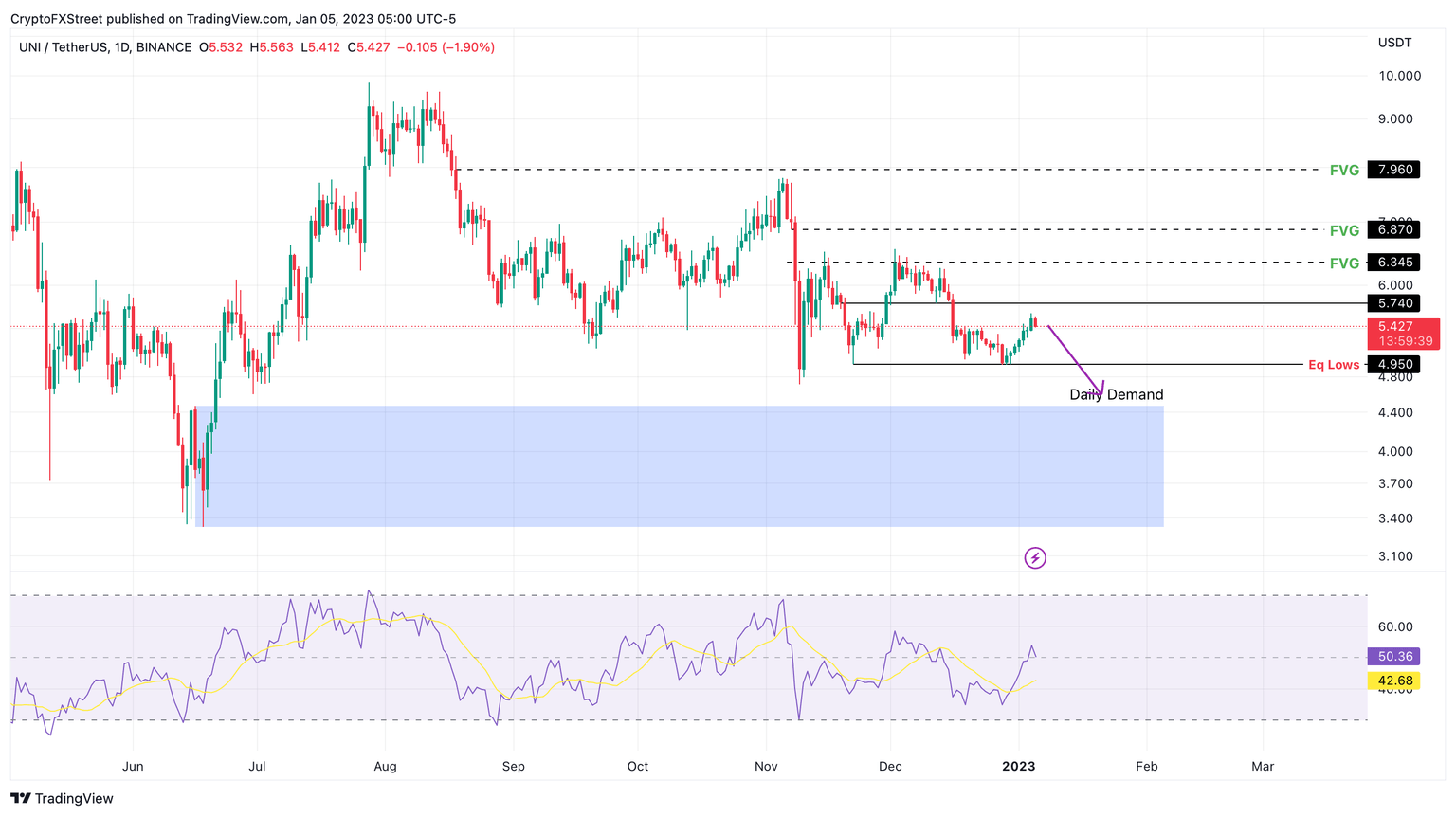

Uniswap price has bounced off the $4.95 support level thrice since November 21, 2022, and has created a set of equal lows here. As a result of the importance of this level, there is sell-stop liquidity resting below it.

After a 13% upswing in the last week, Uniswap price is likely undergoing a deterioration of the bullish momentum, which can be seen in the price action. A daily candlestick close on January 5 that engulfs the previous day’s candlestick will be a confirmation of this waning momentum.

Moreover, the Relative Strength Index (RSI) is hovering indecisively around the midpoint at 50. A rejection here could kick-start the downtrend. Market makers are likely going to push Uniswap price to sweep the equal lows at $4.95, which is roughly 10% from the current position.

However, panicking investors might knock UNI as low as $4.47, which is roughly 17% from where the altcoin currently stands.

UNI/USDT 1-day chart

While things are looking up for Uniswap price, a minor pullback followed by a resurgence of bullish momentum could undo this pessimistic outlook. More specifically, a daily candlestick close above $5.74 hurdle will invalidate the bearish thesis.

If Uniswap price produces a higher high above $6.34, it will indicate a continuation of the uptrend, which could propel UNI to its next target at $6.87.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.