Ten tokens to watch as Bitcoin halving looms

- Bitcoin halving will occur on April 22 at 2:55 UTC, in around 20 days.

- BRC 20 tokens, assets that use Bitcoin as a sidechain, and ecosystem tokens could benefit from BTC gains.

- Stacks, Core, RSK Infrastructure Framework, and Syscoin – which use Bitcoin as their base layer – could rally as the halving narrative gets popular.

Bitcoin’s (BTC) halving, which is expected to occur in April, is typically considered a positive catalyst for BTC prices as historically the asset’s price has peaked within six to twelve months after the event. If history is set to repeat, the upcoming halving event opens doors to gains in beta plays, tokens built on Bitcoin sidechains, BTC ecosystem-based assets, and BRC20 amid rising demand among traders.

Bitcoin halving could fuel gains in these assets

The Bitcoin halving countdown on nicehash.com shows that within less than 21 days, the reward for mining a BTC block will be slashed in half. This is considered a key event that marks Bitcoin market cycles, with peak gains expected within six to twelve months of the halving.

The ongoing market cycle has seen several beta plays emerge, paving the way for traders to benefit from the upcoming halving through other assets apart from Bitcoin:

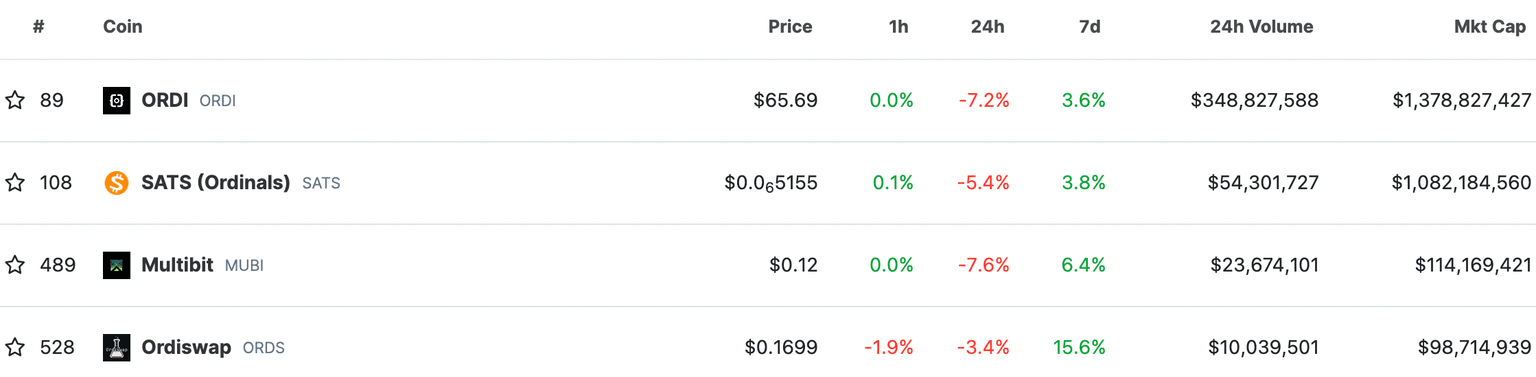

- BRC20 tokens: ORDI (ORDI), Ordinals Sats (SATS), Multibit (MUBI), and Ordiswap (ORDS).

- Bitcoin as base layer or BTC sidechains: Stacks (STX), Core (CORE), RSK Infrastructure Framework (RIF), and Syscoin (SYS).

- Bitcoin-related assets: Bitcoin Cash (BCH), Bitcoin SV (BSV).

BRC20 (Bitcoin Request for Comment) is an experimental token standard in which fungible tokens are minted on the Bitcoin blockchain, similar to the ERC-20 tokens on the Ethereum blockchain. Data from CoinGecko shows weekly gains between 3% and 16% in BRC20 tokens ahead of the upcoming halving.

BRC20 tokens and weekly gains

The Stacks network is Bitcoin’s layer for smart contracts. It is built on BTC, deriving its blockchain’s security, reliability and decentralized nature and using its Proof of Transfer consensus mechanism to incentivize miners in its network. STX price is up nearly 5% on the weekly time frame.

Similarly, CORE is the token of a blockchain that builds on Bitcoin’s proof of work network and uses a delegated proof of stake consensus for its chain and users. CORE has posted nearly 250% weekly and 62% daily gains, as seen on CoinGecko.

RSK is a Bitcoin sidechain, and SYS is a layer 1 chain that combines BTC’s consensus mechanism and Ethereum’s smart contracts. RSK and SYS prices climbed nearly 16% and 4% in the past week.

Bitcoin ecosystem tokens like BCH and BSV have seen a surge in their prices, adding 12% and 2% on the daily time frame, respectively. With the block reward halving less than 21 days away, traders can expect gains in Bitcoin and related assets, although this largely depends on the BTC price trend.

A sharp correction in Bitcoin price, namely a drop to key support at $65,000, could wipe out gains in beta plays. At the time of writing, BTC price is at $69,489, nearly 5% below the year-to-date peak and an all-time high of $73,777 from March 14.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.