Telegram sees crypto holdings surge to $1.3 Billion in first half of 2024

- Telegram's digital asset holdings increased from $400 million in late 2023 to $1.3 billion by mid-2024.

- Telegram generated $525 million in revenue in the first half of 2024, marking a 190% increase from the previous year.

- Pavel Durov, founder of Telegram, encountered arrest and legal issues in France for alleged violations, which briefly affected the TON market before it recovered.

Telegram's cryptocurrency holdings rose sharply to $1.3 billion in the first half of 2024, up from $400 million at the end of 2023. The messaging platform previously revealed it held $400 million in digital assets. Telegram’s crypto portfolio exceeds $1 billion, marking a significant growth.

According to a Financial Times report, Telegram’s crypto holdings have tripled, highlighting the platform’s strong footings in the crypto space. The report shows Telegram has strengthened its finances with more digital asset holdings, profits from Toncoin sales and a deal related to The Open Network (TON), even as its founder encounters legal challenges.

Telegram’s revenue soars 190%

The report shows that the instant messaging platform generated $525 million in revenue from January to June 2024, a significant 190% increase compared to the same period in 2023. In the first half of the year, $353 million of this income came from cryptocurrency sales.

The report revealed about $225 million of Telegram's revenue was generated from a deal with an unnamed entity. TON tokens became the sole method for businesses to buy ads on the platform. The exclusivity arrangement ended on October 1.

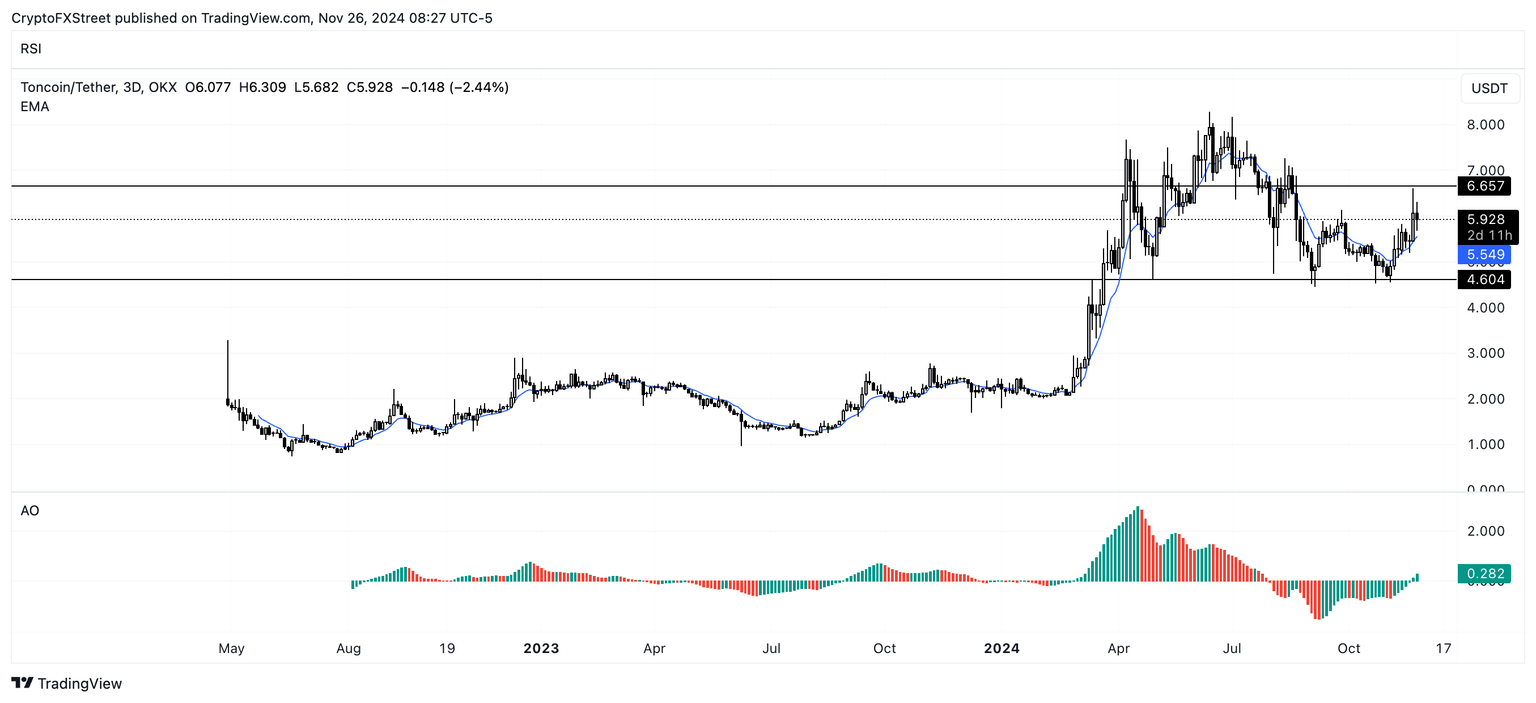

Telegram possesses a large quantity of TON, making the company susceptible to changes in the token's market value. The price of TON fell by 25% to $5.24 during Telegram founder Pavel Durov’s legal issues.

The token rebounded in the following weeks, supported by a broader cryptocurrency market rally, hitting a high of $6.657 on Saturday.

Source: TONUSDT 3-day chart

Author

Reza Ali

FXStreet

Reza Ali is a seasoned crypto-journalist and analyst with over four years of dedicated experience in the crypto and fintech space. He holds a bachelor’s degree in business administration.