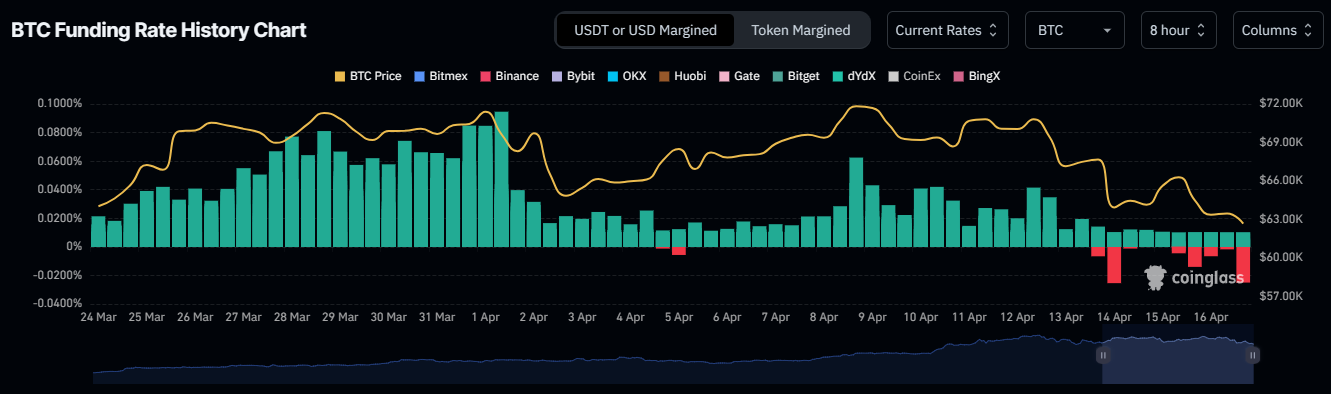

- Bitcoin funding rate chart has been flipping negative of late, signaling a shift in market sentiment.

- Shorts are paying longs, which often precipitates the creation of bullish momentum.

- A potential market correction or squeeze could be on the horizon.

Bitcoin (BTC) price remains on a load-shedding exercise, a sentiment that has spilled over to the broader market. Nevertheless, the bleed seen across the cryptocurrency market could end soon amid possible shifting market sentiment.

Also Read: Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Funding rates flipping negative could be the silver lining for longs

After a prolonged downtrend in the market, fortunes could be starting to change as funding rates flip negative.

BTC funding rate

During a bearish market like the one currently at play, the funding rate shifting negative leads to short traders paying long traders. On the other hand, when the market sentiment is bullish, the funding rate becomes positive and long traders pay short traders.

Funding rates can reflect market sentiment and liquidity. A positive funding rate, where long position holders pay shorts suggests that traders are willing to pay a premium to bet on rising prices, which indicates bullish sentiment. A negative funding rate could mean bearish sentiment with shorts paying longs, suggesting that traders expect prices to fall.

If the bearish sentiment prevails, Bitcoin price could continue to fall, which would justify the negative funding rate. An overly negative funding rate for a prolonged duration, however, could cause a change in sentiment, causing a possible twist in the BTC price action to turn bullish.

The shorts could get squeezed, compelled to buy Bitcoin at a higher price in efforts to cover their losses as the BTC price rises unexpectedly. This unexpected surge in buying pressure can lead to even more price increases. The result would be a snowball effect where more short sellers rush to cover their positions. This can result in rapid and significant price spikes in the cryptocurrency market.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink social dominance surged to a six-month peak on Friday as LINK holders increased their activity. LINK traders started taking profits, on-chain data trackers show. LINK price added 6% on Friday, extending its gains from mid-week.

Binance helps Taiwan crack a virtual asset money laundering case, BNB sustains above $570

Binance’s Financial Crimes Compliance (FCC) department joined forces with Taiwan’s Ministry of Justice and helped resolve a case of money laundering worth NT$200 million, or $6.2 million.

Bitcoin Weekly Forecast: Is BTC out of the woods? Premium

Bitcoin price shows signs of continuing its uptrend, providing a buying opportunity between $64,580 to $63,095. On-chain metrics forecast a bullish outlook for BTC ahead. If BTC clears $70,000, the chances of resuming the uptrend would skyrocket.

XRP trades steady at $0.50 as Ripple shares plan to expand services in Africa

Ripple hovers close to $0.51 on Friday, above the psychologically important $0.50 level, as traders await the court ruling of the lawsuit against the US Securities and Exchange Commission and amid new commitments from the firm to expand its services in Africa.

Bitcoin: Why BTC is close to a bottom

Bitcoin (BTC) price efforts of a recovery this week have been countered by selling pressure during the onset of the American session. However, the downside potential appears to have been capped.