- Major cryptocurrencies trade in relatively tight ranges this weekend.

- NY financial regulator gives green light to Bakkt to offer Bitcoin futures.

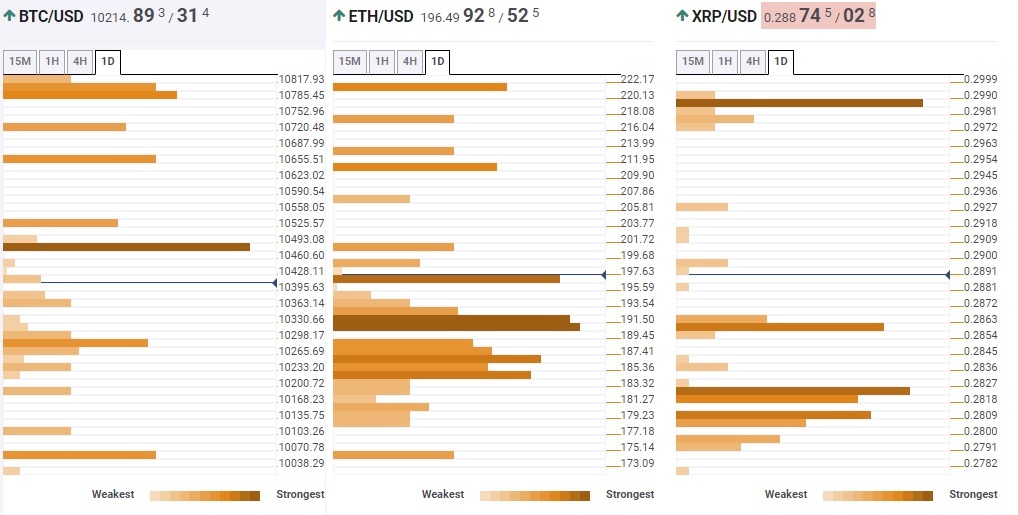

- Confluence Detector shows Ethereum sits above multiple strong support levels.

The strong selling pressure surrounding major cryptocurrencies eased a little on Friday following the news of the NY financial regulator granting Bakkt, cryptocurrency platform affiliate of Intercontinental Exchange Inc, a license to operate as a limited liability trust company, in other words, allowing it to offer Bitcoin futures contracts to its institutional customers. Although the market sentiment turned positive on the back of this development, the three-biggest cryptocurrencies with regards to total market capitalization, Bitcoin, Ethereum, and Ripple, all look to post weekly losses.

Meanwhile, according to a press release published on Globe Newswire, Bitcoin’s mysterious creator Satoshi Nakamoto will reportedly reveal his identity among other information such as education, professional background, and confirm his holding of 980,000 Bitcoins worth around $10,000 billion, in a three-day event title "My Reveal," which will go live on the Satoshi Nakamoto Renaissance Holdings and the Ivy McLemore & Associates websites live at 20:00 GMT on Sunday.

Now let's take a look at the technical picture and identify the key technical levels revealed by the Confluence Detector for the top 3 cryptocurrencies.

BTC/USD to face strong resistance near $10,490

After dropping to its lowest level of August at $9,467 on Thursday, the BTC/USD pair staged a recovery and is now trading above $10,300. Despite this rebound, the pair remains on track to lose around 10% for the week.

On the downside, the 10-period SMA on the H4 chart at $10.280 seems to have formed interim support ahead of $10,060 (the Fibonacci 23.6% retracement of the monthly price action.) Meanwhile, the initial resistance could be seen at $10,480 (previous daily high and the upper range of the Bollinger Band on the 15-minute chart before $10,800 (the Fibonacci 61.8% retracement of the weekly price action and Fibonacci 161.8% retracement of the daily price action.)

ETH/USD trades above multiple support levels

According to the Confluence Detector, the ETH/USD pair is trading a little above the critical $196 support (the 200-period SMA on the daily chart, the upper range of the Bollinger Band on the hourly chart). Just below that level, $189/191 area (daily pivot point R2, the Fibonacci 38.2% retracement of the weekly price action, previous monthly low, the upper range of the Bollinger Band on the H4 chart) is likely to make it difficult for the pair to extend its slide.

On the upside, $210 (weekly pivot point R1, the 100-period SMA on the H4 chart) could be seen as the first hurdle before $222 (the Fibonacci 23.6% retracement of the monthly price action).

XRP/USD recovery unlikely to encounter any resistance until $0.2990

Ripple (XRP/USD) is likely to extend its recovery to $0.2990 (weekly pivot point R1) as the Confluence Detector shows a lack of resistance levels until that point. On the downside, the 10-day moving average is acting as dynamic support at $0.2860 ahead of $0.2840 (daily pivot point R3, the 200-period moving average on the hourly chart and the 50-period moving average on the H4 chart) and $0.2808 (the Fibonacci 61.8% retracement of the weekly price action.)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Solana, Base and AI meme coins rally, are speculative tokens making a comeback?

Meme coins are typically considered more speculative than the rest of cryptocurrency categories. Despite the label, hedge funds and institutional investors have warmed up to meme coins this cycle.

RWA narrative could make a comeback after nearly 50% correction in CFG, ONDO, MKR

Bitcoin halving and developments in the AI sector are the key narratives this cycle. The Real World Asset (RWA) tokenization narrative gathered steam with BlackRock’s tokenized asset fund launch on Ethereum in March 2024.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.