- Uniswap price maintains support in the $15 - $16 value area.

- Price action suggests a drop is incoming, but the oscillators hint at a move higher.

- Opportunities exist for bulls and bears.

Uniswap price action has remained stable enough to keep a prior long setup valid – a positive event given the bearish volatility affecting most of the altcoin market. Two trade setups with strong cases for each now exist for Uniswap.

Uniswap price leans bullish despite bearish near-term price action; a return to the $24 price level is expected

Uniswap price has been disappointing for many bulls, especially those who bought last Thursday and today. From the January 7, 2022 open to the swing high found on January 16, UNI gained a respectable 22% over those seven days. Fast forward to Wednesday, Uniswap has retraced more than that entire move in under three trading days. As bearish as that price action is, it doesn’t mean bears are in total control yet. There is a case for the bulls to take over.

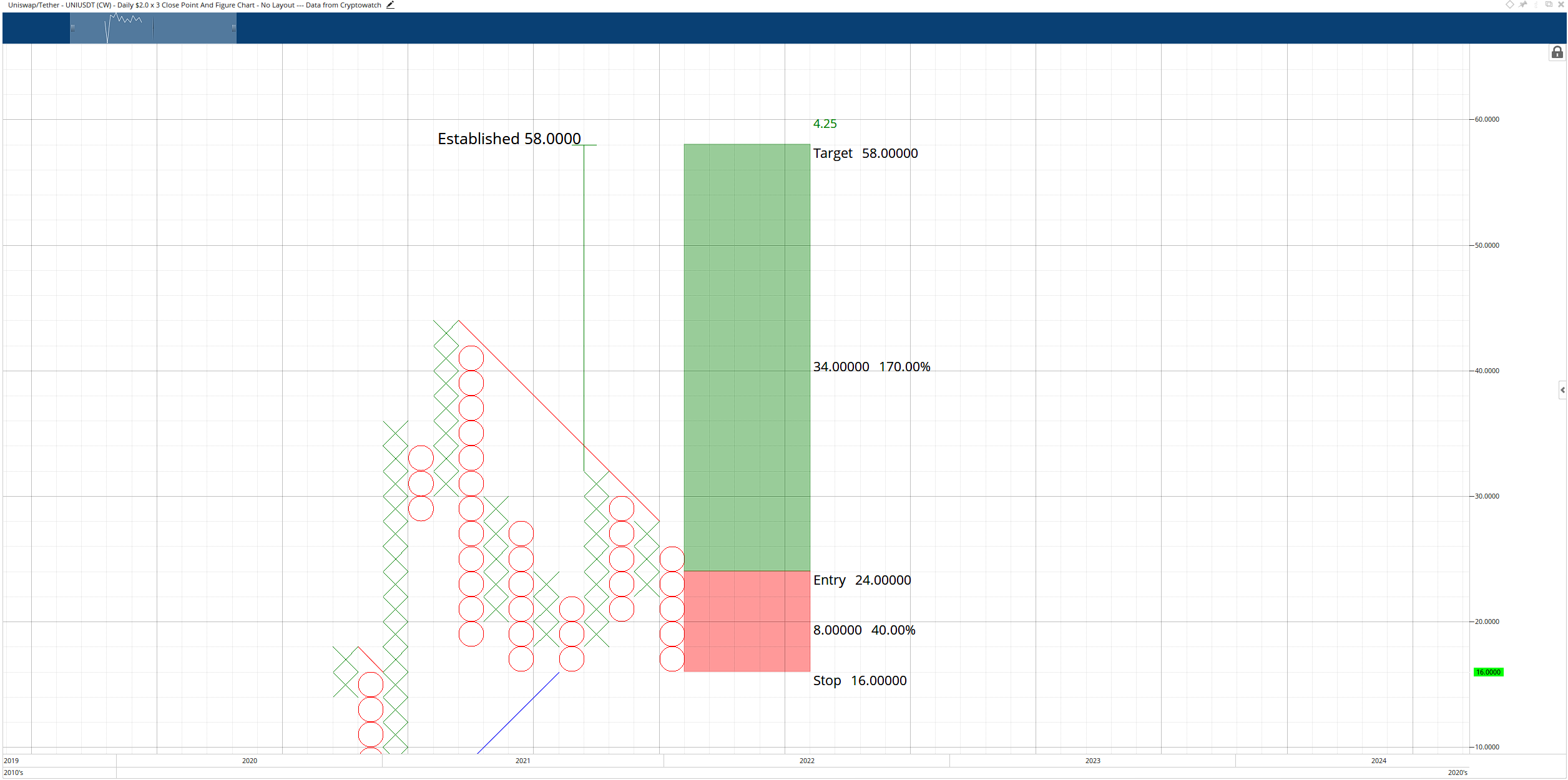

On the long side of the market, a hypothetical long entry exists with a buy stop order at $24, a stop loss at $16, and profit target at $58. This trade is based on a bearish fakeout setup that simultaneously converts the $2.00/3-box Point and Figure chart into a bull market if the entry is triggered. In addition, a two-box trailing stop would help protect any profit generated after the entry.

UNI/USD $2.00/3-box Reversal Point and Figure Chart

The hypothetical long setup is invalidated if Uniswap price drops to $14.

