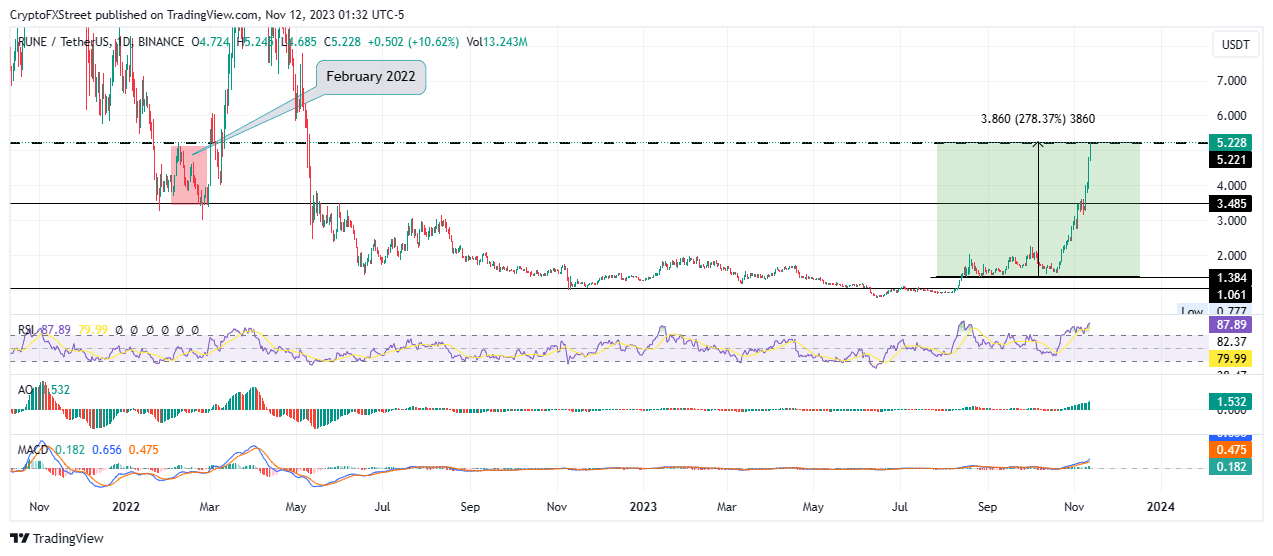

THORChain price reclaims February 2022 highs with RUNE upward mobility on steam

- THORChain price is up 280% on Binance exchange since the market caught fire on October 18.

- With RUNE steaming, the altcoin has reclaimed the February 2022 highs above $5.221 with more upside potential.

- With the RSI flashing overbought, longs should neither open new positions nor close existing ones.

THORChain (RUNE) price is among the greatest gainers in the rally beginning October 18, recording a sustained uptrend past key barricades to reclaim the February 2022 highs above $5.221. While the upside potential remains in the cards for RUNE, investor caution is advised as the cryptocurrency is massive overbought.

Also Read: RUNE 120% surge could be exhausted as THORChain price faces crucial resistance level

THORChain price reclaims February 2022 highs

THORChain (RUNE) price has reclaimed the February 2022 highs above $5.221, with more upside potential both from a technical standpoint and from an on-chain perspective.

Technically speaking, the Relative Strength Index (RSI) is still northbound; suggesting momentum is still rising while it mirrors the price action. This is bullish, pointing to more buying pressure that is driving the price. Nevertheless, investor caution is advised, considering RUNE is massively overbought. Longs should neither close their positions nor open new ones.

Also, the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) indicators are both in the positive territory with green histogram bars, showing the bulls are leading the RUNE market. This adds credence to the bullish outlook of THORChain price.

RUNE/USDT 1-day chart

THORChain on-chain metrics to support bullish outlook

From an on-chain standpoint, the volume of RUNE transactions is increasing, which is value-adding for THORChain price’s midterm analysis when supported by other metrics. In this regard, a surge in volume combined with the daily active addresses is bullish for the cryptocurrency.

For one, it shows that while a large number of RUNE tokens are moving, the daily active addresses for RUNE are also increasing. The latter metric shows the unique or new addresses involved in the transactions, thus the daily level of crowd interaction is fundamentally in favor of THORChain price.

Also, social dominance for RUNE is increasing, showing the share of the coin’s mentions on crypto-related social media, relative to more than 50 popular projects online. This adds credence to the bullish thesis.

RUNE Santiment: Price, Volume, Daily active addresses, social dominance

Still on on-chain metrics supporting THORChain price’s bullish outlook, the volume of active stablecoin deposit is increasing, corroborated by a steady rise in Tether (USDT) market capitalization. This points to fresh capital inflow as more investors look to buy RUNE.

Further, the open interest in USD per exchange for RUNE is also increasing. This points to perpetual traders interacting with RUNE, with the overall number of open long and short positions increasing on the back of speculation.

On the assumption that THORChain price still has upside potential, supported by technical indicators and on-chain metrics above, RUNE shorts closing their positions could inspire more buying pressure for the altcoin.

RUNE Santiment: Active stablecoin deposit, USDT market capitalization, open interest in USD per exchange

Concluding thoughts

Nevertheless, cognizant that RUNE is already massively overbought, a pullback may be impending. As mentioned above, longs should neither open new positions nor close their current open positions. Even so, they should watch for the RSI breaking below the 70 level, which could trigger a sell–off.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B09.40.29%2C%252012%2520Nov%2C%25202023%5D-638353704973915467.png&w=1536&q=95)

%2520%5B09.41.31%2C%252012%2520Nov%2C%25202023%5D-638353705118553511.png&w=1536&q=95)