The cryptocurrency market update: Bitcoin and major altcoins are vulnerable to further losses

- Bitcoin (BTC) has settled below $8,800 after a failed breakthrough attempt.

- Altcoins are mostly range-bound with bearish bias during early Asian hours.

The cryptocurrency market is a mixed picture on Wednesday. Bitcoin and all major altcoins are range-bound with bearish bias amid decreasing trading activity. The total cryptocurrency market capitalization dropped to $239 billion from $240 the day before; the worth of the digital asset of $67 billion change hands daily on average. Bitcoin's market share dropped to 66.0%.

Top-3 coins price overview

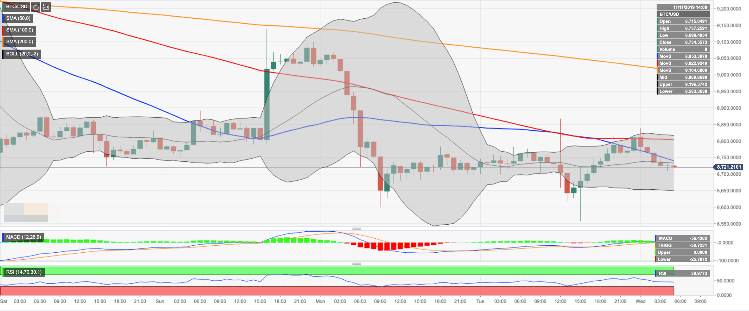

BTC/USD has stayed mostly unchanged both on a day-to-day basis and since the beginning of Wednesday, changing hands at $8,730. On the intraday charts, the coin has peaked at $8,838 in Asia before reversing back below $8,800 handle. This resistance is strengthened by SMA100 (Simple Moving Average) on a daily chart. Once it is out of the way, the upside is likely to gain traction with the next focus on $9,000.

BTC/USD, 1-hour chart

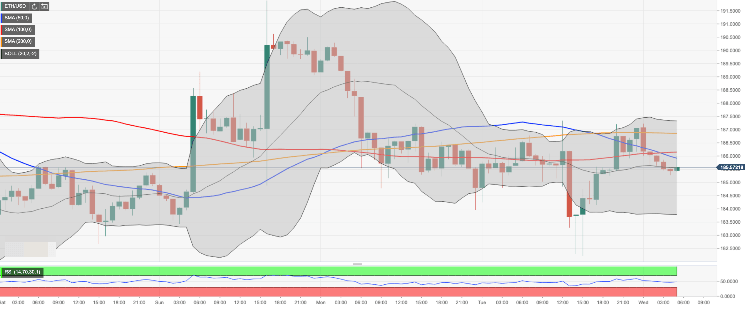

Ethereum, the second-largest digital asset with the current market capitalization of $20.2 billion, is moving within a short-term bearish bias within the recent range. The coin dropped below $186.00 to trade at $185.60 at the time of writing. Looking technically, ETH/USD has recovered from the recent low of $182.30, but the further upside is limited by $186.00 with SMA50 1-hour located on approach.

ETH/USD, 1-hour chart

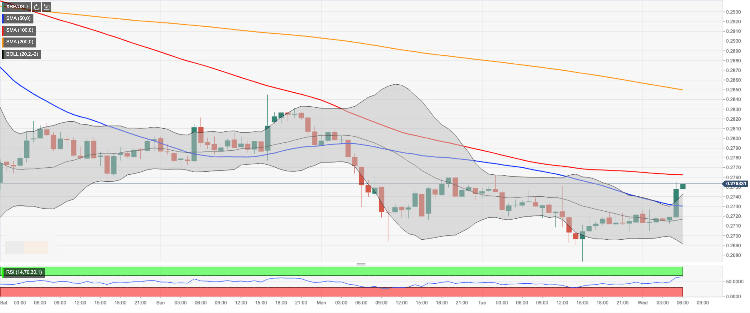

Ripple’s XRP has gained 1.2% since the beginning of Wednesday to trade at $0.2750 by the time of writing. The third digital coin with the current market value of $11.8 is moving within a tight range. The coin jumped above SMA50 (Simple Moving Average) and by the upper line of the Bollinger Band on a 1-hour chart. However, further recovery may be limited by SMA100 at $0.2760.

XRP/USD, 1-hour chart

Author

Tanya Abrosimova

Independent Analyst