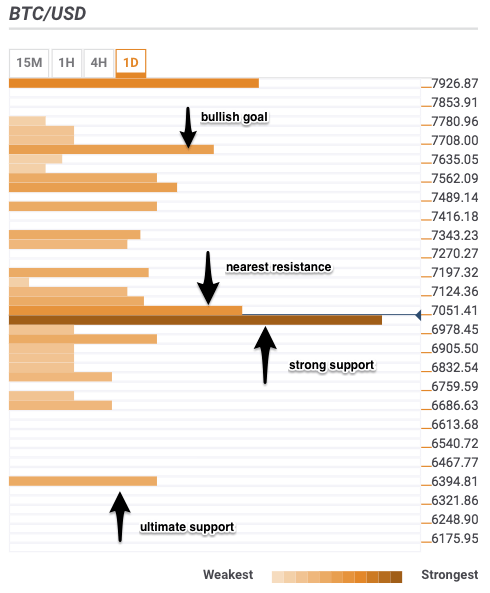

- BTC/USD stays above critical $7,000 for now.

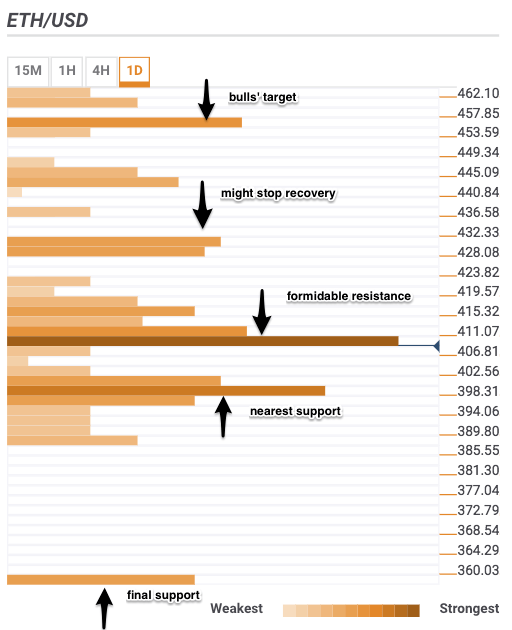

- ETH/USD recovery capped by strong support.

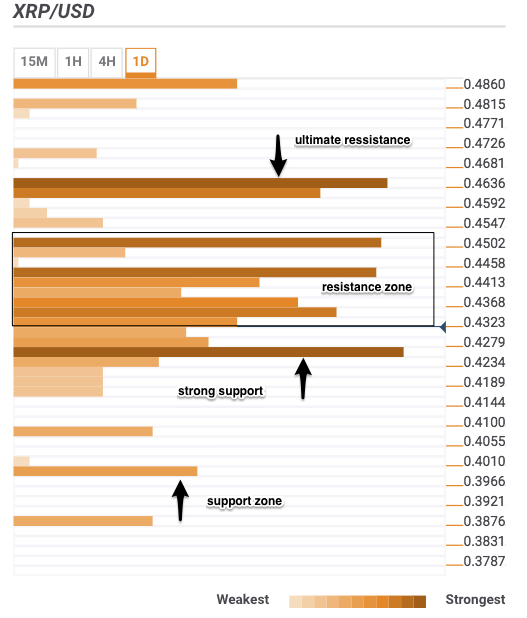

- XRP/USD has no space for maneuver.

Bitcoin recovered from Friday's low and settled above $7,000 handle; however, the upside momentum is too weak to spark hope for extended upside movement. While the recent sell-off was probably caused by a large BTC futures position force-liquidated by OKEx exchange, the lack of positive news left the digital coin No.1 vulnerable to speculative trading and technical positioning. Meanwhile, altcoins were dragged down by Bitcoin weakness, though the fall was less acute.

BTC/USD 1D

BTCUSD gave back its early Monday gains to trade marginally above psychological $7,000 at the time of writing. A strong support area created by the confluence of technical indicators is likely to pour some cold water on Bitcoin bears and limit the downside at least in the near term.

