This singular reason could propel Cardano price by 35% and here's how to trade it

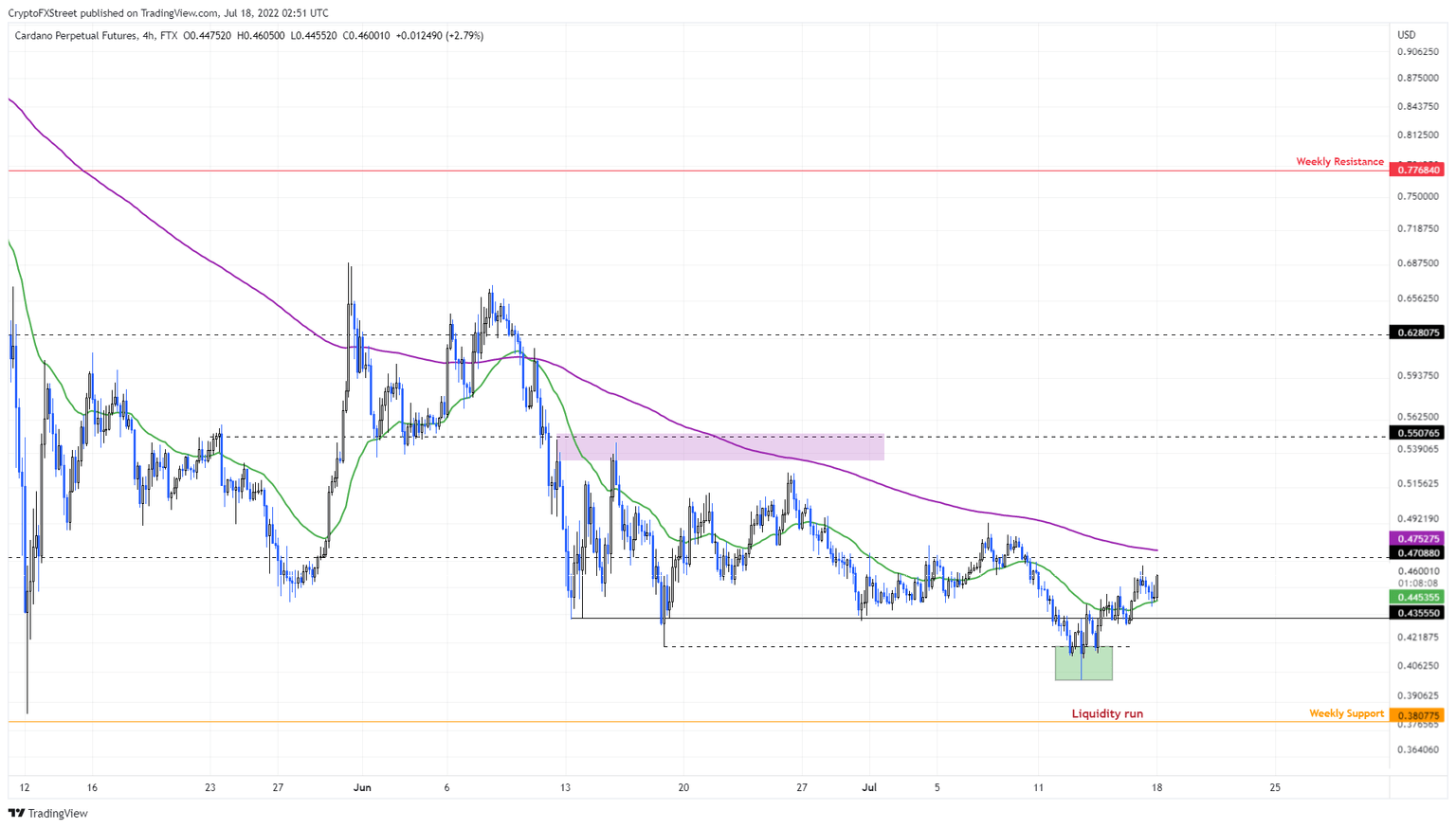

- Cardano price shows promise after a liquidity run below the June 18 swing low at $0.419.

- A flip of the 34 four-hour EMA at $0.475 could trigger a 15% rally to retest the $0.550 hurdle.

- A four-hour candlestick close below the July 13 swing low at $0.401 will invalidate the bullish thesis.

Cardano price has triggered a potentially bullish signal as it swept an important swing low. This move indicates that the next phase has begun, which will result in propelling ADA higher.

Cardano price ready to recover losses

Cardano price bounced off the $0.435 support level multiple times since June 13 but failed to establish a trend. As each bounce reduced in magnitude, ADA weakened and finally broke.

This downswing swept the June 18 swing low at $0.419, triggering a liquidity run. Subsequently, Cardano price recovered 13% to where it currently trades - $0.457. This minor uptrend has flipped the 34 four-hour Exponential Moving Average (EMA) at $0.445, adding credence to the bullish outlook.

Going forward, if ADA manages to flip the 200 four-hour EMA at $0.475, it will serve as a bullish reaffirmation. In such a case, Cardano price could trigger a 15% run-up to $0.550.

In total, this move would constitute a 20% ascent from the current position and is likely where the upside is capped. However, if the bullish momentum is unusually high, ADA could reach the next level at $0.628.

ADA/USDT 4-hour chart

On the other hand, a four-hour candlestick close below the July 13 swing low at $0.401 will create a lower low and invalidate the bullish outlook. In such a case, ADA could revisit the immediate support level at $0.380.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.