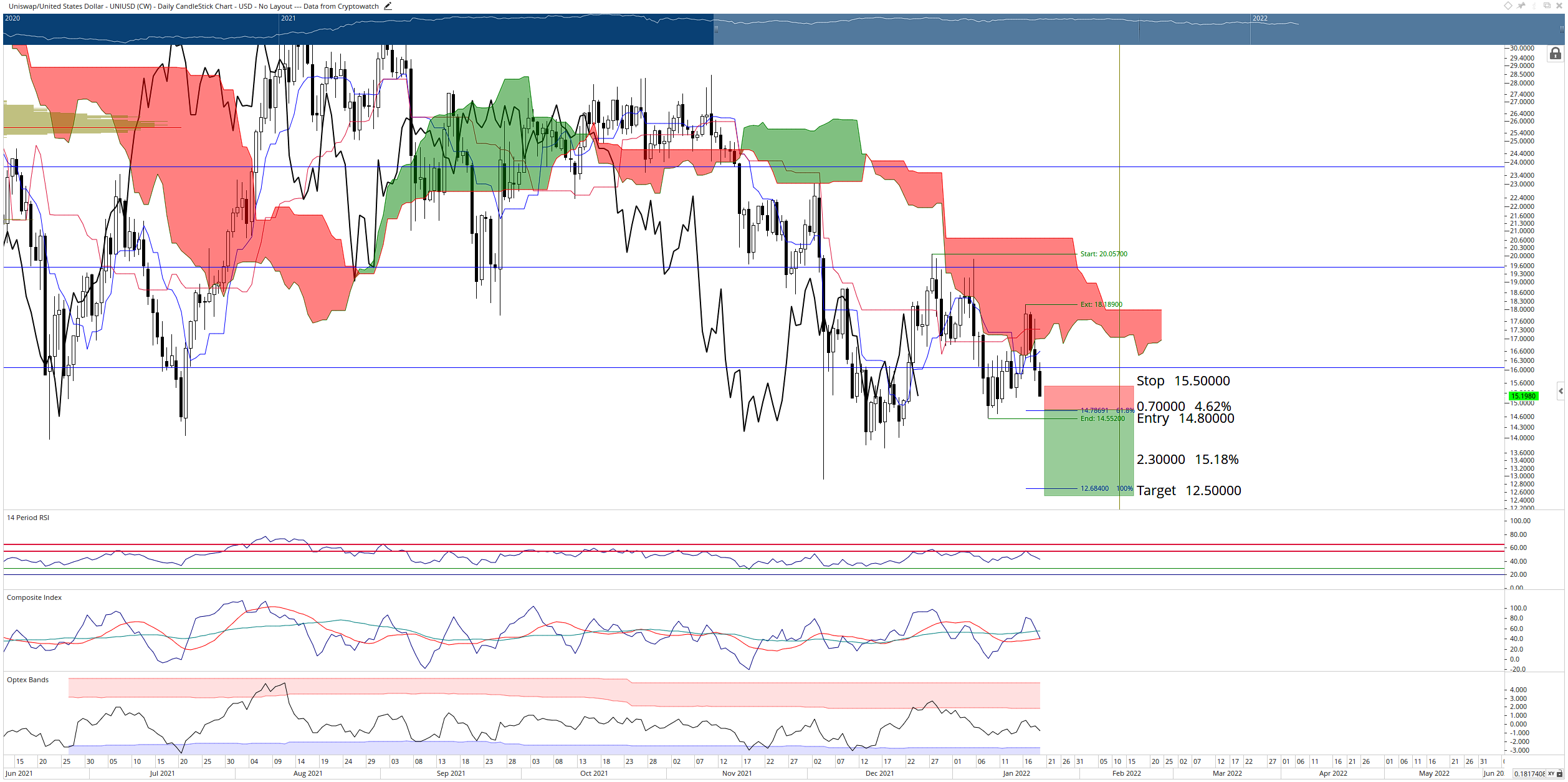

There is an entry opportunity on the short side of the market on the daily Ichimoku chart. A close at or slightly below the 61.8% Fibonacci expansion at $14.78 would position Uniswap price at the lowest close since December 19, 2021. The profit target would be slightly below the 100% Fibonacci expansion level at $12.50. The stop loss is at $15.50. The trade represents a 3.3:1 reward/risk setup with an implied profit target of 15% from the entry.

UNI/USD Daily Ichimoku Kinko Hyo Chart

However, given the current pattern structure in the Composite Index, the short setup may not occur. An inverse head-and-shoulders pattern is present on the Composite Index and could surprise many traders looking to exit longs or enter new short positions. Abrupt and sudden support may appear near the identified short idea’s entry, so sellers may want to pay close attention to how Uniswap price responds near the $14.50 to $14.75 zone.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Solana, Base and AI meme coins rally, are speculative tokens making a comeback?

Meme coins are typically considered more speculative than the rest of cryptocurrency categories. Despite the label, hedge funds and institutional investors have warmed up to meme coins this cycle.

RWA narrative could make a comeback after nearly 50% correction in CFG, ONDO, MKR

Bitcoin halving and developments in the AI sector are the key narratives this cycle. The Real World Asset (RWA) tokenization narrative gathered steam with BlackRock’s tokenized asset fund launch on Ethereum in March 2024.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.