This Ethereum-based dApp noted a 100% increase in TVL in a month, eclipsing Lido DAO, AAVE and more

- Silo Finance which is deployed on both Ethereum and Arbitrum, has attained a TVL of $143 million.

- In comparison, MakerDAO, Curve Finance and Convex Finance noted a decline of 16% to 23% in the past month.

- In the same duration, the native token of the platform SILO also shot up by 102%, according to Nansen.

Ethereum, being the home of Decentralized Finance (DeFi), hosts a bunch of protocols on the network. However, given the tense market conditions, very rarely does a protocol manage to grow as quickly as Silo Finance did over the past month.

Ethereum dApp makes a splash

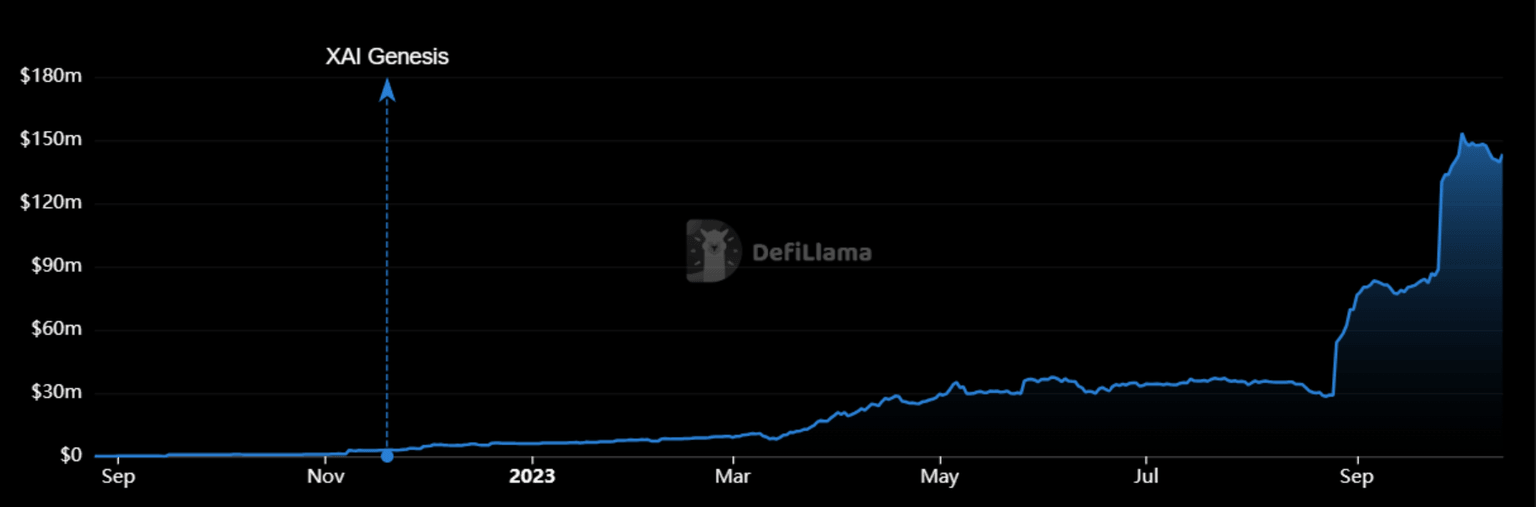

Ethereum-based Silo Finance, a lending market protocol that has also been deployed on Arbitrum, has noted an increase of 94% in the total value locked on the platform. On-chain insights platform Nansen noted that the reason behind this rise is the fact that they enabled crvUSD to be the universally accepted collateral across all their markets.

Consequently, the protocol gained the investors’ attention, which translated to the TVL of the application rising from $70 million at the end of September to $143 million at the time of writing.

Silo Finance TVL

To put this growth into perspective, in the same duration, some of the topmost DeFi protocols, such as MakerDAO, Curve Finance, and Convex Finance, among others, have lost the total value locked on them. This decline ranges from around 16% to 23% in the span of four weeks.

Silo price jumps around 100%

Along with the total value locked on the platform, the trading price of the native token of Silo Finance also grew in the last month and a half. Trading at $0.048 at the time of writing, SILO could see hovering around $0.025 towards the end of September. Since then, the altcoin has shot up by 92%.

Given Silo was trading around $0.029 at the beginning of the year, the overall growth in the altcoin’s price year to date happens to be above 90%, akin to the increase in the last 45 days.

SILO’s trading price is still 56% below the peak of the altcoin’s performance this year. According to CoinMarketCap, the cryptocurrency hit a high of $0.1096 towards the end of April and has been on a downward trend since then until the end of September.

SILO trading price

From here on, Silo price might see some correction as the overheated market would need to cool down.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.