Right under the current price we have 61.8% Fibonacci retracement monthly, 38.2% Fibonacci retracement daily, 1-hour, 4-hour and 15 minutes lows and SMA10- 4hour.

Once below, there is nothing much in terms of support levels. Pivot Point one-day Support 1, SMA50 - daily and Bollinger Band 1hour - Lower clustered around $6,900 might slow down the collapse, though the chances are that the price would reach $6,690 (Pivot Point one-week Support 2) or even $6,400 (Pivot Point one-month Support 1).

Above the current price, the resistance is located on the approach to $7,050. This area includes quite a few critical technical indicators, which include:

Fibonacci 23.6% daily, and SMA100 (15 min) Bollinger Band 15 min -Lower, Bollinger Band 1hour - Middle with Pivot Point one-week Support 1, SMA5 - 4our, SMA100 - 15 min and 15 min high.

Area $7,200 is protected by Bollinger Band 4hour - Middle, SMA200 - 4hour, Pivot Point one-day Resistance 1. If it is cleared, the recovery may be extended towards $7,650 protected by 38.2% Fibonacci retracement weekly.

Click to see the Full Confluence Indicator

ETH/USD 1D

The second digital coin by market capitalization is trading at $407, unchanged on a daily basis. ETH/USD dipped below $400 on Friday but quickly regained ground, despite Bitcoin crash. Such decoupling is a positive sign, though Ethereum's upside is limited by a strong confluence of technical indicators right above the current price. They include:

The 4 -hour low, 1-hour low, 15-min low, the Bolinger Band 15m-Lower, Bollinger Band 1hour - Lower, 38.2% Fibo retracement daily, SMA5 - 4-hour, SMA50 - 1-hour, SMA100- 15min, and SMA200 - 15 min.

Another cluster of SMAs as well as 23.6% Fibonacci retracement daily and Bollinger Band 4hour - Middle produces another resistance area just above $411. Once it is cleared, the upside may be extended towards $430, strengthened by Pivot Point one-day Resistance3 and $460 with SMA200 - 4hour and 38.2% Fibonacci retracement monthly on approach.

Below the current price, the next support area is created by last month and last week's low and Pivot Point one-month Support1 just under $400 handle. Further down, there are no significant support lines until 2018 low at $352, strengthened by Pivot Point one-month Support 2.

Click to see the Full Confluence Indicator

XRP/USD 1D

Ripple is changing hands at $0.4282. The third largest coin is squeezed in a narrow range, mostly unchanged both since the start of Monday and on a daily basis. XRP has no shortage either of resistance or support levels, which means that sideways trading in a current range is the line of least resistance for the time being.

Below the current price, the strong support area comes down to $0.4200. The confluence of technical indicators located in this area include:

The 1-hour low, one day low, 4-hour low, last month low, daily low, last week low, 15-min low, Bollinger Band 1-hour -Lower, Bollinger Band 4-hour -Lower, Bollinger Band 15-min -Lower, Pivot Point one-week Support 1. A sustainable movement below this area will open up the way towards psychological $0.4000, followed by Pivot Point one-month Support 1.

The way up is even more crowded with various resistance levels stretched up to $0.4650, which is considered to be an ultimate bullish goal on the short-term timeframe. A confluence of technical indicators include:

Fibo 23.6% weekly and Fibo 38.2% daily, SMA200 - 15 min, SMA10 - 1hour and Bollinger Band 15min - Lower around $0.4340 level, followed by 23.6% Fib retracement daily, SMA100 - 1hour, SMA5 - daily and 4-hour high.

Strong resistance is seen on approach to $0.4460 with SMA10 - daily, Pivot Point one-day Resistance 2 and Bollinger Band 4hour - Upper.

A confluence of Fibonacci retracement levels (23.6% monthly, and 61.8% weekly), and Pivot Point one-day Resistance 3 is likely to stop the recovery at $0.4500.

Once this area is cleared, the upside may be extended towards $0.4600. This area contains another set of technical levels, including Pivot Point one-week Resistance 1, followed by last week high and 38.2% Fibonacci retracement monthly.

Click to see the Full Confluence Indicator

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.