- Cryptocurrencies have enjoyed an upbeat weekend and advanced.

- Low liquidity during due tot he US Labor Day may trigger higher volatility.

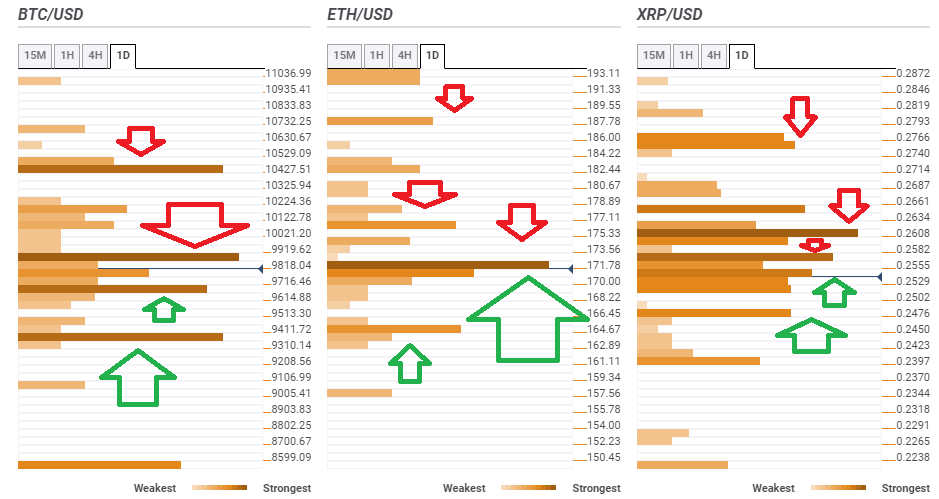

- Here are the next levels to watch according to the Confluence Detector.

Digital coins have had a positive transition from August to September – licking the wounds from the falls and recovering. Can they extend their gains? It will not require significant buying power by the bulls to push prices forward. Low liquidity due to America's Labor Day weekend means that small orders can make big splashes.

Technical levels paint a complicated landscape for cryptos to advance in.

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD needs to break above $9,870

Bitcoin has neared the $10,000 level once again during its weekend recovery. The granddaddy of cryptocurrencies now faces resistance at $9,870, which is the confluence of the Fibonacci 38.2% one-week, the previous daily high, the Simple Moving Average 50-4h, the SMA 200-1h, and the Bollinger Band 1h-Upper.

If it breaks higher, the next level to watch is $10,427, where we see the convergence of the Pivot Point one-week Resistance 1, and the SMA 50-1d.

Looking down, BTC/USD has support at $9,660, which is a dense cluster of lines including the SMA 5-1d, the Fibonacci 23.6% one-week, the SMA 200-15m, the SMA 50-1h, the Fibonacci 61.8% oen-day, and the SMA 10-4h.

Next, down the line, we find $9,310, which is where the previous monthly low, the Fibonacci 161.8% oen-day, and he previous weekly low converge.

ETH/USD battles $171

Ethereum has attempted to recover but is stuck in a minefield of lines around $171. This includes the SMA 5-15m, the Fibonacci 23.6% one-week, the SMA 10-15m, the SMA 5-4h, the SMA 10-4h, the SMA 5-1h, the BB 15min-Middle, the SMA 10-1h, the SMA 50-15m, the Fibonacci 61.8% one-day, and the BB 15min-Upper.

Next, ETH/USD may struggle around $176, which is where the Fibonacci 38.2% one-week and the PP 1d-R2 converge.

The upside target is $187, where we find the confluence of the PP 1w-R1 and the BB 1d-Middle.

Looking down, Vitalik Buterin's brainchild has support at $164, which is the convergence of the previous monthly low and the previous weekly low.

XRP/USD faces fierce resistance

Ripple is stuck around $0.2540, which is a dense cluster of lines including the Fibonacci 23.6% one-day, the BB 1h-Lower, the BB 4h-Lower, the previous monthly low, the SMA 5-15m, the Fibonacci 38.2% one-day, and the SMA 10-15m.

Next, it faces resistance at $0.2570, which is the convergence of the SMA 100-1h, the BB 15min-Upper, the Fibonacci 61.8% one-day, the SMA 200-15m, the SMA 10-4h, the SMA 50-1h, and the SMA 5-1d.

The next cap is close. At $0.2608, we see the PP 1d-R1 and the Fibonacci 23.6% one-month converge.

XRP's upside target is at $0.2740, where the Fibonacci 38.2% one-month and the PP 1w-R1 meet.

Support awaits Ripple at $0.2476, which is the confluence of the previous weekly low, the PP 1d-S2, and the BB 1d-Lower.

See all the cryptocurrency technical levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.